JustKapital has another go at buying US ambulance chaser NHF

Tech

Tech

JustKapital is trying to buy a US ambulance chaser — again.

The now-ex litigation funder (ASX:JKL) tried to buy National Health Finance (NHF) in a debt and equity-funded $US68 million ($85 million) deal last year.

The whole thing was scrapped after three months of trying and failing to raise the ready from investors.

But after offloading chairman-founder Philip Kapp and his litigation business, they’re trying again.

The deal this time is for all of National Health Finance instead of just 70 per cent.

The price is now $68.8 million ($US53 million) half of which goes in cash to major NHF shareholders Presidio Investors.

The founders Dave Wattel and Mark Siegel are taking half of their share in scrip and half as a deferred consideration which is payable after four years. That carries a 13 per cent per year ‘coupon’, a payment which is effectively an interest payment of $2.24 million each year.

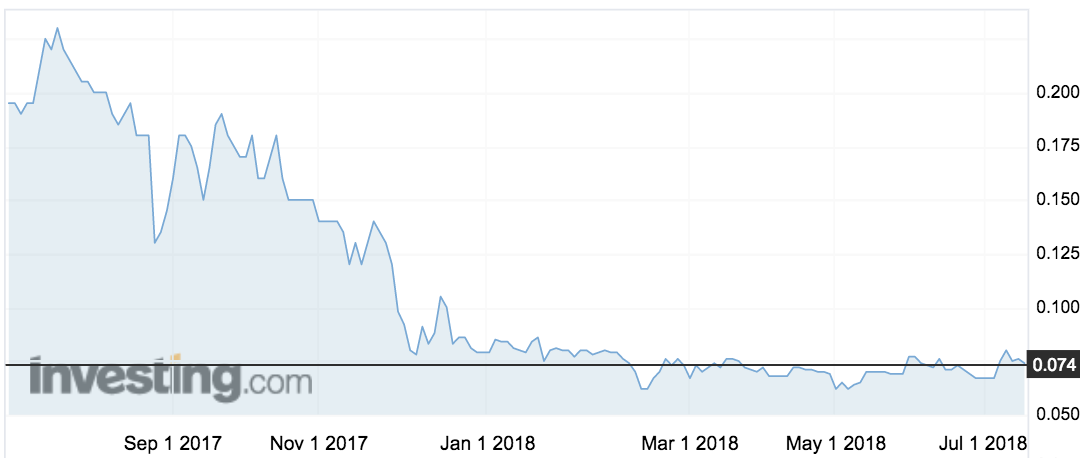

JustKapital says it will give the company an enterprise value of $201 million. Its current market cap is $10 million.

Once again, it’s conditional on JustKapital raising the cash, which it says it has done and all that is required is now shareholder approval.

It wants to raise $7.5 million from sophisticated investors with shares priced at 8c, it has raised a $42 million loan from institutions and family offices, and a rights issue for retail investors to raise $11.8 million.

A JustKapital spokesperson told Stockhead that the first iteration of the deal put a value of $US97 million on NFH and that wasn’t seen as a “reasonable reflection” of the company.

“Upon further diligence and negotiation undertaken by JustKapital and its advisors, the vendors adhered to a more realistic value. The revised consideration concentrated on a deeper understanding of the business and its current value proposition versus the value add that JustKapital would bring to the long-term growth of the combined entity. This consideration was also reflected appropriately in the amended deal structure with regards to the NHF Founders being more closely aligned to the long-term growth and success of JustKapital,” the spokesperson wrote in an email.

They said the current deal is all debt funded, and the fact that the NHF founders are being paid out via a vendor loan and scrip means they will have more of a vested interest in the company than had they received most of the payment in cash.

“Overall, the structure of the revised deal will allow all participants to be more closely aligned to the long-term growth and success of JustKapital.”