Fed eyes x3 rate cuts in 2024; Dow at uncharted highs; Gold shines; SPI Futures up +1pc

News

News

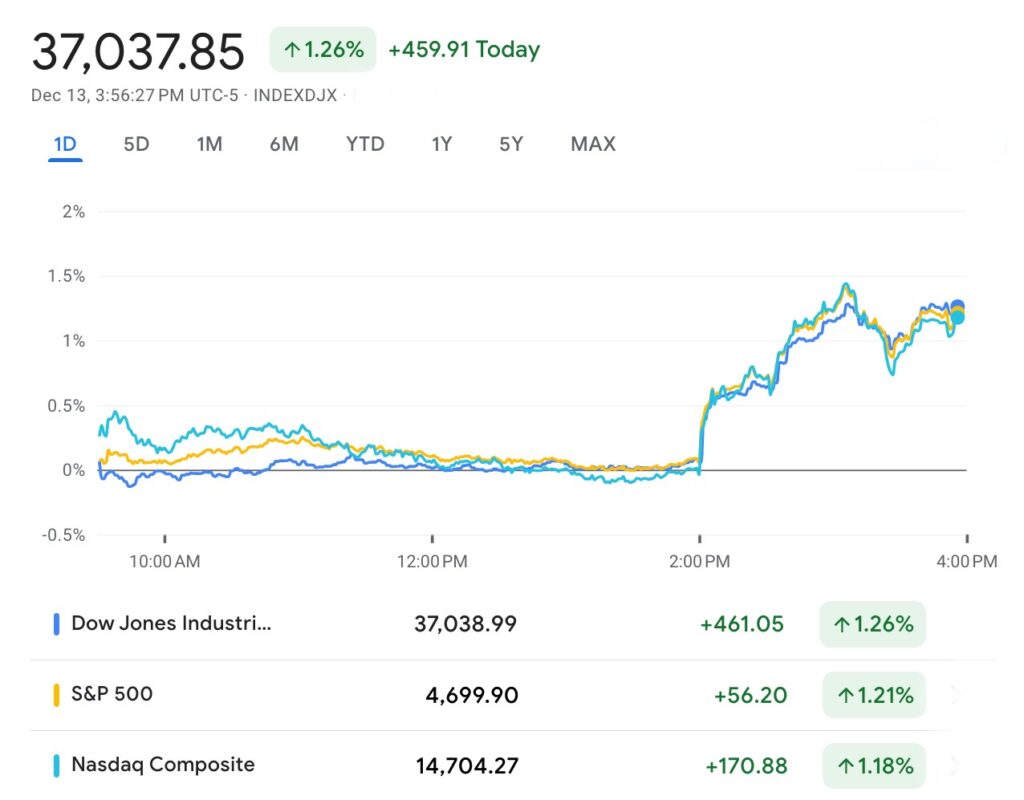

As I sip, write, yawn and watch the blipping and bopping screens on Wall Street – the Dow Jones Industrial Average is smashing its way through an intraday record high, stomping happily past the 37,000pt mark.

With a few exciting minutes left before the final bell, the DJ index has risen over 460 points – or about +1.3% to 37,038 – at last glance, clocking over 37,000 for the very first time.

It’s up just a little less than the S&P500 and Nasdaq Composite, which are both breezing ahead by about +1.25% each.

Wrapping up the final 2-day interest rate meeting of 2023, the US Fed has – as expected – kept the federal-funds target range steady within a range of 5.25-5.50%.

But perhaps even more significantly the central bank forecast three rate cuts next year – far more dovish than previously expected.

Fed officials now expect to lower rates by 75 basis points in 2024 a sharper pace of cuts than indicated in their September’s projections.

Gold smashed past the US$2,000 mark on Wednesday in the states, in line with falling Treasury yields, a weaker USD and the prospect of said projected x3 rate cuts next year.

Whitney Watson, global co-head and co-CIO off fixed income at Goldman Sachs says Fed chair J. Powell and his crew could afford to feel pleased with themselves after the trajectory of US inflation declined much as hoped at the back end of 2023.

“The Fed will wrap up its year with a slight sense of satisfaction, as core PCE inflation has decreased from its peak of 6.6% to 4% without a major slowdown in the economy or sharp rise in unemployment,” Watson says.

“Strong growth and labour market indicators preclude an immediate shift to rate cuts. Should disinflation continue in the coming months, we would expect policy normalisation from next summer.”

US markets have a fair bit of good news to digest late in the day after US producer prices also – but this time unexpectedly – stayed unchanged for November amid the falling cost of oil, cheaper energy goods and subdued factory gate prices.

A US Labor Department report also released overnight described a manufacturing sector slowdown in line with easing overall inflation.

The jobless-American rate in November fell to 3.7%, almost exactly where it was back in March 2022, when rates were as good as zero and right as the central bank began its record tightening cycle.

The aligning stars are good enough for Goldman Sachs to predict rate cuts by mid-year

“We foresee the initiation of a cutting cycle with a 0.25% rate cut in June, with the Fed following a measured approach to reach a policy rate of 4.25-4.5% by the end of 2024—slightly below the updated median policymaker projection,” Watson says.

Market expectations are embracing this upbeat outlook – the Fed also eased off its previous inflation projections, seeing its preferred measure falling to 2.4% in 2024.

While everyone gets a bit transfixed by the consumer price index which dropped earlier this week, the Fed much prefers to go with the core PCE read (minus volatiles like energy and food).

Core CPI was at 4% in November while headline was at 3.1%.

The American central bank also predicted that the core personal consumption (CPC) expenditures price index will slip to 2.2% by kick-off-2025 and after a bit of an adventure at last reach its 2% target sometime in 2026.

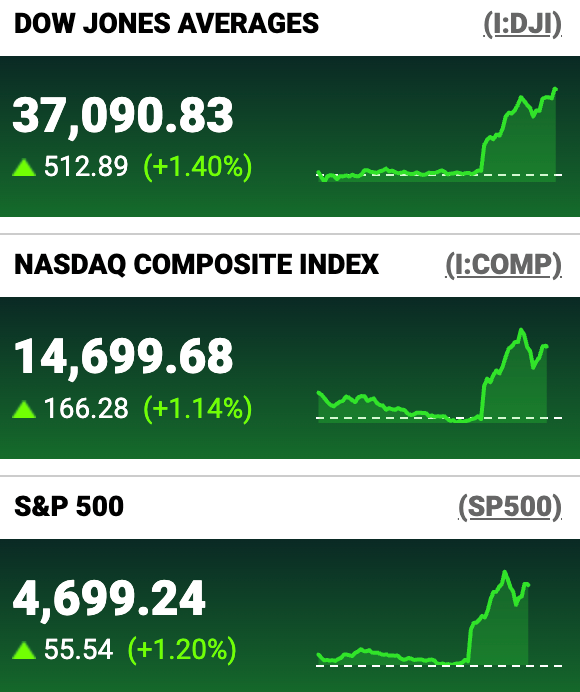

Look, even by the end of this article, the DJ index is adding height:

US stocks are soaring late on Wednesday in Yonkers just as US bonds and the USD withered in the face of a Dow Jones clambering over the bodies of both US Treasury yields and the greenback to a new record closing high.

At home the Aussie dollar’s appreciated to circa $0.667, closing in on its best since end-July on the sharply weaker USD.

In the post-meeting statement, the Federal Open Market Committee (FOMC) would’ve been pleased to share that US inflation had ‘eased over the past year’ a strong concession after a record tightening cycle.

But the FOMC wasn’t done – they also hung around to upgrade US GDP (gross domestic product) forecasts.

They now see America’s GDP growing at 2.6% this year, a full half percentage point booster from September.

One final irony worth observing – the Street’s been incredibly quick to price in these wins.

The FOMC at its last meet emphasised how the back-end of the year’s rise in US long-term bond yields helped the bank stifle inflation and slow the economy.

The yield on the 10-year US Treasury note is below 4.1% right now, its lowest mark since end-July.

In which case the opposite will be true – cliff-diving US Treasury yields and record-breaking US equities (it’s Day 1 of a new rates cycle, literally) as well as the liberating taste of sweeter overall financial conditions could undo all the above work.

The kind of bets on display right now are more than likely the kind that complicates The Fed’s still fraught negotiations with inflation.

Which is still out of the bottle.