You might be interested in

Tech

ASX Tech Stocks Today: FirstWave upgrades cybersecurity platform, Linius Technologies expands deal with Intrepid Productions

Tech

ASX Tech Stocks: PlaySide Studios set to develop mixed reality game for Meta

Tech

Tech

AssetOwl (ASX:AO1) has risen again this morning after updating shareholders on the roll out of its virtual real estate inspection software.

COVID-19 has meant virtual home inspections have temporarily become the only choice for real estate agents. This resulted in a bit of a boom for companies like AssetOwl.

However, restrictions in Australia are now easing, with many states again at least allowing one-on-one physical inspections, but still restricting auctions to online. Queensland and New South Wales are also expected to soon ease these restrictions.

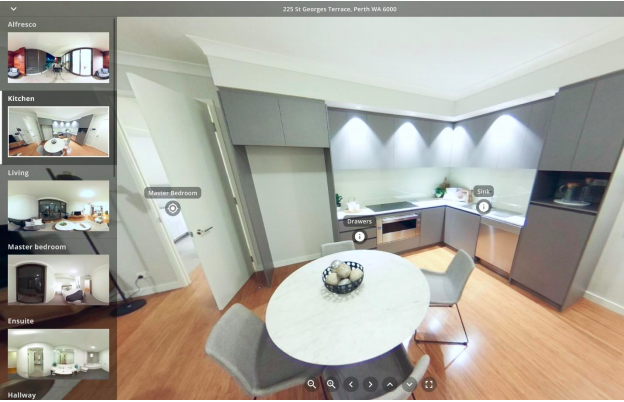

But AssetOwl is still on a mission to get its virtual real estate inspection software out there, announcing today it has begun directly selling its inspector360 platform through one of its key partners.

Property inspection services provider PCR & Routine Inspection Services will utilise the software and resell it to its 170 real estate agency clients.

inspector360 allows agents to take panoramic photos using professional cameras or even smartphones. The app is also able to manage a lot of the paperwork required in property management.

AssetOwl boss Simon Trevisan said last month he expected there would still be demand for virtual real estate inspections long after the pandemic had passed.

Today he told Stockhead it was not just about safety but saving time, money and hassle for property owners, managers and tenants.

“AssetOwl was founded with the purpose of disrupting the way real estate assets are managed long before the current pandemic,” Trevisan said.

“We developed inspector360 to provide a better way to conduct residential property inspections: better in that it is vastly more efficient, and qualitatively it is better.

“Whilst COVID-19 is driving immediate uptake of our solution, the benefits will be immediately obvious to those who use it and will continue long after life returns to normal.”

Assetowl shares gained 10 per cent. While this morning’s gain was modest shares are now nearly four times higher than the low of 0.3c recorded in late March.

Fintech Change Financial (ASX:CCA) has launched its UpChange payment processing platform with its first customer bank, the Central Bank of Kansas City. This came just over seven months after it was first approved as a Mastercard payments processor. The company expects initial revenues from the partnership this quarter.

Video tech stock Linius (ASX:LNU) has signed on millennial-focused financial charting software Grafa as a new client. Linius’ core technology allows static, ordinary video footage to be transformed into dynamic, searchable, “hyper-personalised” video content, using its proprietary Video Virtualisation Engine.

Once Grafa launches in July, Linius will help Grafa subscribers to personalise content, such as economic data and forex movements, to build their own business news channel.