‘Caged bull’ of Bitcoin rests a little more as rally stalls

Coinhead

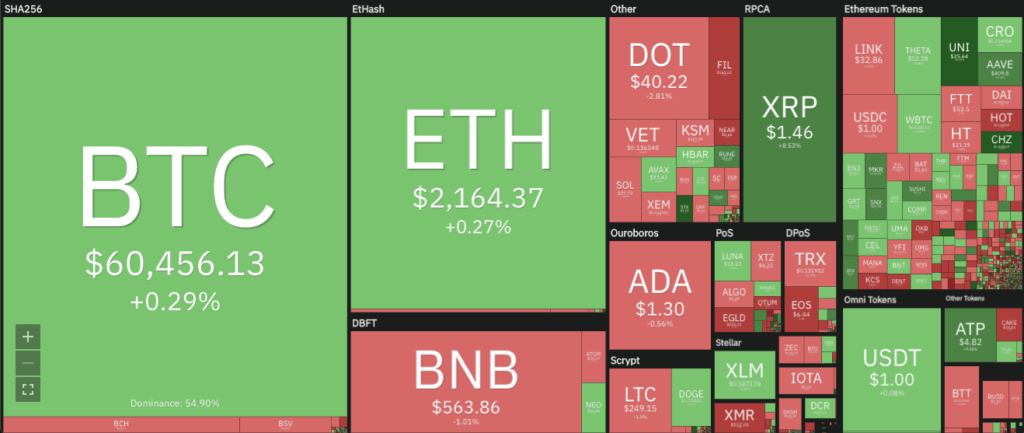

Bitcoin has crept back over $US60,000 – but that hasn’t lead to the surge upward that many cryptocurrency fans were expecting.

At 2.58pm AEDT, Bitcoin was trading at $US60,556 ($79,878), up 0.6 per cent from 24 hours ago. But two moves above $61,000 – one yesterday evening and another around 1pm – were swiftly rejected, leaving intact the original cryptocurrency’s all-time high of $US61,712 set exactly a month ago.

Most altcoins were quiet as well, with only 10 of the top 100 crypto-assets listed on Coingecko having moved more than 10 per cent in either direction. (Nine were gainers; the one decliner was Wink, yesterday’s top token). Forty of the coins had gained ground and 53 had lost it.

Only two tokens had hit all-time highs in the past 24 hours – Nexo and Decred.

Pretty quiet and boring day for bitcoin at around $60,000

— BitBit.BTFD (@BitBitCrypto) April 12, 2021

me, at #bitcoin trying to rally pic.twitter.com/nulCE9fz13

— Meltem Demirors (@Melt_Dem) April 12, 2021

The Crypto Fear and Greed Index remained at 74, indicating “greed,” about where it’s been since March 28.

Many were looking ahead to Coinbase’s direct NASDAQ listing, which will take place overnight Wednesday/Thursday, Australia time.

The US exchange is expected to list for between $US50 billion and $US100 billion – conceivably making it more valuable than New York Stock Exchange owner Intercontinental Exchange (ICE:NYSE), which has a market cap of $US66 billion.

“Coinbase is going to blow people’s minds,” said Matt Hougan, chief investment officer at Bitwise Asset Management, told CNBC. “I think it’s going to force traditional finance to wrestle with the phenomenal growth that is taking place in crypto.”

Overall the fact that Bitcoin had mostly been trading over $US60,000 since lunchtime on Monday was ultimately positive, analysts said, even if its next move upwards was taking longer than some people had hoped.

Bitcoin is holding gains above the $60,000 and $59,500 support levels.

There is a key bullish trend line forming with support near $59,400

The pair is likely to start a sharp upward move once it clears the $60,800 and $61,200 levels. #Crypto #cryptocurrencies #cryptocurrency— Gianluca Galimberti (@mediapw) April 13, 2021

Bloomberg Intelligence analyst Mike McGlone tweeted that Bitcoin was a “caged bull, well rested to escape”.

Technical Outlook: Still in Price-Discovery Mode, #Bitcoin Plateau Appears Distant —

Bitcoin supply is declining and demand is rising, leading us to expect continued price appreciation and the establishment of a higher plateau as the crypto matures. pic.twitter.com/V4kTzfhjZv— Mike McGlone (@mikemcglone11) April 12, 2021