Alicanto Minerals breathes new life into Sweden’s green industrial revolution

Mining

Mining

With sanctions on Russian zinc supply adding pressure on Sweden – Europe’s second largest zinc producer, to increase supplies – Alicanto’s Sala resource might just be the missing link.

The world is going green and at the very heart of decarbonisation efforts lie the raw materials needed to electrify global economies.

As we transition away from fossil fuels to hydrogen production, battery and fuel-cell electric vehicles, as well as wind and solar power generation, metals and mining companies face the challenge of supplying the critical inputs needed to drive what Sweden has called ‘the green industrial revolution’.

Over in Europe, the Swedes are not only leading the race to develop the world’s first ‘green steel’, but the Scandinavian country has big ambitions to become a front-runner in the quest for a fossil fuel-free economy, having already achieved 98% fossil fuel-free electricity supply as it undergoes a massive revamp to decarbonise state-run mines.

All of this bodes well for ~$22.9m market cap explorer Alicanto Minerals (ASX:AQI) and its big plans to position the Sala Zinc-Silver Project as one of the first underground mines fully designed for electrical power with no fossil fuels.

Just last week, the company released a maiden resource of 311,000t zinc, 15Moz silver and 44,000t lead, ranking the Sala project as Sweden’s largest, active and undeveloped zinc-silver deposit. That this was achieved in a little over 12 months from its taking ownership is a strong validation of the company’s capabilities, as well as the strength of the project’s zinc dominant (69%) mineralisation, which is highlighted by very high grade and wide intersections.

“In a country that is the largest producer of zinc in Europe (not including Russia), we have now come out with the largest, undeveloped zinc deposit… out of only three of them, so all of a sudden we are pretty important,” Alicanto’s managing director Peter George told Stockhead.

“We have two drill rigs spinning and we’ve started the permitting process as well, which gets the clock ticking over here so there’s an awful lot of work going on.”

Although not as fashionable as some of the other metals, zinc is slated to play a key role in meeting future clean energy goals, a fact exemplified by its inclusion in the US critical minerals list.

The spark for zinc’s revival comes down to it being the primary galvanising metal used to protect corrosion in things like green steel and renewable energy technologies such as wind turbines, and solar panels.

Batteries featuring zinc as a key component are also being considered as an alternative to the hugely popular lithium-ion batteries, as they are five times cheaper and more stable.

“The green transition, from what I can see being here in Sweden, is unstoppable,” George says.

“Every fourth car is a hybrid or electric vehicle now – they have been very strategic in how they have been promoting themselves and the green transition.

“At the Joint Summit in Sweden the other week I had a good chat with the Minister for Business, Industry and Innovation Karl-Petter Thorwaldsson who said they are very excited about what we are doing.

“He said ‘don’t be afraid to go down the fossil fuel-free path’ – on the face it looks expensive but because the country has already invested quite heavily in it – they are already heads and shoulders above everyone one else and zinc will be sold at a premium.”

Miners have been chasing mineral riches over in Sweden for decades, mainly due to the combination of its location and 1,000-year history of supplying Europe with iron ore and other base metals such as copper, lead, nickel, and zinc.

As far as mining jurisdictions go, Sweden is up there as one of the best with high quality infrastructure in place, strong taxation incentives to explore, and consistently ranking in the top 40 states and provinces globally in the Fraser Institute Investment Attractiveness Index.

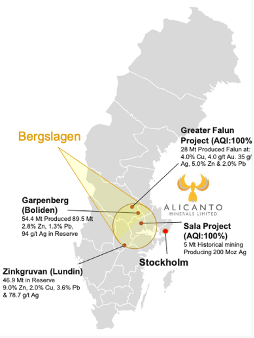

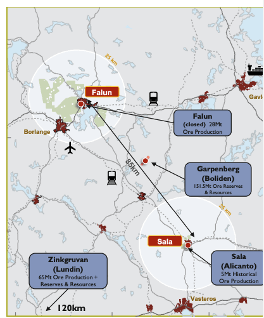

The Sala project is located within the Bergslagen volcanic region, home to some of the biggest polymetallic deposits globally, including major producing mines such as Boliden’s Garpenberg – a proverbial stone’s throw away from Sala.

Interestingly, George says the polymetallic skarn that hosts the Sala system has geological similarities with Garpenberg, which has a cut-off of just US$50 ($74.12) per tonne.

“Sala’s mineral resource of 15.5Mt at 3.6% zinc equivalent at the 1.5% zinc equivalent cut-off is closest to what Boliden have got but it is the higher-grade portion of the Sala resource when a 4% zinc equivalent cut-off is applied that is very contiguous and makes for an attractive first target,” he says.

“From a mining engineering perspective, it is extremely important knowing we can get into higher grade material from surface and quite quickly.”

Exploration at Sala dates as far back as the 1500s.

At this time, the mine was coveted by numerous Swedish kings until the 1800s when it played an important part in the country’s industrial revolution.

In the 1980s Boliden discovered mineralisation at the Prince lode – about 300m away from where Alicanto’s exploration focus is now – before Canadian junior Tumi Resources swooped in and repeated some of the Boliden drilling, exploring for a possible extension of the Sala mine to the northwest.

Alicanto is conducting the first systematic exploration at Sala since the mine closed in the 1960s after production of >200Moz of silver.

Guided by historic exploration data and chief geologist Erik Lundstamm, whose experience spans 25 years with past roles including as former chief geologist at Boliden (and with seven major discoveries to his name), George says there is significant inventory to come at Sala, with the mineralisation open in every direction and numerous targets to drill.

“We are only just getting started.”

This article was developed in collaboration with Alicanto Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.