Wall Street is on the Bitcoin train and the hype cycle may be about to restart

Tech

Tech

Wall Street has finally jumped on the cryptocurrency train and it could be the start of a new Bitcoin bounce.

Yale, Harvard, MIT, and Stanford universities have all invested in cryptocurrency and Fidelity — one of the largest investment managers in the world — is the first traditional financier to offer custodian services to keep those assets safe.

Henrik Anderson, chief investment officer of Australia-based cryptocurrency investment fund Apollo Capital, says people have been talking for years about how the entrance of Wall Street firms will make crypto respectable.

He believes this combined with a long period of low volatility among crypto assets and the expected approval of Wall Street’s first crypto ETF in February is about to push cryptocurrency markets higher.

“We are quite optimistic. Our cash position in the fund is the lowest its has been this year, it’s down to 5 per cent,” he told Stockhead.

“[The majors] don’t really care what prices have done for the last 12 months, they are investing for the long term.

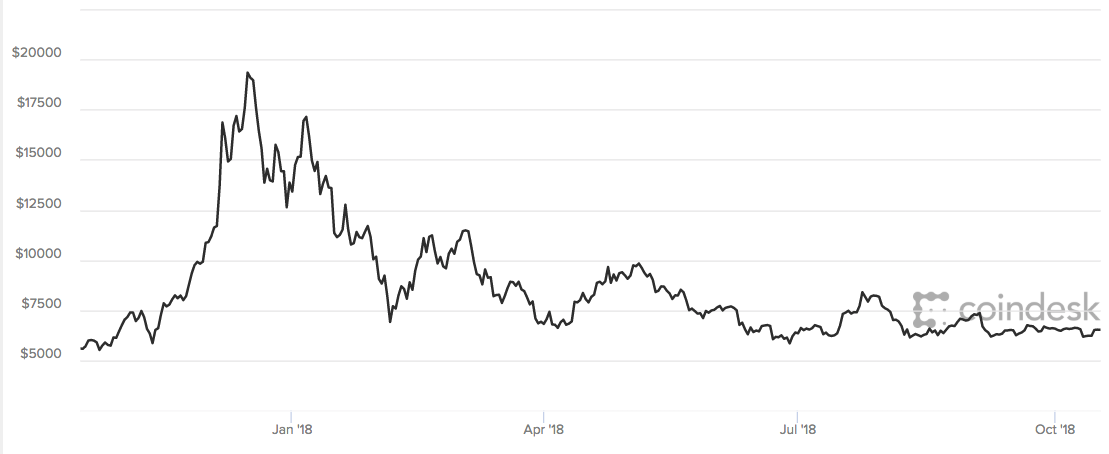

“Combine this with the fact that the volatility experienced in crypto last month was the lowest this year…[and] at at a time when prices are down about 70-80 per cent.”

Mr Anderson does believe most of the 2000-odd crypto assets trading today are probably worthless, even if the space more generally has a lot of potential upside.

Crypto is going professional

While institutional money has not yet flooded the crypto space, moves by long-term investors such as the $US29b Yale fund, the $US40b Harvard fund, the $US16.4b MIT fund, and the $US24.8b Stanford fund suggest it’s not be far off.

Or as satirical news website the Betoota Advocate so aptly put it:

“If it doesn’t benefit rich people then it won’t catch on. If the current system of hiding money or making transactions through shelf companies isn’t broken, then why fix it?”

Fidelity is the first traditional institution to offer crypto custodian services so they can also store those assets in places they trust — rather than face a CoinCheck-like hack which lost $US533m worth of client coins.

Fidelity Investments chairman and CEO Abigail Johnson said the goal was to make crypto more accessible investors.

Mr Anderson says in the past only crypto-first offered custodian services, and traditional financial institutions like Fidelity were not likely to trust their clients’ crypto assets with them.

“But now we have traditional financial institutions offering these services, like Goldman Sachs, Fidelity, Nomura which have all announced or are offering custodial services for crypto assets,” he said.

“It has been tremendously powerful because it hasn’t been really possible for traditional financial institutions to enter this market.”

The launch of the NYSE owner Intercontinental Exchange’s (ICE) crypto warehouse in November, a federally regulated entity, will also be a game changer.