IPO Watch: Subscription meal provider Marley Spoon announces $70m ASX float

IPO Watch

Marley Spoon, a subscription-based meal kit provider, today launched an Initial Public Offering to raise $70 million at $1.42 per share.

Most of the funds will be used to support the continued growth of Marley Spoon’s existing and potential customer base.

The Institutional Offer, Broker Firm Offer, and Chairman’s List Offer are underwritten by Joint Lead Managers Canaccord Genuity and Macquarie Capital.

Current management and other existing investors, including Rocket Internet and Lakestar, will retain all of their current holdings, which will represent 66 per cent of Marley Spoon.

The $70 million will cover costs of growth, expected losses and working capital and also repaying debt.

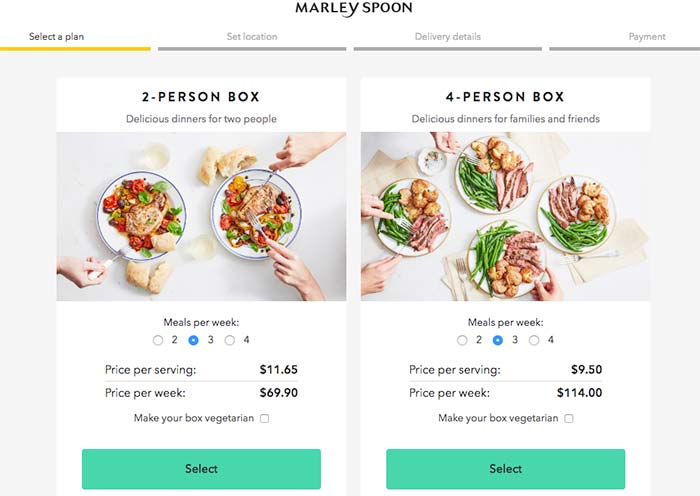

Marley Spoon was launched in Germany in 2014 by Fabian Siegel and Till Neatby. It provides subscription-based meal kits to 110,000 active customers in Australia, the US, Austria, Belgium, Germany and the Netherlands.

“As we continue to experience strong growth in our markets, in particular the Australian market, we believe an ASX-listing provides the ideal platform to build our major consumer brands – Marley Spoon, Martha & Marley Spoon, and Dinnerly – for the coming years,” says Marley Spoon Chief Executive Officer Fabian Siegel.

“We established Marley Spoon in Australia in June 2015, followed by the recent launch of Dinnerly in March 2018.

“As of March this year, Australia represented 37 per cent of Marley Spoon’s revenue and over one-third of our global workforce is represented here.

“Marley Spoon’s meal kits offer variety in weeknight home cooking, convenience and time-saving.

“However, it is still early days for this kind of service and we are just getting started to make consumers switch over from the supermarket.”

Since 2014 Marley Spoon has developed more than 9000 recipes and served more than 14.5 million individual meals to customers in Australia, Europe and the United States.

The offer opens on June 14 and closes a week later on June 21, ahead of an expected July 4 listing.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.