Bauxite Resources jumps 14pc as Ron Brierley’s Mercantile raises offer

Mining

Mining

Mercantile Investment Company is dangling what it hopes is a more attractive offer in front of shareholders in its bid to take control of Bauxite Resources.

The investment firm of legendary corporate raider Sir Ron Brierley is now offering 11c cash per share, an increase of 2c over its prior offer, for half of Bauxite’s (ASX:BAU) shares. The offer has been extended to February 28.

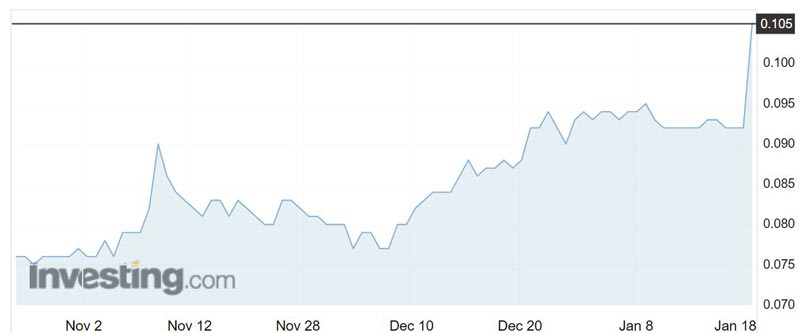

Bauxite’s share price climbed 14 per cent to an intra-day high of 10.5c on Friday — its highest point in five years — on the back of the news. The company has gained 40 per cent in the past three months.

Mercantile has increased its stake to 4.5 per cent. The suitor has its eye on Bauxite’s $16.2 million in cash reserves.

An independent expert report concluded in December that the original off-market offer of 9c per share, which valued the company at $19.8 million, was “neither fair nor reasonable”.

The expert valued Bauxite at 11c to 13.3c, with a sweet spot of 12.1c

Consequently, the board urged shareholders to reject Mercantile’s bid. Bauxite offered shareholders $10.7 million if they remained loyal.

Bauxite CEO Sam Middlemas told investors the board, which controls 27.8 per cent of the stock, would reject the offer.

If the takeover succeeds, Mercantile will immediately pay shareholders 6c a share, terminate a joint venture with HD Mining & Investment, and stop all exploration activities.

It also plans to sell off all assets, including two farms, and pay the proceeds to shareholders once debts have been cleared.

Stockhead is seeking comment from Mercantile and Bauxite.