Brookside Energy is hitting the mark at every turn but is trading well below its inherent value, according to one analyst who believes the junior oil and gas producer is worth about double the current share price.

Very few ASX energy sector juniors have $US171m worth of oil and gas reserves, nearly $18m cash in the bank, zero debt, a latest full year Net Profit of $15m and is also in the enviable position to launch a chunky share buyback, of what appears to be very cheap stock.

Brookside Energy (ASX:BRK), an oil-focused producer in Oklahoma’s prolific Anadarko Basin, has ticked every box but the company’s share price sits at around 1.6c, placing its market value at just $80m.

Brookside Energy (ASX:BRK) share price chart

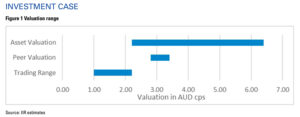

A newly released report by Independent Investment Research (IIR), however, has outlined a base case valuation range of 2.9c to 3.6c.

IIR said in its May 17 report that Brookside’s strategy of drilling very low risk wells in mid continental USA is resulting in drilling costs being paid back in six to 12 months with very low risk of failure.

“The company has hit a sweet spot in the last 12 months, with production from four initial wells drilled resulting in very strong cash flow and at least 20 more planned,” the report said.

Brookside has also just announced its maiden oil and gas Proven & Probable (2P) Reserves of 11.9 million barrels of oil equivalent (Mboe), which have a pre-tax Net Present Value of $US170.5m, according to Dallas, Texas-based independent reserve certifiers, Haas Petroleum Engineering Services. It has also flagged the potential to bump these up a further 20% over the coming six months.

“These metrics provide clear evidence of the success that Brookside has enjoyed as operator (through its controlled subsidiary Black Mesa) and provides solid metrics around which the company can be valued,” IIR said.

“The management are delivering as promised.”

But the market seems to have underestimated the growth potential in this small cap oil and gas play.

“The share price response to the recent reserve announcement has however been muted, which is puzzling,” IIR noted.

IIR said the recent reserve announcement should have been a trigger for a share price re-rating.

“While the share market has appeared to have ignored the reserve release of 26 April 2023, we believe this information is the clearest indication to the market so far that Brookside has transitioned from a capital consuming oil explorer to a strongly cash generative oil developer and producer,” the firm said.

Although the March quarter did see a reduction in cash on hand, due to $18.9m in drilling costs related to the Wolf Pack and Juanita wells, and lower revenues due to Wolf Pack production delayed until the June quarter, IIR believes this sets Brookside up for a ripper coming quarter.

“All this means that the June quarter should be highly cash generative, and once that positive cash flow becomes visible to the market, and it refocuses on the reserves, we would expect to see a more rational share price response.”

The expectation for the June 2023 Quarter is that all four wells will be in production, Brookside will book sales of 70,000 boe of unsold March production from the Wolf Pack well alone, and there will be no major well drilling payments.

The recently announced share buyback is also a strong indicator of the robust position Brookside is in and a signal of management’s confidence in generating cash in the years ahead.

The company is in the process of buying back up to 5 million shares, roughly 10% of the shares on issue. In the context of the Brookside’s recent trading activity, this could provide meaningful share price support. According to IIR, it is the equivalent of buying 100% of the turnover in Brookside since the start of February this year.

This article was developed in collaboration with Brookside Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

You might be interested in