SomnoMed boss apologises for upsetting dentists, shares surge

Health & Biotech

Health & Biotech

The apology was heartfelt, but now the focus at medical devices outfit SomnoMed is on how it plans to reclaim lost ground in the key US market, after it was forced to axe a costly plan to launch sleeping centres in its biggest market.

In the process, it has replaced its chief executive and forecast further losses of as much as $4 million to shut the door completely on its US disaster.

Difficulties in the US were behind the heavy $4.2 million loss in 2016-17, which surged to $10.7 million in 2017-18.

“I apologise to you, our shareholders, for the losses incurred by [its US sleep centres] over the last two years,” chairman Peter Neustadt told shareholders at Tuesday’s annual general meeting.

The heavy losses and the cost of the investment in sleep centres forced SomnoMed (ASX:SOM) to go to shareholders for funds, although it has vowed to rebuild the company without coming back to shareholders for more money.

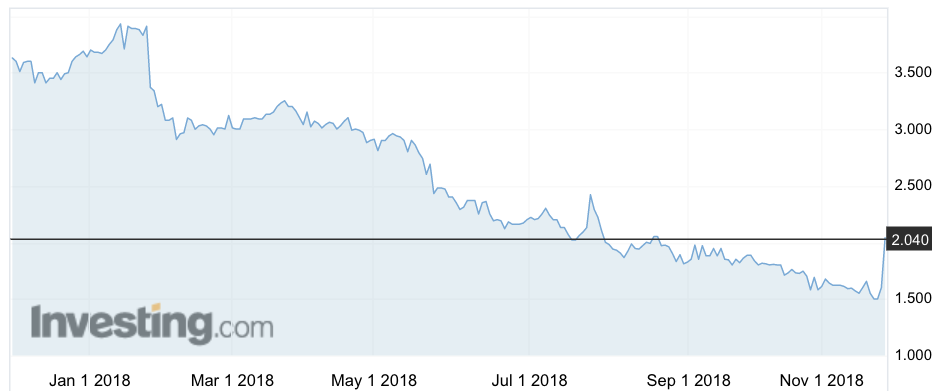

That undertaking helped to trigger a 28 per cent rebound Tuesday in its shares to trade at $2.04, which is still down around 50 per cent over the past year.

“The impact [the sleep centre roll-out] has had on the value of our stock has been very significant and is deeply regretted,” Neustadt said.

While its mouthguard, which treats sleep apnoea, was traditionally sold through dentists, SomnoMed figured that it made little sense for dentists to be treating a medical condition.

But as SomnoMed sought different ways to market in the US, both through doctors and more recently via its own chain of sleep centres, this posed a threat to the profits dentists made from getting patients to use the medical device.

So a core part of its traditional US customer base of dentists actively turned against the company.

A device which typically costs around $2,000 in Europe and Australia for assessment and application, can cost as much as $10,000 in the US. But despite the advantage of working through its own sleep centres, changes in the medical insurance landscape in the US ultimately forced SomnoMed’s hand, with the decision this week to shutter all of its sleep centres.

Not only is the focus on rebuilding market share in the US but this will also involve much greater linking of digital computer aided design and production software production programming to both boost operating efficiencies and patient needs.

And, as new competitors such as Oventus, another ASX-listed mouthguard maker for treating sleep apnoea, circle, SomnoMed is finalising plans for a next generation product which will be launched in 2019, and which may help it regain market share.

Research and development spending has been running at around $1 million as it prepares new products for launch.