Markets ’23: We need to talk about panic-selling…

News

Things are fairly quiet early in 2023. And that’s probably good.

Last year was a bit of a wringer, and then exhaustion set in.

But since eternal vigilance is the price of (financial) freedom, now might be a good moment to go back over your flight safety instructions.

There is only this:

Or perhaps this:

But, according to Dan Hunt, Managing Director and Senior Investment Strategist at Morgan Stanley Wealth Management, there’s always one constant with every sell-off, no matter the cause or it’s painfully discombobulating effect:

“The effort to convince investors to avoid the serious investing mistakes that come from short-term thinking during a sell-off.”

Hunt says investors make a handful of typical mistakes, but right at the top is – The Panic Sell.

“It can be gut-wrenching to see your investment portfolio or the 401(k) plan that you’ve been building for years take a sudden dive.

“The urge to staunch the bleeding can be overwhelming—to salvage what you can and wait for the dust to settle. Ironically, this can be the single most damaging thing an investor can do.”

Dan says that selling into a falling market ‘ensures that you lock in your losses.’

“If you wait years to get back in, you may never recover.”

According to MIT research, more than 30% of panic sellers during pre-2015 downturns never ever ever got back into the stock market.

That’s a failure to re-launch on a thousand levels. The obvious being if you leave the stock market and pack for the hills you’ll miss out on the recovery.

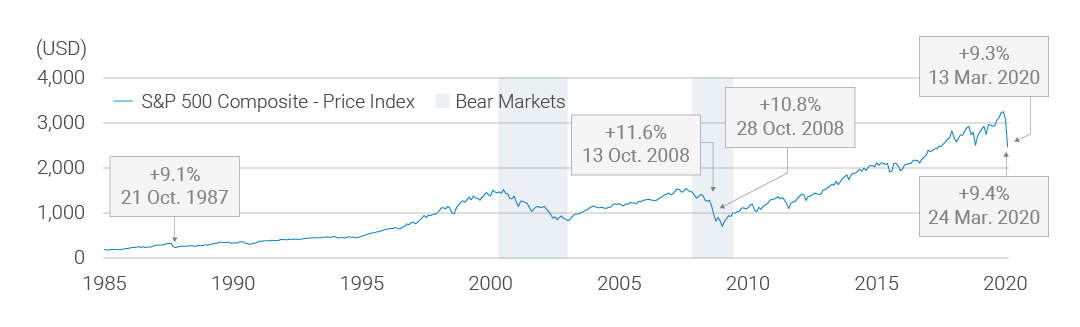

In fact, most of best returns can follow some of the biggest heartbreaks.

CNBC, quoting research complied by the Bank of America says that since the end of the Great Depression, circa 1930, missing the S&P 500′s 10 best-performing days every decade led to a total return of 28%.

On t’other hand, the cooler heads who stayed put through the ups and downs may’ve enjhoyed a – wait for it – 17,715% return.

Here’s more speculative math from Morgan Stanley to make you feel both foolish and chill – He whom stayed put from 1980 until the end of February 2022 would have a 12% annual return,.

“Compared to someone who started at the same time, but sold after downturns and stayed out until two consecutive years of positive returns, who would have averaged a 10% return annually.

“That may not sound like a huge difference,” Dan Hunt says, “but if each investor contributed $5,000 a year, the buy-and-hold investor would have $4.3 million now; the waffler would have $2.5 million.”

Hunt: Instead, do this: Take the long view.

He says that if (unlike me) you don’t need that sweet cash right away and have a well-researched, diversified portfolio, wake up and realise that downturns ultimately are temporary.

“The market may sometimes feel like it could go to zero, but market history shows that rebounds can return many portfolios to the black in just a few years.”

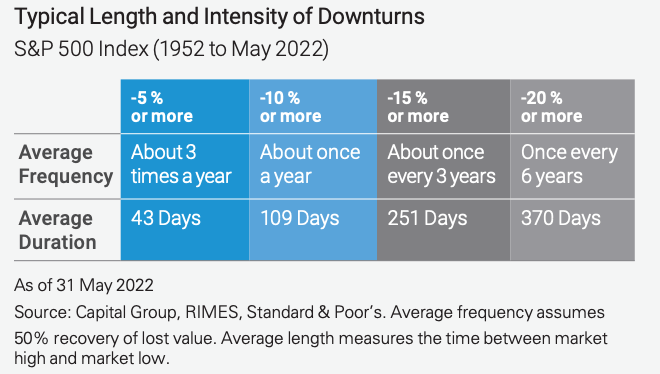

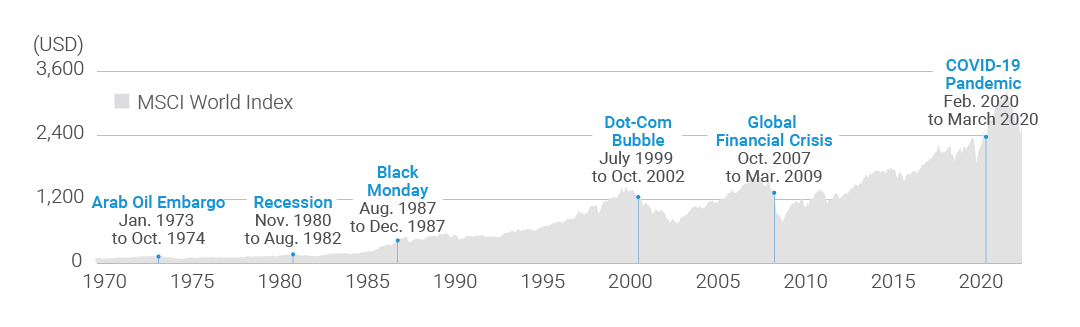

Tracking the history of equity fluctuations from the dawn of time, Werner Krämer Managing Director and Economic Analyst at Lazard Asset Management believes market history shows that panic-selling is simply counterintuitive.

“Downturns—whether corrections, pullbacks, or bear markets—tend to follow a predictable rhythm, with recovery typically following just a few years behind major dips in asset prices,” Werner says.

“We have watched this pattern play out repeatedly over the course of several decades, with the global financial crisis and the pandemic’s early days being just two recent examples.”

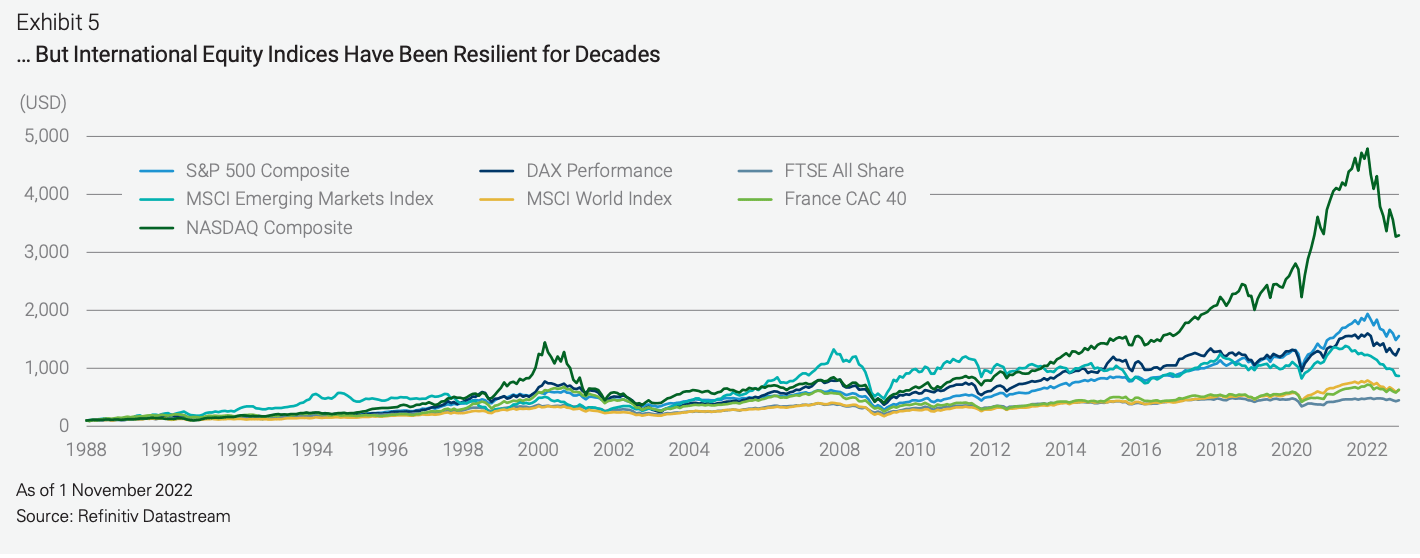

Via: Lazard, Refinitiv (As of Nov 2022)

Via: Lazard, Refinitiv (As of Nov 2022)

According to the history, the data and dignity, it’s not the right time to lose your head(s) when the firefight’s already begun.

And crying about it all later is unlikely to help. Financially.

Via Giphy

“The moral of the story is almost always this: Slow and steady wins the race. Investors who sit with the discomfort of a downturn and remain focused on the long term—even while everyone around them flees—tend to benefit from doing so.”

“This is not only because markets recover with time, but also because the most profitable days for investors tend to fall in the middle of (or in the direct vicinity of) bear markets.”

Via Lazard. Source: Baird, Refinitiv

The phenomenon of panic-selling – and panic in general is hardly new and the other painful aspect for fleeing investors is that so many are aware of the risks such a move carries and of the consequences, Lazard notes in its enjoyable but slightly disturbing December study, The History and Psychology of Panic-Selling.

“We believe the best explanations come from the fields of psychology and behavioural finance.

“While traditional market theories assume the rationality of the investor, these two fields focus on the opposite: the irrational nature of investing, and the emotional, psychological forces that drive it.”

So… 2023.

Looks like there’ll be a fair bit of that ‘ongoing volatility’ to go around for everyone across global markets this year and if you’re freaking out even a little, well, that’s just human nature (or possibly cowardice, jks!)

Even Werner says it is ‘understandably worrying for investors.’

“But we do not believe that panic-selling — a move that is often driven by emotion rather than logic—is the answer.”

“Pullbacks, corrections, and bear markets are all part of the “normal” investment cycle—and history has consistently shown us that they do not last forever.

“Investors who are willing to wait it out—and sit with the temporary discomfort of a downturn, even while everyone around them flees—tend to benefit from doing so.”