Fatfish Internet is off to the US to dual-list on the over-the-counter market

Tech

Tech

Bitcoin miner and crypto investor Fatfish Internet wants to move to America where it reckons it can get more bang for its shares.

ASX-listed Fatfish (ASX:FFG) is seeking an extra listing on the US over-the-counter (OTC) market OTCQB.

An OTC share is one traded somewhere other than on a securities exchange. Companies that can’t meet the listing requirements of US markets can use them to market shares to US investors.

In this case, the dealer network is OTC Markets Group in New York. Finra is another major dealer network.

There are three types of over-the-counter markets.

OTCQB — which Fatfish is targeting — is the middle tier for early-stage stocks.

The top tier is the OTCQX for established companies. The lowest tier is the Pink Market offers which offers equities in a range of companies which include those in default or financial distress.

“The dual listing on the OTCQB and ASX is an excellent opportunity for Fatfish to gain investor awareness in North America and increase liquidity without dilution to existing shareholders,” said chief Kin Wai Lau.

The company promises the move will not be dilutive to existing shareholders. No capital is being raised and no new shares are being issued.

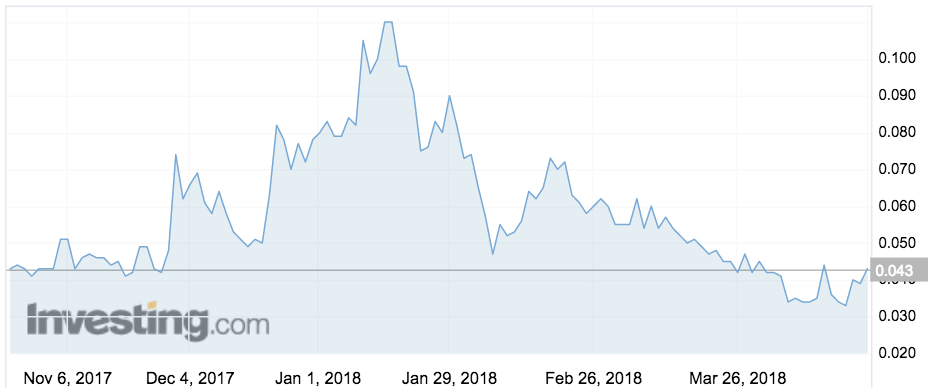

Fatfish shares were up 10 per cent on the news to 4.3c.