Vanadium play Technology Metals takes final steps towards definitive feasibility study

Mining

Mining

Special report: Vanadium explorer Technology Metals is starting a definitive feasibility study at its Gabanintha vanadium project, as it continues to lead the pack among aspirational vanadium miners in Australia.

The company (ASX: TMT) has commenced a stage one follow-up program of drilling that consists of 2700m diamond drilling and 3900m of reverse circulation drilling, with data and results expected to start flowing shortly.

The plan is to have the definitive feasibility study ready by the end of June 2019.

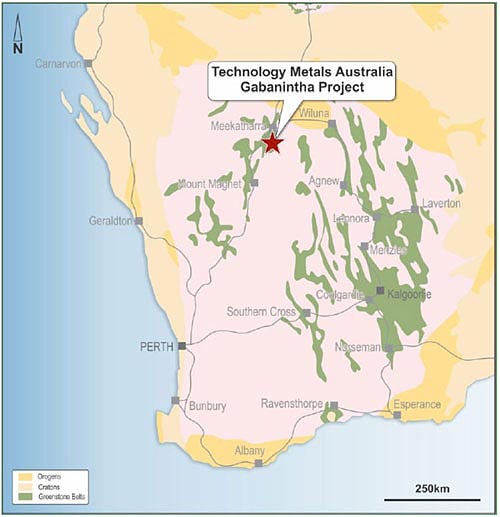

A base case pre-feasibility study completed in June estimated TMT’s Gabanintha project, 45km south-east of Meekatharra in Western Australia, to have a production rate of up to 13,000 tonne per annum.

It also estimated a pre-tax internal rate of return (IRR) of 55 per cent and a payback period of just 2.5 years from the start of operations. It’ll cost about $380 million to build.

IRR is a metric used to assess the profitability of a project. The higher the IRR, the more profitable a project will be.

The mine will have an initial 13-year life, based on only 21.6Mt of the projects 119.9Mt global resource, and is expected to generate $3.1 billion of total earnings before interest tax, depreciation and amortisation.

Operating costs are estimated at US$4.27/lb V2O5 which compares very favourably to global peers.

Technology Metals was one of the first Australian vanadium companies to complete a PFS and expects its Gabanintha project to be up and running by 2021.

Well-positioned

Technology Metals is in a good position as the market for vanadium continues to tighten.

Vanadium has been one of a number of metals caught up in a crackdown by China on the back of environmental inspections — but at the same time China has raised standards for steel which is requiring more vanadium.

It has also been affected by the shutdown of the Highveld Steel and Vanadium’s Mapochs mine in South Africa in 2015.

Prices have been rising continuously as a result: the August price of ferro-vanadium is $US79/kg ($108), a 511 per cent rise on the $US13/kg price seen in late 2015.

For the first-half of 2018 the price averaged $US65/kg.

At the moment, about 86 per cent of global vanadium production is used to make high-strength steel. But future demand stems from its role in vanadium redox flow batteries (VFRBs), which can store more power and last much longer than lithium batteries, and the emerging aeronautical industry.

Projections estimate new demand of 300,000 tonnes of vanadium coming online over the next few years because of vanadium flow batteries – more than three times what is now produced.

Getting it done

Technology Metals only listed in December 2016. In the space of about 18 months it has completed a major drilling program, delivered a “globally significant” resource, completed a high quality pre-feasibility study (PFS) and moved on to a definitive study.

The PFS showed that Technology Metals’ Gabanintha mine is worth $1.3 billion NPV pre-tax – significantly higher than the company’s current market cap of just $31 million.

The company has already proven it can produce a high purity vanadium pentoxide product of over 99 per cent, using low-cost conventional processing methods, with a product generation program underway aiming to provide quantities of high purity final product to be provided to potential vanadium end-users.

Benchmark vanadium pentoxide pricing is based on a 98 per cent purity product. The high purity of Technology Metals’ product means it could potentially receive premium pricing.

This special report is brought to you by Technology Metals Australia.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.