Alpha Mail: 5 names and addresses for making hay in an FY23 without shine

News

Roiling volatility and a global market downturn have thrown a few curly ones at Aussie investors of late, and while there’s still danger lurking, Maple-Brown Abbott’s lead on Aussie small caps told Stockhead this week that the storm-churn is also yielding rich opportunities.

Phillip Hudak, co-portfolio manager at Maple-Brown Abbot’s Australian Small Companies fund, says the FY 2022 earnings season will be “a stock-picker’s market” – with entirely navigable market conditions offset by weakening, often contradictory economic indicators.

Asian equities, emerging markets and Australian small caps are among the asset classes to watch, and active management will be key, Hudak told Stockhead.

“The market pullback so far has been driven more by valuation with downside risk to future earnings expectations going forward. And, despite the negativity regarding the outlook, the current market fundamentals are sound.”

And so far the breadth of downward revisions across the market aren’t exhibiting the symptoms of any pending collapse in earnings.

So in Hudak’s eyes companies which can deliver on earnings will be rewarded this reporting season, with outlook commentaries being more important than ever.

“We believe value is emerging at the smaller cap end of the market given the indiscriminate selling across parts of the market,” he said. “I believe the companies that will benefit during the upcoming reporting season include those with pricing power, defensive earnings streams, leveraged to industry tailwinds, structural growth stories and/or have cost levers to pull.”

Hudak says fans of emerging companies might also want to keep an eye on a few of these themes:

Companies with rising input costs and the ability to pass on to the end customer

Any clear COVID-beneficiaries

Any companies with potential risks regarding both top-line and margins reversing back to normal levels

Companies with elevated inventory levels in a potentially slowing economic environment

The impact COVID-interruptions have on personnel availability

“In addition, companies with low expectations that meet or slightly disappoint market earnings expectations may do well, Hudak told Stockhead. “Many growth-related and consumer-exposed companies have been indiscriminately sold off and any positive news will be well received by the market.

“There are also signs that ‘transitory’ supply challenges may be easing with freight costs having peaked and rolling over in addition to semiconductor chip shortages starting to ease – these factors are expected to benefit those companies exposed to new vehicle and IT equipment supply.”

“Many of the information technology companies that provide essential services, including Hansen Technologies (ASX:HSN) and Technology One (ASX:TNE), may have the capacity to pass through price increases to their customer bases on a timely basis.”

In the last week of July Hansen stock jumped about 10%, after the Software as a Service (SaaS) provider to the utilities sector secured a partnership expansion, with the owners of Australia’s largest electricity distribution network Energy Queensland (EQL) choosing to upgrade to the latest versions of Hansen MDM (meter data management) and Hansen NBM (network billing management). That also includes an upgrade of EQL’s existing Hansen CIS for customer care and billing onto Hansen’s latest platform.

This new deal is for an initial five years and worth some $45m of revenue.

TechnologyOne delivered its 13th year of record first half profit, at the end of March, with SaaS ARR up 44% and post-tax profit up 18%, underpinned by strong demand for its global SaaS ERP solution.

TechnologyOne’s SaaS and Continuing Business revenue jumped more than 20% to well over $169 million, a huge shift from its legacy licence business.

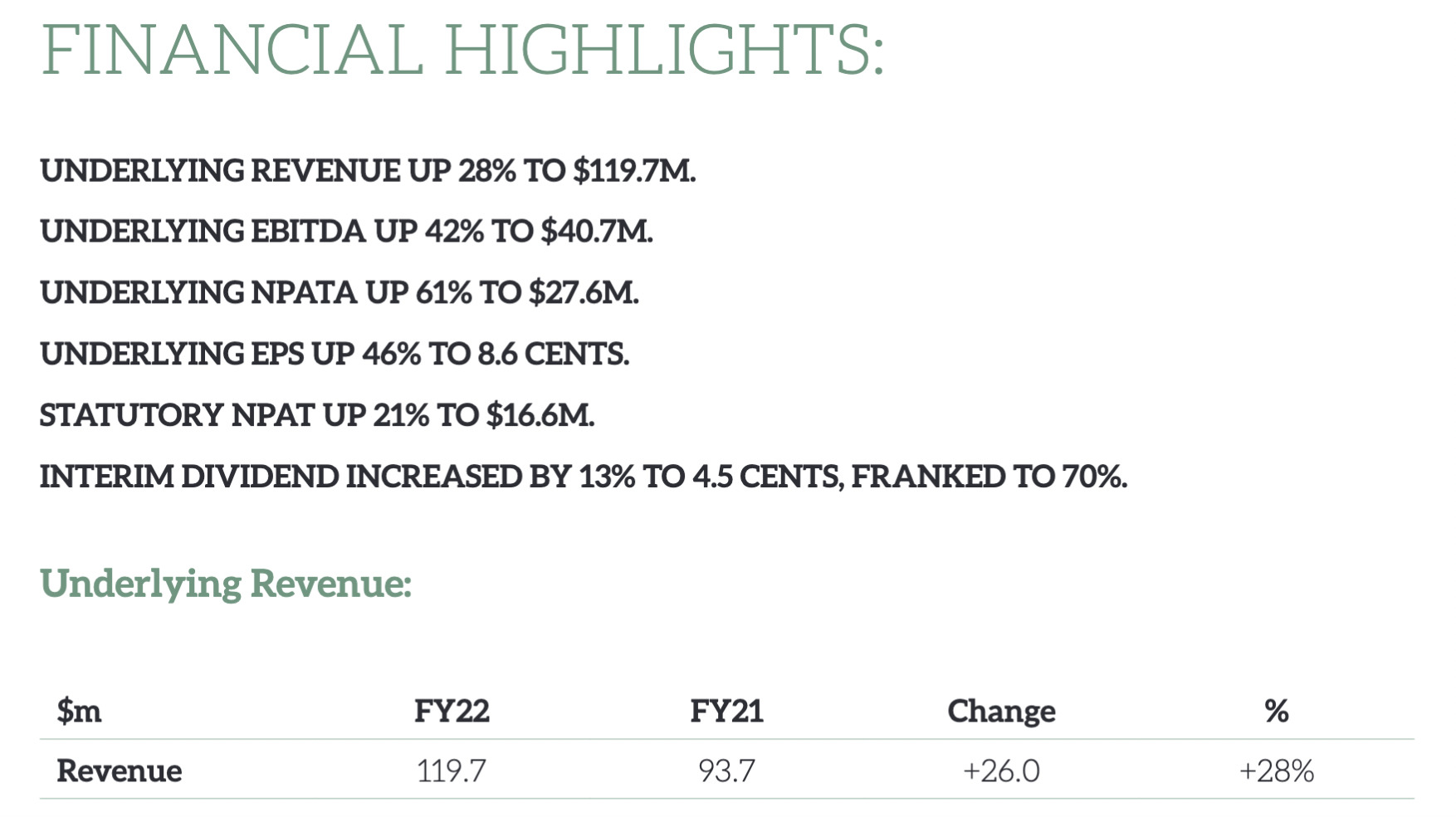

“In addition, those companies with earnings certainty are expected to be better placed, including insurance brokers – PSC Insurance (ASX:PSC) has indicated strong organic growth led by favourable market conditions in addition to a good pipeline of acquisition opportunities.”

(ED: I looked these up from the August 2021 Full Year presso and thought I’d add them ‘cos they’re pretty good)

A few weeks ago PSC told the market it was snapping up the UK ops of ASX-listed competitor Ensurance in a deal valued at well over $8.2m.

The deal has PSC forking out $6.15m in cash and the remaining $2.05m via PSC shares for Ensurance UK, a construction-based underwriting agency with offices in London and Manchester.

PSC calls the investment “highly complementary” with its UK strategy, a market where it now owns a sizeable presence with broking acquisitions. Ensurance UK makes about $4.4m in annual revenues, has a depth of distribution within the local broking market and strong supporting underwriting capacity.

In a more cautious environment, companies exposed to industry tailwinds should be somewhat sheltered – the travel industry continues to recover back to pre-COVID levels with Corporate Travel Management (ASX:CTD) recently indicating strong market share gains in all regions with June 2022 quarter profitability providing strong momentum into FY23.

CTD is currently Morgans’ number one pick in the ASX travel sector. The brokers have placed an Add rating on the stock and slapped a $25.85 target on the corporate travel specialist’s share price.

This provides a certain amount of value to Corporate Travel Management’s closing price of $19.05

CTD has already corrected 34% since the height of the “reopening trades” optimism back in late April.

“Unfortunately,” says Market Matters’ portfolio manager James Gerrish, “we believe there’s probably still further to go as a third Covid wave washes across Australia.”

“We believe the stock is still priced for life after Covid albeit with less enthusiasm than three months ago. We are a fan of CTD as a business but feel the sentiment towards the Covid-influenced travel stocks is likely to see its shares make fresh 2022 lows,” he added.

Structural growth stories should also fare better, including Lovisa Holdings (ASX: LOV) which has signalled a significant global store rollout and expansion into new geographical markets. In addition, companies that can reduce costs in a more cautious environment will also benefit.

LOV is a vertically-integrated jewellery retailer. With a cannily broad 15 to 45-year-old target market, the business appeals to women and fast-fashion fans at cheap prices ‘ranging from $6.99 to $49.99’.

LOV management’s consistent focus on creating and selling super fashionable stuff at a super disciplined price range is among the key reasons for Lovisa’s continued success.

The Aussie-listed retailer is now taking on US-based Claire’s in a race to scale and dominate the market.

(Ed: And I respect this observation from A Rich Life analyst Raymond Jang):

Lovisa fails fast if new markets do not meet their high thresholds. The management team is not afraid to cut ties quickly if the economics are not favourable as illustrated by Vietnam and Spain. This is best summed up by (founding CEO) Fallscheer’s response in the HY20 call when asked about why Lovisa isn’t proceeding with rolling out stores in Spain.

“Just a conservative approach, to be honest. We need to make sure we’ve got positive sales growth and get to a point where we’re comfortable.”

A number of stores have also been cut in more mature markets like Australia and New Zealand, reflecting management’s obsession with maintaining stores that contribute high returns on capital.

Maple-Brown Abbott focuses on active management of differentiated listed equity strategies.

Privately owned and headquartered in Sydney (with some $10 billion in assets under management as at 30 June 2022), Maple-Brown Abbott focuses on active management of differentiated listed equity strategies.

At Stockhead we tell it like it is. While we admire the work of Maple-Brown Abbott they neither sleep with our journos nor advertise with their bosses.

This article does not constitute financial product advice. You should consider obtaining some independent advice, from someone with your best interests in mind, before making any financial decisions.