You might be interested in

Tech

ASX Tech Stocks: Your mini mobile anti-stealth radar has arrived, and YPM launches counterfeit app

Tech

ASX Tech Stocks: Manta Ray inspired submarines and Nearmap aims for positive free cash flow in FY24

Tech

Tech

Location analytics player Nearmap (ASX:NEA) is trading 22% down from this time last year, with a share price of $1.20.

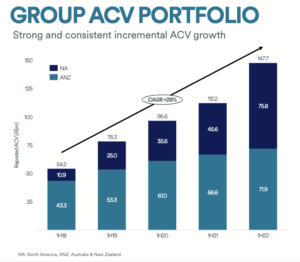

But its 1H22 report showed significant growth in US markets – with its North American portfolio exceeding the size of its Australia and New Zealand (ANZ) portfolio for the first time.

The company takes aerial images of urban areas, presenting them in 2D and 3D, and delivers them to customers under a subscription-based model.

And it’s just delivered a record annual contract value (ACV) of $147.7m for the first half, a 32% growth on pcp.

And in the US, the ACV was US$55m – a 57% jump from US$35.1m at 31 December 2020.

Plus, the North American business has delivered positive cash for the first time.

A bit of an in-your-face to a Hong Kong-based short-seller’s who claimed that it was hiding its struggling operations in the US last year.

“We’re a growth company with a global opportunity that has a very, very long runway,” Nearmap CEO and MD Dr Rob Newman told Stockhead.

“If you look at just the spaces we’re in at the moment, we’re talking about a $32 billion market globally for analytics based on location, aerial imagery and 3D content.

“That’s in US dollars, in Australian dollars we’re talking close to $150 million annual contract value, and we are just starting that journey.”

Evans and Partners recently gave the stock a valuation of A$4.49 and said the company’s North American business continues its “impressive rate of traction within insurance (+76%), government (+38%) and roofing (+76%).

“It was driven by a mix of new business and net up-sell, as the ongoing premiumisation of the content library (AI apps, targeted industry use-cases) further differentiates Nearmap from a field of commoditised image providers,” the note said.

“It is difficult to poke any holes in the operating metrics, with churn and net revenue retention stable across both regions.”

The company says the market opportunity for roof geometry alone up to US$200m per year, but Dr Newman said its insurance vertical that’s been particularly successful and now accounts for around 40% of the North American portfolio.

Plus, four of the top six property and casualty insurance carriers are now subscribers.

“Our content really helps with both the underwriting, so when you’re first putting out a policy for a property, as well as when there’s a claim against the property like the roof has been damaged for example,” he said.

“And we’ve just penetrated a small part of that insurance market, so we’ll look at providing more content and more solutions that are specific to the insurance industry.”

One of the unique products for insurers and insured alike is the company’s ImpactResponse post-catastrophe capture program – and its potential is clearer than ever right now with the extreme flooding on the east coast of Australia.

“We are able to fly above after a flood, after a bushfire, after a cyclone, we fly as soon as possible afterwards and because we’ve already captured the imagery before we can see this house has been destroyed, this house has been partly damaged, this house is okay,” Dr Newman said.

“So, from the homeowners point of view and the insurance company’s point of view, they don’t need to send people in to a risky area, we can just cut the check straightaway for the homeowner to get on with rebuilding the home, or they have the relief that actually my home is ok before emergency services can get in there and clarify the impact.”

Nearmap is aiming to bring its HyperCamera3 intro production, with protoype testing underway and manufacturing scheduled for Q4.

Canaccord Genuity said they expect the camera to “further embed NEA’s competitive technology advantage over its peers.”

Mainly because the camera is expected to represent a doubling of capture efficiency (i.e., imagery at lower cost versus peers) and should bring about new use cases given its improved resolution capability.

Dr Newman said there are two main ways the company can push its camera capture system forwards.

One is increasing coverage, covering more properties more frequently and the other is capturing at a much higher resolution to provide more detail.

“We currently cover about 70% of the US population, we’re going to push that to 80% and that new camera allows us to fly more, but at a lower cost,” he said.

“We can also fly it at a similar cost to get much higher resolution, so then you can see details of damage on roofs, for example, or details of the property construction materials, which allow the customers to make more decisions more accurately.”

Plus, the company increased its average revenue per subscription by 29% to US$22,350 in North America, and $103m – or 70% – of its group portfolio now relates to subscriptions incorporating premium content.

That’s a 56% increase of the pcp.

Dr Newman said its this subscription-based model that keeps Nearmap ahead of its competitors, in the same way people chose Netflix over Blockbuster.

“There are established competitors here in North America but they’re very much the old business model where the customer asks them to fly Providence, Rhode Island, and they go fly it and three to six months later the deliver them the disk with the data on, whereas we’ve already flown it three times a year for the last six years, – so we’ve got all this library of content,” he said.

“It’s much more subscription business model that everybody’s used to, think of us as like Netflix and think of them as like the blockbuster. That’s really the transition that we’re doing. “That’s what’s happening here in America, that’s why we’re growing so rapidly.

“Everybody wants to go subscription – nobody wants to go blockbuster.

“Now in Australia, we effectively were the first ones to do this business model, there are other players attempting to do the same, but for the SAS business model we dominate with greater than 90% share.”

The company also updated its guidance, with the group ACV portfolio expected to close FY22 at the upper end of the $150-160m guidance range.

Dr Newman said the Australian business is generating free cash flow at 55%, and the North American business has just gone cashflow positive.

“This means that, as the top line grows, the free cash out of North American business just expands in proportion, because the cost of our product, the cost of goods stays flat, but the top line grows, gross margin and free cash increases,” he said.

“We’ll see both businesses generating cash, which then ultimately ends up funding all the tech investment we’re doing, which allows the business to turn cashflow positive in FY24. “We will continue to burn cash this fiscal year next fiscal year, but we have more than enough cash reserves with $110 million in the bank, so we’re in a very strong position to fund those investments over the next three halves before we turn cashflow positive.”