Renewables collapse almost 60pc as risk, policy uncertainty bite

Tech

Tech

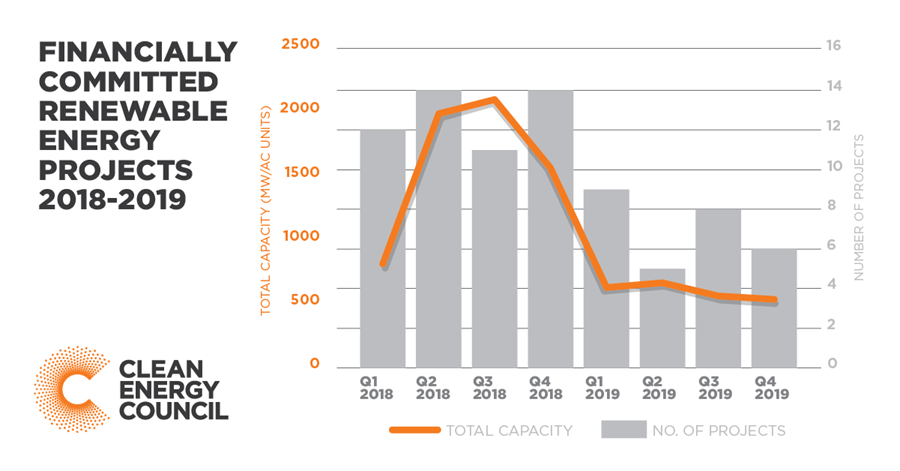

Another study has revealed how far renewable energy investment sank last year, with the Clean Energy Council reporting a 58 per cent dive in spending in 2019.

Investment in large scale renewables fell from $10.7bn to $4.5bn.

The number of large-scale renewable energy projects reaching financial close was 29, down from 51 in 2018.

The top reasons for a decline in investor confidence was due to grid connection issues, a lack of strong national energy and climate policy and network congestions and constraints.

Last week, Bloomberg New Energy Finance (BNEF) came out with data saying investment in new generation capacity fell 40 per cent in 2019 as commitments dived to $US5.6 billion ($8.1 billion).

The federal government however is using a different figure.

Federal Minister for Energy and Emissions Reductions Angus Taylor said The Clean Energy Regulator estimated that 6.3 gigawatts (GW) of new renewable capacity was installed in 2019, which was 24 per cent higher than the 2018 record, according to a report in the AFR.

Reaching financial close is when a project receives enough funding to start building, while installed capacity refers to when a project is completed, so it includes developments that reached financial close in the prior year or years.

Clean Energy Council chief Kane Thornton said mounting regulatory risks, under-investment in transmission and policy uncertainty have contributed to increased risks for investors and resulted in a lowering in confidence and slow-down in investment commitment.

“A continued slow-down in new investment will put greater pressure on reliability and power prices as Australia’s old coal-fired power stations continue to close,” he said.

“New investment is critical to replacing these coal-fired power stations and delivering on Australia’s emission reduction targets.”

The study said many of the rules relating to grid connection, network investment and market design were no longer fit-for-purpose and were a significant deterrent to potential investors.

The large scale Renewable Energy Target (RET), credited as supporting the massive levels of investment in the sector over the past few years, winds down in 2020 and is not being replaced.

In terms of policy, the emissions reduction requirement of the National Energy Guarantee in 2018 was dropped by then-Prime Minister Malcolm Turnbull in a bid to keep his job, and the government has committed to not bringing it back.

The ASX has some 22 listed renewable energy companies, spanning solar and wind, but also waste-to-energy player Volt Power Group (ASX:VPR) and retailer ERM Power (ASX:ERM).