Australian Mines and Impact Minerals on the hunt for copper-gold porphyries in NSW

Mining

Mining

It could be argued that ‘diversity is strength’ when it comes to (non-gold) mineral exploration and mining. Single project/commodity explorers and miners are particularly exposed to a particular metals’ upside and downside.

Higher reward, but also higher risk.

Australian Mines (ASX:AUZ) is a good example. When battery metals were running hot in 2017-2018, this advanced nickel-cobalt explorer was sizzling, with a share price that peaked at ~14c.

At preopen Tuesday the stock was selling for about 0.8c.

The explorer’s slow decline was triggered by cobalt’s fall from grace and the massive amount of capital required to get its multi-generational Sconi nickel-cobalt project in Queensland off the ground.

The company remains confident that battery metals will rise again. But it doesn’t hurt to have a few other irons in the fire in the meantime.

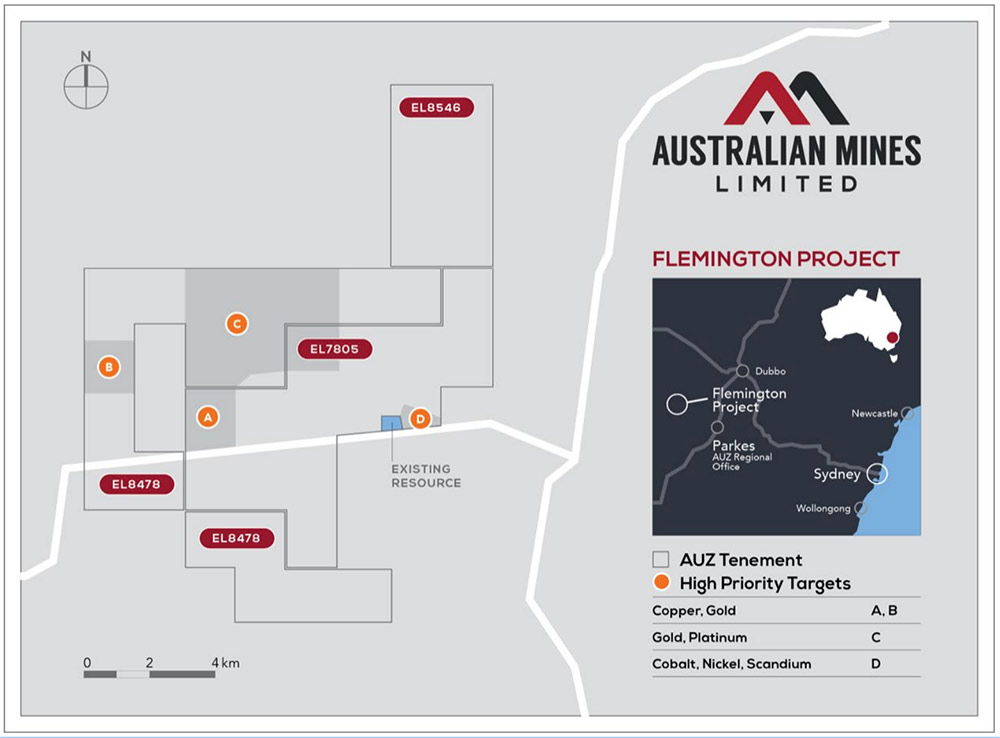

On Tuesday, the company said a third-party exploration report by RSC had picked up a number of interesting targets at its Flemington cobalt-scandium-nickel project in New South Wales, including two potential copper-gold porphyry systems (A and B):

Porphyries are multigenerational monsters responsible for ~60 per cent of the world’s copper, most of its molybdenum, and significant amounts of gold and silver.

And Flemington is located within the red-hot Lachlan Fold Belt, a favourable geological setting for porphyry copper-gold systems.

The Lachlan Fold hosts truly world-class deposits like Newcrest’s Cadia operation, as well as more recent discoveries including Alkane Resources (ASX:ALK) Boda/North Molong porphyry project.

Australian Mines is also “encouraged” that surface copper has been observed by its exploration team in the vicinity of ‘Target A’.

The explorer is now organising an induced polarisation (IP) survey over Targets A and B, designed to detect the presence of buried chargeable bodies such as disseminated copper-gold porphyry mineralisation.

This will help Australian Mines determine the estimated scale of any copper-gold anomalism located within the target areas ahead of drilling during the 2020/21 field season.

EXPLAINER: Why are so many explorers chasing a porphyry payday?

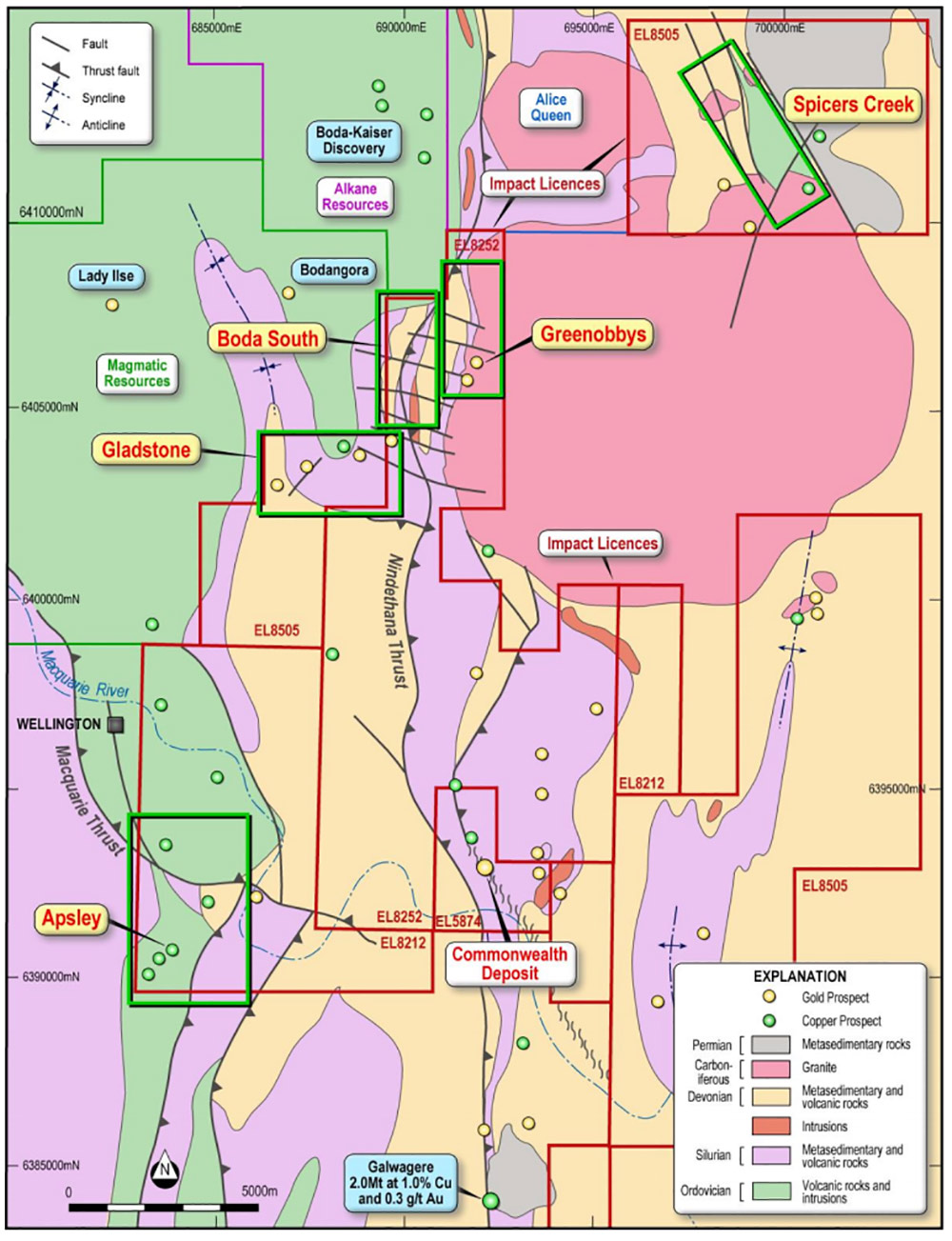

Fellow Lachlan Fold-er Impact Minerals (ASX:IPT) has dialled in on more targets at the Commonwealth project, a stone’s throw from Alkane’s massive Boda discovery:

The two prospects, Greenobbys and Boda South, have been identified as part of a group of five priority areas for follow-up exploration.

Rock chip assays returned up to 9.5 grams per tonne (g/t) gold, 215g/t silver (7 ounces) and 745 parts per million (ppm) bismuth from the Greenobbys prospect and up to 0.1 per cent copper, 2g/t silver and 40ppm bismuth from Boda South.

This early stage exploration indicates there are two different styles of mineralisation — epithermal gold-silver at Greenobbys and porphyry copper-gold at Boda South, Impact says.

A detailed airborne magnetic and radiometric survey was recently completed over all five of Impact’s priority prospects and a soil geochemistry survey is in progress at the ‘Apsley’ prospect. This data will be used to help define follow up work programs, including drilling.

“Our reconnaissance rock chip assays across four of our priority targets have exceeded our expectations as they have all returned encouraging results that require follow-up exploration,” Impact managing director Dr Mike Jones says.

“This has further confirmed and enhanced our belief that our extensive ground holdings in the prolific Lachlan Fold Belt have the potential to host not only a major porphyry copper-gold deposit, but also other possible styles of intrusion-related mineral deposits such as the newly recognised epithermal gold-silver mineralisation at Greenobbys.

“Incredibly, none of these prospects has been drilled and we will be doing the necessary work to get them to drill ready status as rapidly as we can.”