Hastings Tech Metals says it’s designing a blockchain for rocks

Tech

Tech

The blockchain virus is spreading and now it’s breached the mining sector.

Hastings Technology Metals (ASX:HAS) says it will start designing a supply chain platform based on blockchain’s so-called “distributed ledger” technology.

Blockchain is best known as the basis of cryptocurrencies such as bitcoin. But it has many other potential applications such as securing digital contracts and supply chain data.

Hastings wants to used blockchain to trace and track mixed rare earth carbonate (MREC) from its Yangibana mine.

Chairman Charles Lew also threw in a few more buzzwords, saying Hastings would use Radio Frequency Identification (RFID) tagging and Internet of Things (IoT) for digital smart contracts.

Smart contracts and IoT are a new hype sector for blockchain technology.

>> Here’s a recent table of ASX-listed small caps with exposure to blockchain technology

An Internet-enabled RFID tag could come with a smart contract designed to execute automatically when buyer and seller conditions are met.

Finance director Guy Roberston says they have done considerable work on the tech already, and it will be ready for use when they start production in 2020.

He told Stockhead part of the attraction was the future commercial opportunities this kind of tech throws up — but he declined to go into further detail.

Functioning like a ledger, blockchain creates a tamper-proof, indelible record of transactions, enabling it to work in a “trustless” environment. The system can be made fully transparent so the list of transactions is visible to everyone on a public domain.

Hastings will use the technologies for material tracking, proof of source and ownership of the physical product.

Physical properties such as weight, composition, date and time will be recorded and stored in the RFID directly from the Yangibana mine.

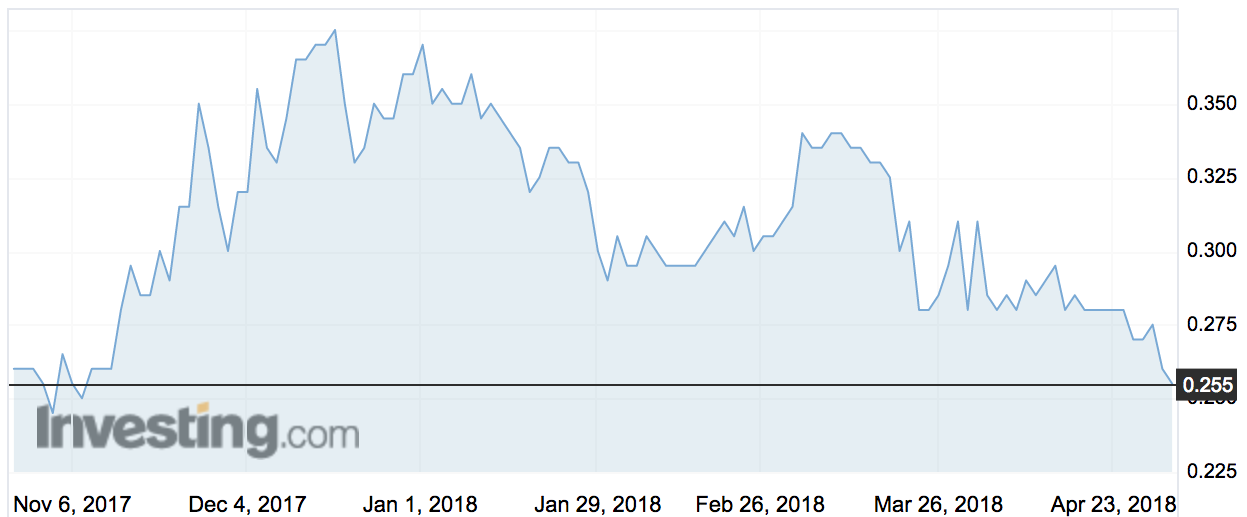

Hastings shares were down 2 per cent to 25.5c, making it one of the few companies not to receive a bounce for blockchain news.