You might be interested in

Tech

Zhik's neoprene-free wetsuit range sets sail with six SailGP teams onboard

Mining

Monsters of Rock: MinRes has 'seen the bottom' in lithium prices, Lynas tightens the screws on rare earths supply

Mining

Mining

A mining expert believes Australia is not necessarily leading the way when it comes to addressing the key risk factors of ESG and decarbonisation, saying investors should not discount the advances being made at operations in the developing world.

Big Australian mining companies like iron ore miners BHP (ASX:BHP) and Rio Tinto (ASX:RIO) and gold miner Northern Star Resources (ASX:NST) have historically promoted their preference for operating in ‘Tier 1 jurisdictions’.

Primarily that means Australia, the US and Canada, locales known for their relative geopolitical stability, legislative consistency and wealth.

But increasingly the need to source scarce minerals, particularly rare metals like copper, cobalt and nickel, has seen some of the major mining houses increase their exposure to operating in the Third World.

BHP, which has long had a preference for operating in First World nations, signalled a shift in its thinking amid rumours it is looking to secure copper assets in the DRC from Robert Friedland’s Ivanhoe Mines.

EY Global Mining and Metals Industry Leader Paul Mitchell, speaking to Stockhead on the release of the accounting firm’s 2022 report on mining risks and opportunities, warned investors should not resort to stereotypes with regard to operations in the developing world.

“I think there’s obviously going to be geopolitical risks that are probably heightened, but there was only ever a certain amount of minerals in the world,” he said.

“And we are getting to the point where we’ve reduced the availability of those in Tier 1 countries. And so we are going to have to look more and more to other countries to be able to do this.

“And so I think we are going to start with a bit of a relaxing of that rule and not so much of a discount on companies that may have invested more in Africa and Chile than we have seen over the past few years.

“I think that will start to reduce for those who can manage it well, and they can understand that risk and understand how to manage that (geopolitical) risk rather than just avoiding it.”

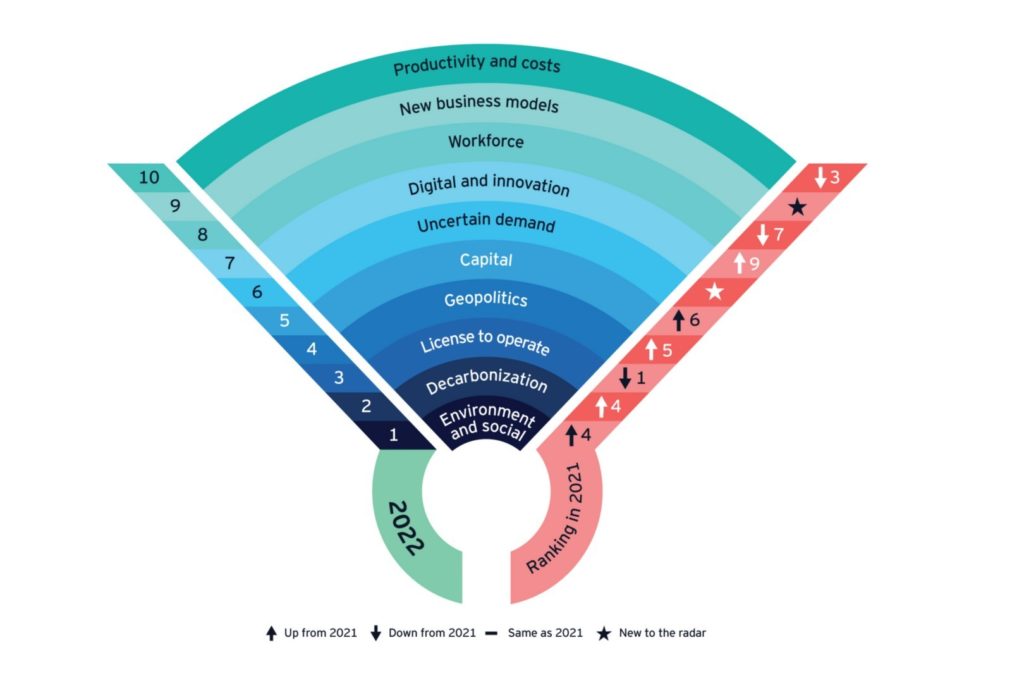

For the first time in three years, leaders surveyed by EY did not nominate licence to operate as the key risks and opportunities facing the industry.

Instead, environmental, social and governance has taken the crown as the make-up, attitude and substance of the investing community changes.

Decarbonisation has also moved from fourth to second place in the mining risk list, above licence to operate, with EY saying businesses were now being forced to incorporate decarbonisation efforts into their core business models, not just in siloed research teams.

“Almost 40% of the Australian Stock Exchange is super funds and those funds need to be able to satisfy their members,” Mitchell said.

“And if they don’t, some manager is going to change or people will vote with their feet in terms of which fund they’re a member of.

“And so the fund managers are trying to reflect the views of their members. And then that’s getting passed down to the mining companies, when they have discussions, so that that really drives that behavior.

“So you’ve got the majority of the capital market these days is driven by pension funds, sovereign wealth funds, those things that have to respond to what society and what their members want.”

Mitchell said it was not a given that Australian operators were handling this risk better than their counterparts in South America and Africa.

He pointed to Codelco, a major copper producer in Chile, which was an early mover on grid scale solar as one example.

“Most people in Australia think of the industry and think we’re out front. But we’re seeing some different advances being made in different geographies,” Mitchell said.

“And so I think those things are really starting to come into play, because they’re issues that hit earlier.

“So if I think about water management and if I think about power, I don’t think about Australia being the leader anymore, I think of Chile.

“Australia is still the leader in terms of productivity, talent and those sorts of things, (but) getting overtaken by those others I think should send a real message about how do we develop?”

Concerns are also rising about long-term demand for the products miners export, primarily to Asian markets and China, with uncertain demand a new entrant to the top 10 risk list at 6th.

Iron ore in particular is at a crossroads, with China looking to become self-sufficient and wean itself off Australian and Brazilian suppliers over time.

While China’s plan to support mines like the Simandou operations in Guinea are one issue, Mitchell believes its decarbonisation goals and its plans to use scrap steel to feed a growing fleet of electric arc furnaces are a bigger factor.

“So recycling in China accounts for about 5% of steel production, whereas in the US, it’s about 45%,” he said.

“And so if China moved from sort of 5% to 35-40%, because the US number will continue to grow, that takes 350 million tons of seaborne iron ore out of the market and gets replaced by recycled.”

The other area where that risk is emerging is in battery metals, because of the uncertainty about which technology will be the leader in energy storage decades down the line, as well as the threat of substitution if relatively scarce minerals become harder to find and price out of the market.

“What’s going to be the answer for batteries or electricity storage? Is it going to be lithium? Is it going to be nickel? Is it going to be hydrogen? Where are we heading?” Mitchell said.

“As sentiments change and new sort of markets come on, that uncertainty is felt.

“And the problem you get as a result is you want people to be risking their capital and investing in starting new lithium mines, and all those sorts of things.

“But if you can’t view a good price curve on it, your chances of attracting capital or cheap capital, your chances of attracting financing just get that much more complex.

“And so there’s a couple of different sort of risks. There’s the risk of technology and innovation changing it, the risk of recycling changing it.”

Productivity and costs was the biggest slider in EY’s top 10 risk list, falling from 3rd to 10th as companies transition from operational concerns to ESG.

New business models made their way into the list at ninth, with workforce at 8th, digital and innovation at 7th, capital moving from 6th to 5th, and geopolitics up from 5th to 4th.

One area Mitchell said did not feature prominently but should be of concern to miners is the risk of cyber-security as the cloud and internet-based work practices envelop mining supply chains and production lines.

“The one that surprised me for the last two or three years, actually, for not getting on the risk list was cyber,” he told Stockhead

“As we continue to invest more in technology, integrate operational technology with information technology, and start to give access to supply chain infrastructure, the processing plants, those sorts of things, to the internet, the risk of a malicious act increases.

“And I think people underestimate what the impact of those could be.

“So I think they get that it could happen, but what they underestimate is how big the impact could be.

“If a major piece of infrastructure at one of our critical ports was taken down, or if a critical railway line was taken down or a critical road was taken down, the impact on mining companies or on industry could be really huge.”