High Voltage: Battery metals stocks buoyed by Tesla’s Battery Day

Tech

Tech

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, and vanadium.

First of all, how do you applaud the CEO when the boardroom is a drive-in? Loudly:

We show @elonmusk love by honking today. ♥️🚗 honk honk @Tesla pic.twitter.com/q7EDFRATdA

— jordy🚀 (@AstroJordy) September 22, 2020

Battery company shares had a good day’s trading Wednesday as the sector was lifted by bullish sentiment from Tesla’s Battery Day event at its factory in Fremont, California.

Tesla CEO Elon Musk highlighted the company’s shift to nickel cathode batteries as a means of lowering its production costs.

The move is key in order for Tesla to produce an affordable EV for the mass-market, Musk said.

Battery materials company Novonix (ASX:NVX) saw its share price zip 32 per cent higher in early Wednesday trade to $2.26 before falling back to $1.77.

Novonix said it had made “significant progress” in its anode material business with founder customer Samsung and with Sanyo Electric, part of Panasonic Group.

Panasonic has produced battery cells at Tesla’s Gigafactory in Nevada, but the partnership is in some doubt after Elon Musk announced that Tesla was going into battery production.

The company said its battery cell technology has demonstrated an ability to exceed one million miles, a holy grail in performance terms for the EV industry.

Several automakers including General Motors and Volkswagen are set to open a combined 130 gigawatts of EV battery production in the US by 2023, the company said in a presentation.

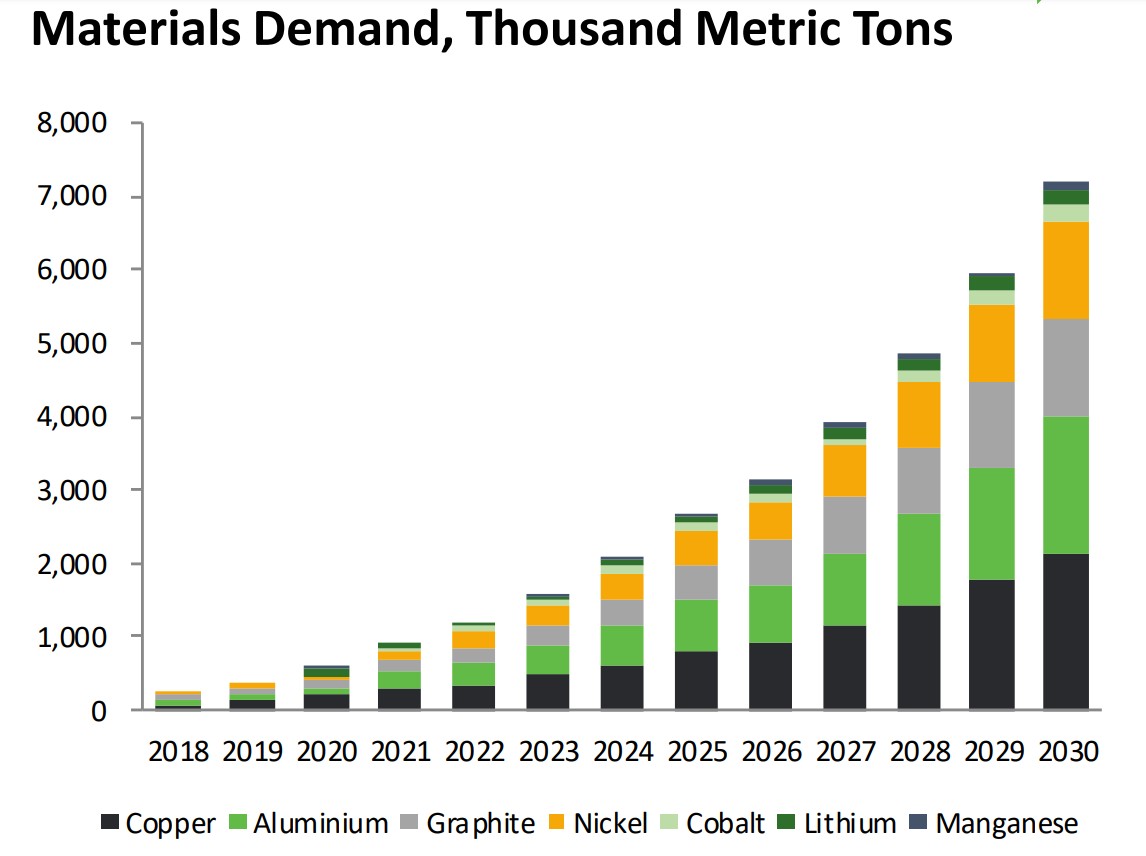

Demand for high performance battery anode and cathode materials is set to grow to $US50-$US100bn ($70-$140bn) by 2030 from $US10bn currently, said Novonix.

Novonix announced a board re-shuffle Wednesday, to increase its customer and shareholder focus, appointing Dr Chris Burns as group chief executive.

Burns is co-founder and chief executive of Novonix Battery Testing Services in Canada, and has been chief operations officer for the company’s Puregraphite business in the US.

Commenting on Tesla’s Battery Day, Burns said: “Their [Tesla’s] approach to rethinking battery cell manufacturing exactly aligns with Novonix’s approach to rethinking battery materials manufacturing.”

“The cost of production of cells and materials has been stuck on existing technology and there is opportunity to disrupt these sectors through re-engineered solutions,” he said.

Novonix’s anode materials processing technology delivers lower cost, higher performance graphite to support long cycle life battery applications and uses simpler metal inputs to reduce cathode manufacturing costs, said the company.

EcoGraf (ASX:EGR), a producer of high purity graphite for the lithium-ion battery market, experienced a 41 per cent jump in its share price Wednesday to peak at 24c.

The company released a presentation based on Tesla’s Battery Day. It operates a processing facility at Kwinana in WA that exports graphite products to Asia, Europe and America.

EcoGraf is developing a pilot plant in Germany to produce graphite batteries for Europe, and sources its graphite from its Epanko project in Tanzania.

The company’s presentation said there is “unprecedented investment in new European battery capacity” supported by the European Union’s commitment of €3.2bn of funding.

Japanese industrial company Mitsubishi is a 12 per cent shareholder in EcoGraf which said it expects 700 per cent growth in demand for graphite by 2025 driven by the EV market.

| CODE | COMPANY | 1 WEEK CHANGE % | 1 MONTH CHANGE % | 1 YEAR CHANGE % | SHARE PRICE [c] | MARKET CAP |

|---|---|---|---|---|---|---|

| BAR | Barra Resources | -4 | -11 | 9 | 2.4 | $ 12,817,553.92 |

| ASN | Anson Resources | 33 | 4 | -35 | 2.4 | $ 14,885,570.31 |

| PM1 | Pure Minerals | 28 | 44 | 35 | 2.3 | $ 11,942,439.42 |

| EGR | Ecograf | 0 | 150 | 120 | 20.5 | $ 61,877,750.56 |

| JRL | Jindalee Resources | -9 | -14 | 79 | 44 | $ 16,016,595.00 |

| JRV | Jervois Mining | 5 | 2 | 46 | 33.5 | $ 189,806,700.78 |

| INR | Ioneer | 10 | 5 | -35 | 11 | $ 168,215,741.40 |

| FGR | First Graphene | 8 | 4 | -28 | 13 | $ 63,083,278.20 |

| NMT | Neometals | 14 | 17 | 23 | 20.5 | $ 103,616,740.54 |

| PUR | Pursuit Minerals | -18 | -18 | 40 | 1.4 | $ 6,241,421.11 |

| TMT | Technology Metals | 14 | 58 | 63 | 28.5 | $ 32,595,000.00 |

| VUL | Vulcan Energy | -1 | 61 | 436 | 88.5 | $ 58,438,714.95 |

| VR8 | Vanadium Resources | 11 | 3 | -43 | 3 | $ 10,479,768.26 |

| TKL | Traka Resources | -5 | -8 | 102 | 2 | $ 8,753,915.66 |

| MNS | Magnis Energy Tech | 8 | -2 | 11 | 20.5 | $ 137,877,635.61 |

| WKT | Walkabout Resources | 0 | 0 | -21 | 22 | $ 73,318,065.45 |

| SYA | Sayona Mining | 28 | 28 | 18 | 1.15 | $ 31,275,105.73 |

| TNG | TNG Limited | 54 | 67 | 37 | 12.5 | $ 134,945,414.88 |

| AXE | Archer Materials | -9 | 18 | 323 | 55 | $ 119,067,056.19 |

| LIT | Lithium Australia | 2 | 2 | 20 | 5.5 | $ 42,782,338.94 |

| ADV | Ardiden | 12 | 75 | 600 | 2.8 | $ 56,165,045.87 |

| MLL | Mali Lithium | 3 | 14 | 98 | 16 | $ 56,621,884.25 |

| CLA | Celsius Resources | 39 | 100 | 88 | 3.2 | $ 24,186,760.51 |

| AVL | Australian Vanadium | 25 | 59 | 35 | 1.75 | $ 43,627,488.14 |

| LTR | Liontown Resources | 18 | 44 | 110 | 19.5 | $ 327,663,858.37 |

| CXO | Core Lithium | 5 | -7 | 11 | 4.1 | $ 39,773,212.84 |

| TON | Triton Minerals | -4 | -7 | 36 | 5.3 | $ 58,992,064.92 |

| BKT | Black Rock Mining | 6 | 6 | -14 | 5.7 | $ 37,422,150.64 |

| MIN | Mineral Resources | -9 | -10 | 79 | 2530 | $ 4,746,999,100.17 |

| VRC | Volt Resources | -6 | -17 | 51 | 1.5 | $ 30,308,330.60 |

| TLG | Talga Resources | 46 | 32 | 104 | 84.5 | $ 224,500,720.75 |

| SVD | Scandivanadium | -3 | -32 | 233 | 3 | $ 13,449,197.31 |

| RNU | Renascor Resources | -13 | -13 | -13 | 1.3 | $ 17,351,066.11 |

| RLC | Reedy Lagoon | -14 | 9 | 200 | 1.2 | $ 5,636,805.41 |

| PSC | Prospect Resources | 10 | -11 | 59 | 16.5 | $ 47,179,526.46 |

| PLL | Piedmont Lithium | 50 | 67 | 52 | 15 | $ 173,298,030.90 |

| MLS | Metals Australia | -17 | 0 | -17 | 0.25 | $ 9,120,881.94 |

| LPD | Lepidico | 7 | 0 | -55 | 0.8 | $ 41,485,880.30 |

| LML | Lincoln Minerals | 14 | 14 | 60 | 0.8 | $ 4,599,869.49 |

| HIP | Hipo Resources | -6 | -29 | 50 | 1.5 | $ 6,639,035.60 |

| GME | GME Resources | 5 | 25 | -34 | 4.5 | $ 25,059,011.85 |

| GLN | Galan Lithium | 7 | -3 | -27 | 15 | $ 27,352,796.70 |

| GED | Golden Deeps | 0 | -6 | -50 | 1.6 | $ 8,615,051.18 |

| EMH | European Metals | 10 | 14 | 53 | 45 | $ 51,847,010.10 |

| CNJ | Conico | -11 | -6 | 60 | 1.6 | $ 7,073,228.29 |

| BSM | Bass Metals | 14 | 14 | -50 | 0.4 | $ 13,926,702.94 |

| ARR | American Rare Earths | -13 | -8 | 78 | 3.3 | $ 9,600,346.54 |

| AML | Aeon Metals | -4 | -18 | -13 | 13.5 | $ 91,471,913.15 |

| AJM | Altura Mining | 0 | 0 | -7 | 7 | $ 209,037,029.25 |

| ARL | Ardea Resources | -12 | -13 | -8 | 47 | $ 55,717,706.63 |

| LPI | Lithium Power International | 16 | 9 | -43 | 18.5 | $ 49,972,641.57 |

| BEM | Blackearth Minerals | 0 | -8 | -37 | 3.7 | $ 4,318,909.80 |

| ESS | Essential Metals | 17 | 13 | -42 | 11 | $ 17,350,789.11 |

| CLQ | Clean Teq | -13 | 76 | -21 | 27.25 | $ 212,741,158.43 |

| AVZ | AVZ Minerals | 0 | -2 | 29 | 6.3 | $ 187,340,901.53 |

| ORE | Orocobre | -1 | -6 | 1 | 264 | $ 909,445,349.70 |

| COB | Cobalt Blue | -12 | -17 | -47 | 8.5 | $ 21,607,077.31 |

| PLS | Pilbara Minerals | 1 | -1 | 0 | 34.5 | $ 823,444,242.60 |

| MRC | Mineral Commodities | -3 | 36 | 74 | 34 | $ 168,383,881.27 |

| AGY | Argosy Minerals | 14 | 6 | -30 | 5.6 | $ 62,189,630.60 |

| INF | Infinity Lithium | -13 | -18 | 13 | 7.8 | $ 23,721,024.22 |

| GXY | Galaxy Resources | -4 | 15 | 16 | 132 | $ 597,839,833.48 |

| LKE | Lake Resources | 38 | 86 | 59 | 6.5 | $ 56,730,389.55 |

| AUZ | Australian Mines | -18 | -36 | -50 | 1.4 | $ 63,383,261.60 |

| EUR | European Lithium | 2 | 2 | -46 | 4.8 | $ 40,137,592.50 |

Other ASX battery-related companies shared in the wave of positive sentiment from Tesla’s Battery Day.

Among them was Anson Resources (ASX:ASN) whose share price leapt 31.5 per cent, and Pure Minerals (ASX:PM1) up 11 per cent.

Anson is developing a salt brine resource in the US state of Utah, its Paradox Basin project, to supply lithium chemicals to the fast-growing battery market.

Elon Musk expressed an intention to utilise US-based lithium resources in Tesla’s battery production, and Anson is well-placed to meet this demand.

Pure Minerals has a high-grade energy chemicals processing hub in Townsville, Queensland, that receives nickel-cobalt sulphate from the company’s project in New Caledonia.

Ioneer (ASX:INR) and Triton Minerals (ASX:TON) both experienced a 10 per cent jump in their share prices.