Greatcell Solar delays shareholder meeting as it moves closer to re-listing

Tech

Tech

Solar power company Greatcell Solar has made incremental progress towards its goal of re-listing on the ASX, telling investors in its latest refinancing update that it has a couple of payments imminent.

Greatcell (ASX:GSL) claims to be a global leader in the development and commercialisation of third generation photovoltaic (PV) technology called Dye Solar Cells (DSC) — solar cells that convert light into energy.

DSC photovoltaic tech is cheaper and more versatile than first and second generation PV technology, it says.

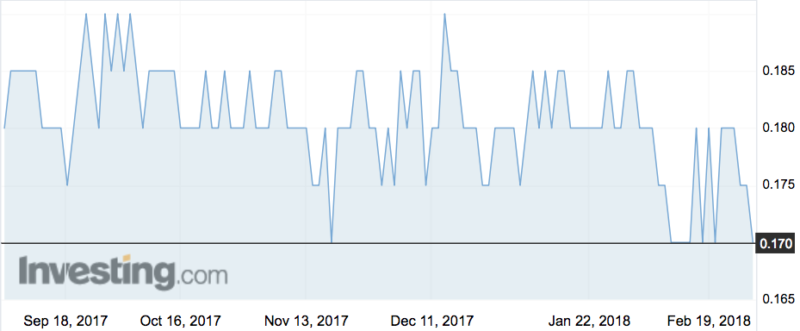

However, the company has been suspended since the end of February as it tries to raise funding for a prototype facility located at the CSIRO in Clayton, Victoria.

At the time of suspension, it said it was a “substantial project costed at between $15 and $20 million” and that it was likely to “take up to four weeks for negotiations to be completed and documentation finalised”.

But Greatcell has had to put out regular financing updates ever since as it struggles to get the money together.

Today, however, it told investors that “significant progress has been achieved in recent weeks”.

That includes a grant payment of $425,000 to Greatcell from the Australian Renewable Energy Agency, which is expected to hit $5.4 million as the project advances, as well as $2.4m convertible note from New Moonie Petroleum, to be split into four payments of $600,000 over the next 12 months.

“The financial commitments provides improved confidence in relation to the proposal to provide further investment funds of up to $15 million over the next 3 months with the establishment in Australia of their food, water and energy focused infrastructure fund,” the company said.

“This will ensure that our prototype project is fully funded. Once this refinancing has been completed, the company intends to seek re-listing of its securities on the ASX.”

Greatcell pushed its AGM back to February next year thanks to late preparation of its 2018 financial year accounts.