GetSwift nabs former IBM exec as tech boss in effort to turn company around

Tech

Tech

Troubled software-as-a-service company GetSwift has nailed a hire from IBM for its new chief technology officer, as it tries to supercharge its AI and machine learning tech.

The appointment comes as the tech play has been defending itself against class actions along with queries by the ASX and the corporate watchdog.

In May, Getswift told investors in an ASX announcement: “The company strongly disputes the allegations made, including any alleged loss, and will vigorously defend the proceedings. The company will continue to keep shareholders informed of developments.”

New appointment Dennis Noto was the executive architect of Watson Cognitive Enterprise Solutions at IBM since February 2016. He was responsible for advising C-suite executives at Fortune 500 companies on AI and leading IBM’s AI technology.

GetSwift (ASX:GSW) said they’d been looking for a CTO for some time and Mr Noto “emerged as the natural choice”.

GetSwift chief Bane Hunter, who replaced ex-Melbourne Demon Joel Macdonald as CEO after a board reshuffle — Mr Macdonald switched to president and managing director — emphasised the new CTO’s experience in scaling enterprise systems and consumer-facing software.

GetSwift’s new chairman Michael Fricklas earlier stressed the importance of scaling at an extraordinary general meeting last month, according to The Australian.

“The company’s growth requires a build-out of its infrastructure and human resources, while the legal challenges of class action lawsuits and an ASIC investigation are requiring management attention that we would rather focus on the underlying business,” he said.

Mr Noto said he was drawn by the company’s technology, and believed GetSwift had a strong reputation in the SaaS last-mile marketplace.

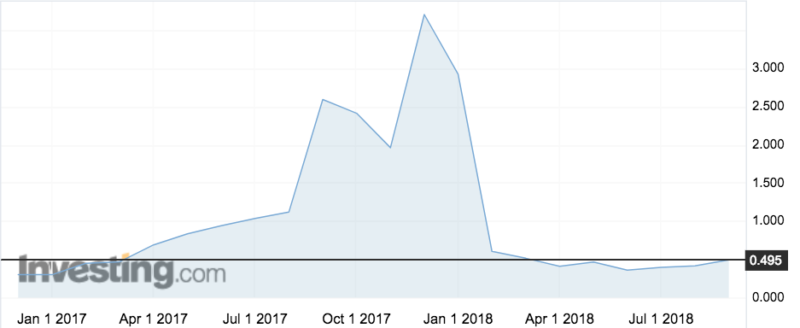

GetSwift shares rose three per cent on the news to 49.5c, a long way short of its once high watermark of $4.60.

Revenue is up along with exec salaries

GetSwift’s full-year accounts last month revealed revenue grew 130 per cent to $773,000, but the company’s loss worsened by 531 per cent.

It blew out to $12.1 million.

Consultancy expenses, thanks to the much-publicised legal battles, rose 1,427 per cent to $4.7 million.

Wages also increased by 489 per cent to $4.7 million, and administrative costs rocketed 530pc to $1.5 million.

Mr Macdonald was paid a $696,460 salary and Mr Hunter banked $629,095.

Those figures included bonuses although Mr Macdonald declined 37 per cent of his bonus and Mr Hunter declined 44 per cent of his “in recognition of the challenges presently faced by the company and as a demonstration of their loyalty to, and investment in, the company”.

These salaries were hefty rises compared with the 2017 financial year, when Mr Macdonald and Mr Hunter received $250,000 and $240,000 salaries respectively.

Mr Noto’s salary is yet to be disclosed.

Stockhead has reached out to IBM for comment.