Have ASX video game developers finally found the cheat code for profitability?

Tech

Tech

Over the past decade, the gaming industry has smashed Hollywood’s earnings out of the park.

In 2021, the global video games market raked in a massive US$200 billion, bigger than Hollywood and the music industry combined.

(Hollywood only reached $100 billion in revenue for the first time in 2019, while the music industry is currently at US$20 billion).

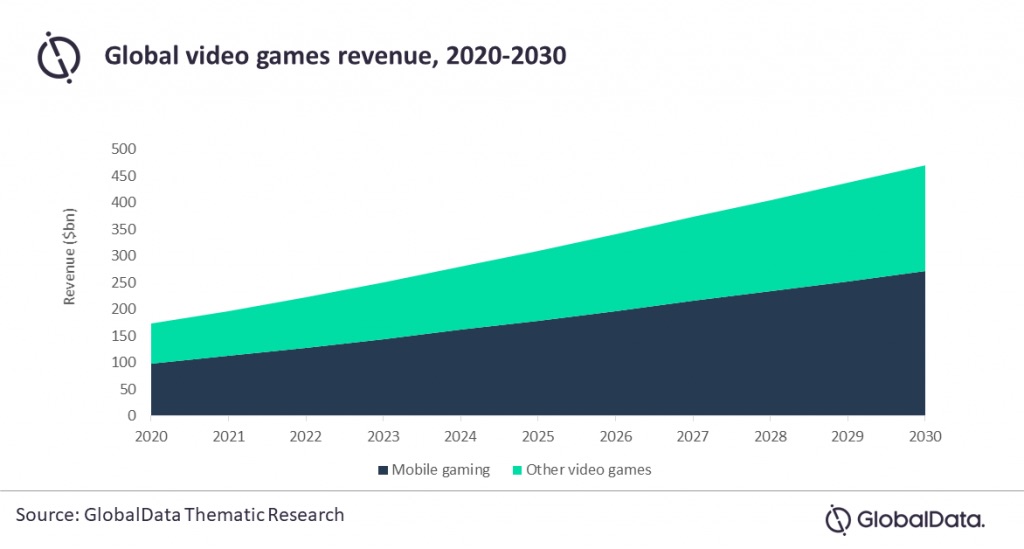

According to Zion Market Research, the gaming industry will break further away from Hollywood, doubling to US$435 billion by 2030.

Covid was no doubt the catalyst for this massive growth. As businesses shut down, the gaming industry remained busy throughout 2020 and 2021 – busier than it had ever been in fact.

But the sector has struggled of late, as the surge in new players we saw in those two years is starting to level off.

In the US, spending on video games fell by double digits this year. This decline is evident in the earnings results of several leading gaming companies in recent weeks.

On Tuesday, US chipmaker giant Nvidia missed its Q2 revenue target, citing lower sales in gaming products.

Adding to the industry’s woes are the ongoing production halts due to Covid lockdowns in China, which have crimped the supply of gaming consoles.

But according to Morningstar analyst Neil Macker, there is some ray of light at the end of this tunnel.

Macker believes these problems are just a short term bump, and the gaming sector will continue growing healthily in the post-pandemic world.

“Long-term growth trends remain in place,” he said.

We’re already seeing signs of this rebound with the release of solid earnings from several ASX-listed gaming stocks last week.

iCandy reported its highest half-year revenue ever of $12.9 million, making the company operationally profitable for the first time.

Mighty Kingdom had its highest revenue quarter in history, delivering a 72% pcp increase.

Playside Studios meanwhile delivered a very strong revenue increase of 94% against the pcp.

Animoca Brands, the unlisted company behind more than 340 gaming and crypto assets, has just closed another $US75 million in funding – valuing the company at a mammoth US$5 billion.

Less than a year ago, the Hong Kong founded company was valued at only US$2 billion.

In addition, money is still pouring into video game companies big and small through M&A deals this year, with some 650 deals completed to June.

The marquee deal so far has been Sony’s $2 billion purchase alongside KIRKBI of a share in Epic Games, the maker of Fortnite.

“What has been clear is that companies whose gaming projects incorporate play-to-earn mechanics, tokens, or NFTs continue to drive investments,” said a report out of DDM Consultancy.

So what are the top segments in gaming, and how do investors make sense of all that’s happening in this fast moving industry?

Dean Fergie, fundie at Cyan Investment, believes that console gaming offers the best risk reward.

“Console games need a bigger investment and have a longer lead-time in development. But they potentially offer a higher return,” Fergie told Stockhead.

“Mobile games can be cheap to make, but they’re hard to differentiate. Because of that, they have a much lower risk return profile than consoles.

“Metaverse is only a pipe-dream at the moment, and the hype has certainly gone out of the sector of late,” Fergie added.

Fergie also doesn’t see any traction in eSports on the ASX at the moment.

“eSports are not seeing much in the way of traction, certainly not in the ASX sector,” Fergie continued.

“Although there is some merit in the online businesses such as Fortress, I think.”

To make things simple, here’s a quick breakdown of where the biggest markets are.

| Platform | Market size now | Estimated market size in 2030 |

|---|---|---|

| Console gaming | $50bn | $100bn |

| PC gaming | $30bn | < $30bn |

| Mobile gaming | $120bn | $300bn |

| eSports | $1bn | $4.75bn |

| Metaverse | - | ~ $500bn |

AAA CONSOLE TITLES

Triple AAA titles refer to an unofficial ranking system for the highest-budget, highest-profile games developed by the most well known publishers.

These games often rank as “blockbusters” due to their extreme popularity, and you may have heard some of the titles from this list.

Here’s a few names:

Call of Duty by Activision. The game has hit a US$30 billion milestone across its lifetime to date.

Grand Theft Auto V by Take-Two Interactive with revenues of over US$6 billion since release.

FIFA by Electronic Arts with revenues of around US$2 billion since release.

INDIE GAMES

In contrast to the AAA titles, indie (or independent) games are created by individuals or a small studio without the technical support of a large publisher.

Gamers say that indies are better because the programmers usually spend more time in crafting the game to perfection, as opposed to AAA games which are often created in round-the-clock development sweatshops in order to feed the $200bn beast.

One of the most popular indie games of all time is Minecraft, which started out as being developed by only one person, Markus Persson. But now it’s developed by a team of Microsoft developers, making it a AAA title.

Other popular indie titles include: Cuphead, Braid, Spelunky, Darkest Dungeon and Undertale.

MOBILE GAMING

The quality of mobile gaming is getting better and better, and has exploded over the past few years.

In fact it’s outpacing the gaming industry as a whole, snagging around 60% share of the entire market in 2022.

At the height of the pandemic in 2021, a staggering 1.1 billion mobile games were downloaded per week.

The biggest mobile game producers in the world include Tencent, Sega, Konami and Activision Blizzard.

The highest ever grossing mobile game is Honor of Kings, also known as Arena of Valor internationally and was published by China’s Tencent.

Other high grossing mobile titles include: Candy Crush Saga by King (owned by Activision Blizzard), Pokemon Go by Niantic, and Monster Strike by Japan’s Mixi.

PC GAMING

Games played on personal computers (PC) are declining fast as they lose traction to the console and mobile markets.

Before console and mobile games became popular, some of the early era PC hits included Doom, The Sims, Civilization and World of Warcraft.

The best selling PC game of all time is in fact another indie hit, PUBG: Battlegrounds, the Fortnite forerunner which has sold over 42 million copies.

eSPORTS

eSports are competitive tournaments organised for video game players, typically pro gamers.

The market accounts for around $1.1 billion, and China account for half of that.

eSports involves teams competing against each other in tournaments for a cash prize, and major broadcasters like ESPN, TBS, and SyFy often broadcast these events.

Some of the biggest games in this category include DOTA developed by Valve, The International Fortnite by Epic Games, and League of Legends by Riot Games.

DOTA has the biggest championship prize money at $35 million … and rising.

The eSports calendar is also stacked, with many global tournaments being held ever month.

METAVERSE

The Metaverse is the fast rising new kid on the block, but is considered a pipe-dream at this moment.

The Metaverse platform intersects different technologies such as Web 3.0, blockchain, VR, and AR – allowing traditional games to appear in a 3D virtual reality world.

Game publishers working in this space include Decentraland, Tencent, and Roblox.

Some of the earliest Metaverse games, or games experimenting with Metaverse capabilities, already in the market are: The Sandbox, Alien Worlds, Illuvium, Fortnite and Axie Infinity.

Currently the Metaverse is hot commodity, attracting significant investments from gaming companies, tech giants, and VCs alike.

There’s a lot of predictions out there, but most estimates value the Metaverse market at half a trillion dollars by 2030.

iCandy’s focus is in developing mobile games from its studios based in Malaysia, Singapore and Indonesia.

Its games have been played by more than 350 million gamers.

The company also assists other game developers and cross promote those games within its network for a profit share.

iCandy has become Southeast Asia’s biggest gaming company after its acquisition of Lemon Sky Studios.

Lemon Sky is best known for its involvement in AAA titles like Call of Duty, Spider Man, and Marvel’s Avengers. Lemon Sky is also currently looking to develop more AAA titles for the Metaverse.

iCandy has launched itself into eSports by co-founding the eSports Players League (ESPL). The ESPL league has caught on and already has a presence in Asia, Europe and Latin America.

Playside is the biggest pure play video gaming company on the ASX.

It hires over 130 games creators with a portfolio consisting of 50+ titles that are delivered across four platforms – mobile, virtual reality, augmented reality, and PC.

Playside also has relationships with major AAA publishers, including a work-for-hire co-development deal with Nasdaq-listed Activision Blizzard.

The company has in the past worked in developing titles such as The Lego Batman Movie Game (Warner Bros), and Cars: Lightning League (Disney/Pixar).

The core focus for Playside however is in creating its own titles in-house.

Major titles released by the company include Age of Darkness, Animal Warfare, Bits and Ropes franchise, AR Dragon and Battle Simulator Warfare.

Playside acquired the Dumb Ways to Die franchise for $2.25 million from Metro in October last year – a title which has won a lot of awards.

Following that deal, Playside launched its first strategic Metaverse Web 3.0 project titled BEANS by Dumb Ways to Die (DWTD).

Founded in 2010 and headquartered in Adelaide, Mighty Kingdom is the largest independent game developer in Australia.

The company has released more than 50 titles with more than 50 million downloads worldwide.

Mighty Kingdom’s strategy is to develop original IP, which it then licenses to publishers to fund the distribution of those games.

It produces titles for consoles and mobiles, including Project Ball Stars, Conan Chop Chop and Ava’s Manor.

Mogul focuses solely on the eSports segment.

The company does not develop games but rather provides a matchmaking platform with a full automation for a range of major eSports titles.

Mogul’s strategy is to implement a “buy and build” strategy, focusing on acquiring profitable small to midsize games companies fitting the company’s criteria.

The Mogul platform has hosted titles on its platform including: Fortnite, Overwatch, Rainbow Six Siege, NBA, and Call of Duty.

Emerge Gaming is also in the eSports market, and like Mogul, its strategy is to acquire assets that provide platforms for competing in eSports.

The company has just partnered with MTN to launch eSports initiatives in South Africa.

These eSports initiatives are meant to promote subscriber acquisition for MTN Arena and MTN Arena 5G.

MTN Arena 5G is a game streaming service with contents that are selected from Emerge’s games studio proprietary libraries of short form AAA quality premium games.

Video Gaming ETFs on the ASX

There are two ETFs on the ASX focusing on the gaming industry.

VanEck Video Gaming and Esports ETF (ESPO) gives investors exposure to a diversified portfolio of the largest games developers in the world.

Its top 10 stocks include US-listed names such as Nvidia Corp, Activision Blizzard, Tencent, Roblox and Nintendo.

Another games-focused ETF on the ASX is the BetaShares Video Games and Esports ETF (ASX: GAME).

GAME also aims to track the performance of an index that provides exposure to big global gaming giants.

Its top 10 stocks include Roblox, Electronic Arts, Unity Software and Bandai.