Fintech lender MoneyMe fires on all cylinders as it delivers record Q2 revenues

Tech

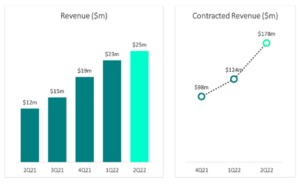

The 108% increase in revenues to $25m was a record for MoneyMe, as it pursues further near term growth following the SocietyOne acquisition in December.

Fintech lender MoneyMe (ASX:MME) has continued its strong start to FY22, having just delivered another record revenue in Q2.

MoneyMe reported Q2 revenues of $25m, which was a massive 108% increase from the previous corresponding period (pcp).

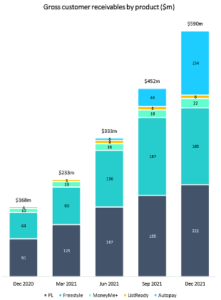

The company also grew its contracted revenue to a record level of $178m, an increase of 44% on pcp while gross customer receivables also rose by 252% to $590m during the quarter.

And after surpassing the $1 billion of originations in FY21, the rapidly growing lender has added $269m in the quarter, a 290% increase on pcp and 56% higher than the first quarter.

Originations have remained strong despite the Covid-19 impacted environment in the last few months.

“MoneyMe’s growth trajectory is now well established reflecting success with our diversified product and distribution strategy, and consistent focus to deliver a leading innovative and digital experience for the Generation Now customer through our proprietary Horizon technology platform,” says CEO Clayton Howes.

MoneyMe has managed to significantly grow its loan book without compromising credit quality.

The book’s credit quality metrics continue to perform within planned ranges, with a closing Gross Average Equifax Score of 672, compared to 638 in Q2 FY21, and 658 in the first quarter.

The net charge-offs rate, a figure that measures the difference between gross charge-offs and any subsequent recoveries of delinquent debt, was at 4% for Q2, an improvement from the Q1 rate of 5%.

The Autopay segment has contributed significantly to overall originations, gaining strong market take-up despite the challenges for car buyers during lockdown.

The auto lending business now has 350 dealers and 845 brokers who have access to the Autopay platform, including Westside Auto in Perth which is the biggest used car dealership in Australia.

The Personal Loans segment also continues to post record originations, with strong growth in November and December in particular.

The growth in this segment is expected to be boosted going forward following the set-up of a personal loan broker distribution channel in November 2021.

“The businesses remain well positioned to continue this high growth despite the Covid-19 headwinds, and to ensure that credit quality is maintained through the cycle supported by robust risk adjusted pricing, asset diversification and digital servicing capabilities,” Howes said.

MoneyMe’s $1bn origination milestone reflects the company’s consistent focus over time to invest in and develop the digital capabilities of its Horizon technology platform.

The AI-based platform enables applications to be completed and checked within minutes. It also allows security to be established, funds to be disbursed, and credit limits to be available to the customer shortly after approval.

Following the landmark acquisition of industry disruptor SocietyOne in a $132m deal last December, MME expects to synergise the Horizon platform with SocietyOne’s customer base to capture huge potential cross-selling opportunities.

The deal is expected to provide multiple synergies and create a dominant, and possibly earthshaking player in Australia’s sophisticated fintech lending market.

It’s also expected to generate a 63% lift in MME’s annualised revenues to $146m, with more than $15m of cost synergies through the medium-term.

“We’re looking forward to welcoming the Society One shareholders to the MoneyMe journey from March to merge two of the most widely recognised customer credit disruptors to further accelerate revenue, customer and profit growth,” Howes said.

This article was developed in collaboration with MoneyMe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.