One-armed robot bricklayer Fastbrick just raised $35 million

Tech

Tech

Fastbrick Robotics, the company behind the one-armed bricklaying robot, just raised $35 million in an equity placement — enough to fund the business for two years.

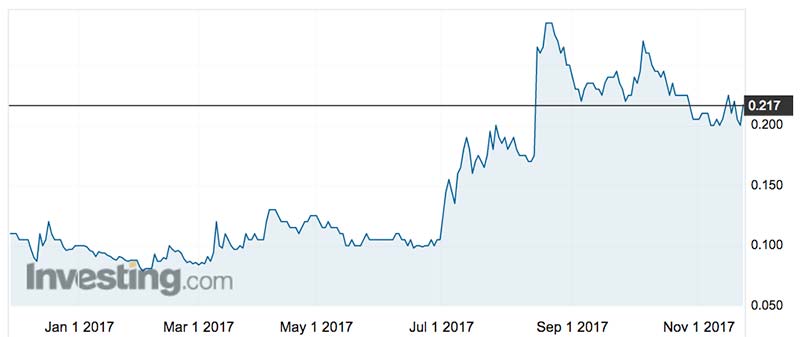

The shares gained 7.5 per cent to 21.5c in Wednesday lunchtime trade.

The placement of 184,210,526 shares at 19c a share was completed with a small group of international and domestic institutional investors. The capital raise was managed by Bell Potter Securities.

“We are pleased with the support from new and existing global, regional and domestic funds who are participating in this placement,” chief Mike Pivac told investors.

“Leading into 2018 and beyond, we are now well-placed and confident to deliver on the company’s strategic objectives and key milestones.”

The key focus is the assembly, testing and demonstration of the two Hadrian XTM commercial prototypes now being built.

The company is also working with global partner and shareholder Caterpillar to commercialise, manufacture and distribute the Hadrian XTM.

Earlier this year the US machinery giant invested $2 million in Fastbrick, with an option for a further $8 million.

“Beyond these immediate milestones, we will also look to bolster the company’s strength through the addition of senior management and investing in new IP [intellectual property],” Mr Pivac said.

Fastbrick also has a deal with Saudi Arabia for the construction of a minimum of 50,000 new home units by 2022.

The commercial bricklaying robot is expected to cost about $2 million when it goes into full production in 2019.

The machine requires minimal human interaction and works day and night, laying up to 1,000 bricks an hour — about the output of two human bricklayers for a day.

The prototype Hadrian 105 robot, the first of its kind, can be seen in the time-lapse video below:

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.