iSignthis is still in the wars after a rough week

Tech

Tech

It’s been another rough day for listed payments company iSignthis (ASX:ISX), which remains under pressure following a report last week questioning its governance practices.

A 2019 market darling, iSignthis shares climbed from below 20c in January to a record high of of $1.70 on September 10.

But in the wake of the report from markets watchdog Ownership Matters, the stock swiftly fell more than 40 per cent.

iSignthis lodged a strongly worded response to the report on Tuesday, which it said contained false and misleading statements.

The stock was sold off heavily again this morning, losing another 20 per cent on no news before clawing back some ground in afternoon trade.

This afternoon, iSignthis responded to an ASX price query after the stock slumped to an intra-day low of 66 cents with a “significant increase” in trading volume.

The company said it was not aware of any new information — with respect to both an ongoing legal case and its latest earnings guidance — which may explain the sharp decline. In response, ISX said it was not aware of any such information.

The Ownership Matters report highlighted performance rights issued in the company’s 2014 prospectus, in connection with a back-door listing when the company renamed itself from its previous iteration — Otis Energy.

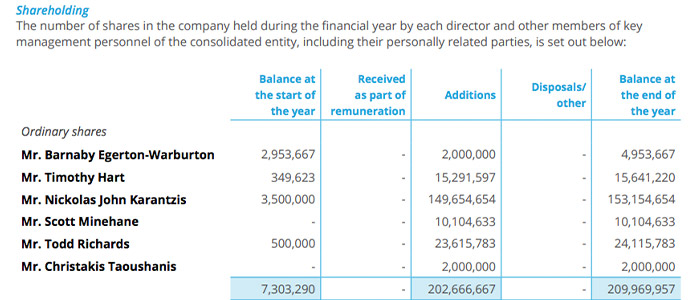

The prospectus allocated 336.6 million shares in three tranches to company CEO John Karantzis — along with other executives and shareholders — if three separate revenue targets were met by June 2018.

iSignthis then built momentum with a reg-tech payments network aimed at companies that need assistance complying with anti-money laundering laws.

All three revenue hurdles were cleared, which resulted in a shares windfall for the executive team. The company’s 2018 annual report shows Karantzis’ stake in the company climbed from 3.5m shares to 149.65m shares as at December 31:

The first two hurdles were cleared easily, while for the third tranche — a $5m hurdle — iSignthis reported half-year revenue to June 2018 of $5,512,057.

But the Ownership Matters report said if it wasn’t for an R&D tax concession and interest income, the third tranche would’ve been cleared by just $1,347 — a fact iSignthis didn’t directly dispute in its response.

The company also changed its reporting date from June 2018 to December 2018 in April last year. Full-year revenue to December was booked at $6,623,413, indicating a sharp decline in the second half of the year.

At the stock’s all-time high, Karantzis’ interest in iSignthis would’ve been worth over $250m. A report in the AFR said the company is also involved in a legal dispute with an early shareholder, David Edmonds, who says he never received performance rights owed to him.

In a statement to the ASX on Monday September 9, iSignthis said annualised gross processing turnover volume rose to $1.1 billion to the end of August, indicating a sharp pickup in activity from June 30 this year.

With markets now concerned about the company’s governance structure and reporting practices, iSignthis’ next 4C filing is likely to attract plenty of scrutiny.