You might be interested in

Mining

Here’s why Australian Mines answered the clarion call from its Brazilian critical minerals projects

Mining

Resources Top 5: Australian Silica Quartz hunts 10Mt motherlode; Aldoro delves in thick for nickel

Mining

Mining

Australian Mines has submitted extensions to its already granted Mining Leases (ML) at the Sconi battery minerals project in QLD, with the aim of ‘significantly de-risking’ project development.

The company is seeking sustainable nickel and cobalt production from the project from 2028 to supply offtake partner LG Energy Solution – one of the largest producers of advanced batteries for the electric vehicle industry.

The US$1 billion project, including a 2mtpa ore processing plant for mixed nickel-cobalt hydroxide precipitate (MHP), is estimated to support 800 jobs and increase Gross Regional Product by A$2.2 billion over its 30-year life.

That 30-year mine life could produce enough battery grade nickel and cobalt to power 5-6 million high-performance electric vehicles.

The mine could also potentially produce scandium oxide as a valuable by-product.

Application for the lease extensions come after Australian Mines (ASX:AUZ) secured the Greenvale mining lease back in July from the Queensland Government Department of Resources for 25 years.

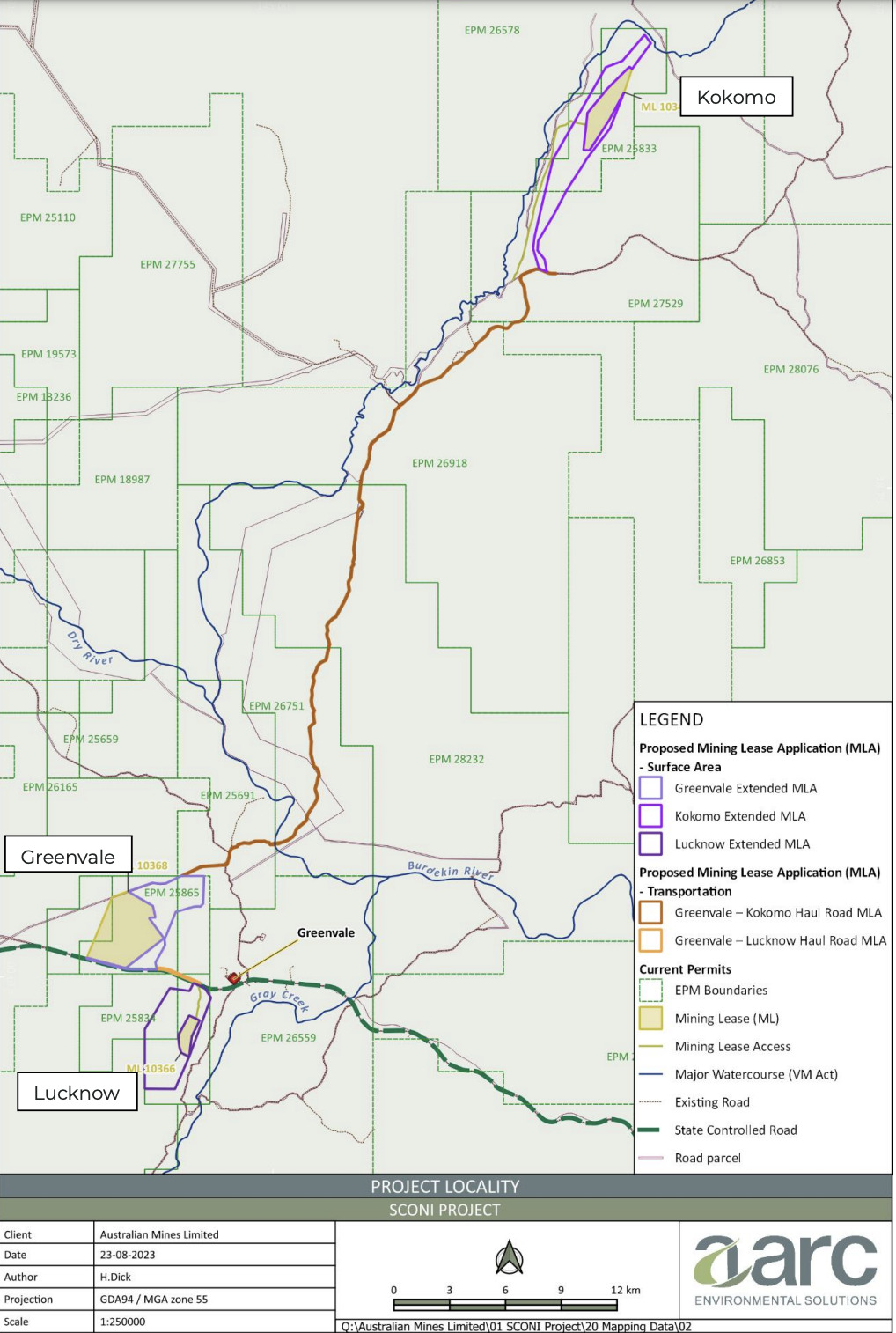

The Sconi project comprises three granted mining leases covering the main deposit located at Greenvale (ML 10368) together with two satellite deposits at Lucknow (ML 10366) and Kokomo (ML 10342).

“On detailed review of the project parameters, the environmental impacts and considering social and economic factors, Australian Mines has submitted extensions to the already granted mining licences,” the company said.

“These expansions are expected to de risk the Sconi project development significantly and will add additional flexibility and optionality regarding the optimal and efficient extraction of the battery minerals contained within the deposits.”

In conjunction with the expansions submitted to the already granted mining leases, two additional transport/ infrastructure leases have also been submitted which are expected to follow the current road reserves.

The company says the approval of the lease extensions would lead them another step closer towards a final investment decision for the project, expected by the end of 2025.

In the meantime, environmental monitoring and studies and exploration works are under way.

Australian Mines is also in discussions about the potential for a strategic collaborative partnership for the development of the project and will look to explore opportunities to acquire additional, synergistic battery mineral projects under the leadership of recently appointed CEO Andrew Nesbitt.

Nesbitt – formerly of Resource Mining Corporation – was appointed to Australian Mines in September, bringing more than 25 years’ experience in the resources sector. He has held positions with De Beers and Goldfields and has worked on several project feasibility studies across the world with technical consulting group SRK.

This article was developed in collaboration with Australian Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.