Bringing back the boom: ActivePort sales jump 74pc as reach goes global

Tech

Activeport’s sales have boomed during the quarter as it partners with more telcos and network service providers globally.

Global telecommunications software provider, ActivePort Group (ASX:ATV) has followed up a strong first quarter of FY22 with an even better Q2.

The company saw significant revenue growth from its managed services and software licenses business in Q2, which delivered a 74% increase from the last quarter to $4.3m.

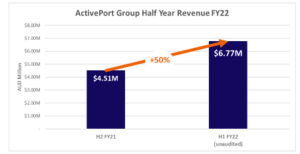

As a result, the group’s half year revenue for FY22 is now 50% above the previous year’s corresponding half.

During the quarter, Activeport successfully increased its partnerships with more network service providers and telecommunications carriers, laying the foundation for software sales agreements moving forward.

Currently, 20 network service providers and 10 major telcos have signed up and are now promoting ActivePort’s software to their customers across 11 countries.

From this network of partnerships, the company expects its license revenue to build through the second half of FY22.

“Our first task was to contract our partners, then work with them to promote our software to their customers,” says Activeport CEO, Karim Nejaim.

“We’ve been extremely successful at signing on partners globally, and now we’re working to close sales via our new partners to deliver license revenue to ActivePort.

“With the amount of sales activity currently underway and the deals we are close to concluding, I expect software license revenue growth to accelerate throughout the second half,” he added.

Activeport’s core product is its proprietary SD-WAN software, which is revolutionising data communication and making networks easier to connect and cheaper to operate.

The SD-WAN 2.0 product lets customers manage all their cloud hosting and networking technology end-to-end, from one single screen.

Using this unique software, customers can create network connections, deliver cloud services, and manage their data at a local, national or global scale.

Activeport’s strategy is to sell the software globally via channel partners that come in the form of telecommunications companies and network service providers.

Under its partnership referral agreement with Radian Arc, ActivePort has so far delivered software to 10 major telecommunications companies in countries such as Australia, Indonesia, Malaysia, Brazil, Vietnam – with the US and Netherlands currently in progress.

In each region where ActivePort deploys to a major telco, the company appoints network service providers as partners to assist in pre-sales engineering, field deployment and technical support.

These arrangements mean that ATV’s business model is capital light, since there is no need for it to buy linkages or capacity in data centres in order to build a global network.

The company has also effectively removed the need to have a specific vendor lock-in hardware, enabling customers to use its software with any hardware platform.

During the last quarter, Activeport has successfully appointed network partners with capacity to cover Australia, South- East Asia, Africa, India and the Middle East.

The sales team is currently engaged in competitive bids in a number of large enterprise projects, which Activeport says should result in significant contract wins in the second half.

Having successfully engaged partners and deployed the technology, the team is now focussed on contracting customers to generate additional license revenue in the second half.

Meanwhile, the company’s R&D team has signed off on a number of new products and features that will be officially released to the market in the second half, following completion of field trials that are currently underway.

This article was developed in collaboration with ActivePort, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.