Antipa Minerals Scoping Study delivers the goods

Mining

Mining

Antipa Minerals says its Scoping Study has confirmed the Minyari Dome Gold Project presents a potential commercially viable development opportunity.

The study is based on the Mineral Resource Estimate (MRE) of 33.9 million tonnes at 1.60g/t gold, 0.19% copper, 0.54g/t silver and 0.03% cobalt for 1.8 million ounces of gold, 64,300 tonnes of copper, 584,000 ounces of silver and 11,100 tonnes of cobalt.

Notably, it shows the technical and financial robustness of a stand-alone gold mining and processing operation, with an initial combined open pit and underground mine schedule of 21.4 Mt at 1.6g/t Au (1.1 Moz gold).

The project would have a 7+ years initial processing life at nameplate 3 Mtpa throughput, at a forecast average All‐In‐Sustaining‐Cost (AISC) of A$1,475/oz (US$1,062/oz), a total pre‐production capital cost of A$275M (including pre‐production mining of A$68M) and a post-tax payback of around 2.5 years from first production.

Plus, there’s also potential upside in further resource growth, and project optimisation with copper and cobalt by-product opportunities.

“Critically, this is just the beginning for Minyari Dome. Project economics are hugely leveraged to future resource growth, from both extensional and greenfield drilling opportunities,” Antipa Minerals (ASX:AZY) MD Roger Mason says.

“An aggressive growth drilling program was commenced in June at Minyari Dome, focused on testing of open pit targets with the objective of extending high‐grade mine‐life.

“Substantial and immediate opportunity for such further discoveries exists across the Minyari Deposit Keel Zone, Minyari South, Sundown, Minyari North, GP01, along with several high‐prospectivity geophysical and soil greenfield targets across the tenure.

“This drilling program is planned to continue through the second half of calendar 2022, with the next update of the Minyari Dome Mineral Resource Estimate targeted for around the middle of calendar year 2023.”

Mason said that, alongside this drilling and resource work, and as a direct function of the Scoping Study outcomes, the Antipa Board has approved the commencement of a Pre‐Feasibility Study (PFS) on Minyari Dome.

“The PFS is planned to incorporate the next Mineral Resource estimate update into the mine scheduling, as well as progress a range of other upside opportunities identified as part of the Scoping Study – including the obvious by‐product metal potential that exists,” he said.

“The PFS is scheduled for completion during Q4 CY2023.”

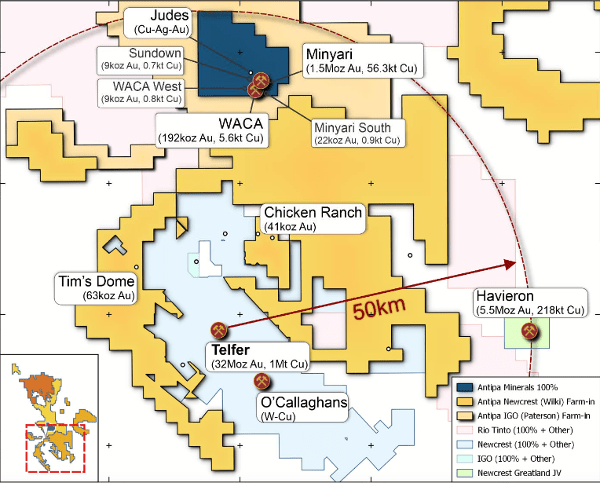

It’s worth mentioning that the project is nestled between Newcrest’s (ASX:NCM) Telfer mine and processing facility, Rio’s (ASX:RIO) Winu development project, and surrounded by its Paterson Farm-in Project with IGO (ASX:IGO) – so there could be room for some third-party development pathways.

“Strategically, Minyari Dome is also primely located just 35km from Newcrest’s Telfer 22Mtpa processing facility,” Mason said.

“While a stand‐alone development of Minyari Dome is our base case, and was the subject of this Scoping Study, we will naturally continue to assess all potential third‐party pathways that might offer greater risk‐weighted value for Antipa shareholders.”

###

This article was developed in collaboration with Antipa Minerals Limited (ASX:AZY), a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.