AuMake cancels $20m cap raise after share price crash

Health & Biotech

AuMake has cancelled a $20 million capital raise after the underwriter pulled out.

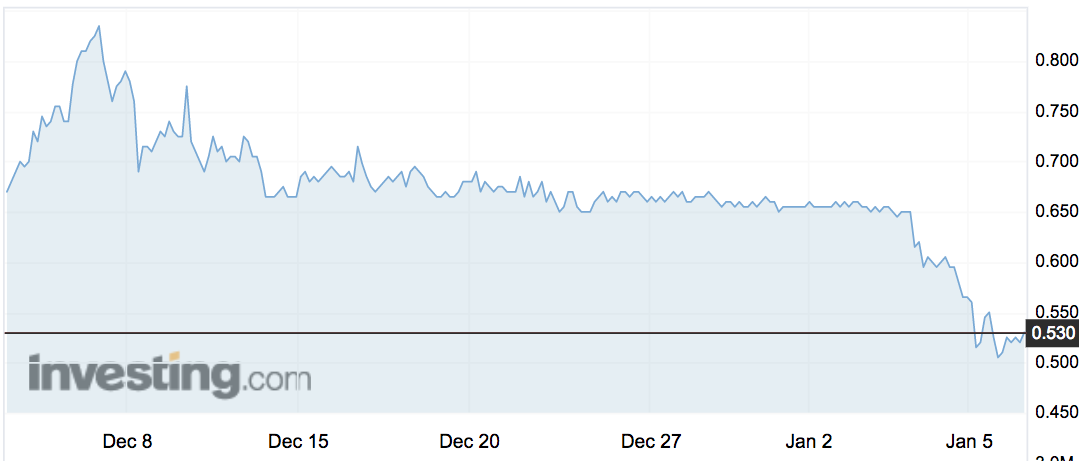

The company (ASX:AU8) said this was reasonable given its share price volatility – the stock has lost 37 per cent from its December peak.

The entitlement issue was priced at 65c a share in December, a month where its stock hit a 12-month peak of 83.8c.

But since the start of this year they’ve lost 18 per cent to rest at 53c in morning trade.

AuMake targets shoppers (“daigou”) who buy Australian healthcare, cosmetics or local food products on behalf of people in China.

“There is no obvious explanation for the share price volatility, however to secure the business’s future we took pre-emptive measures and are very comfortable that AuMake is now fully-funded to deliver on our strategic growth initiatives,” chairman Keong Chan told Stockhead.

They will now try to raise $14 million at a price of 45c a share via a placement to strategic investors in China and Australia.

“The company has conducted a thorough review of its growth strategies to maximise efficiencies,” the company told investors.

“The company will be fully funded to accelerate its retail store rollout program across Australia and China in addition to further investment into and production of AuMake own branded products.”

The larger cap raise was supposed to fund the addition of at least 20 new stores across Australia in the next 18 months, lift inventory levels of its home branded products, and lift the number of diagou support teams in China to five.

They still plan to open three news stores in Sydney alone in February, and create a ‘daigou hub’ system where Australian suppliers can sell directly to Chinese customers.

They say the business of selling to Chinese customers in Australia is still sound however, in spite of share price-created problems.

AuMake is forecasting profit margin growth in December least 15.8 per cent, thanks to a Chinese tourist-focused store in the centre of Sydney and “efficiencies” in the supply chain.

The company is trying to buy up excess milk formula production capacity to cater to the huge demand in China for safe milk powder, as senior management are visiting manufacturing facilities in Australia and New Zealand.

Since listing, AU8 have already acquired brands Health Essence in health supplements and UGG AUS wool products but say the capital injection opens the possibilities to expand into cosmetics and milk formula – product categories that have already been successful for several ASX players.