You might be interested in

Energy

Oh, What a Beautiful Mornin’: Brookside to treble output and boost net income via Full Field Development at SWISH in Oklahoma

Uncategorized

Rock Yarns: Brookside Energy hard at work in the Anadarko Basin

Energy

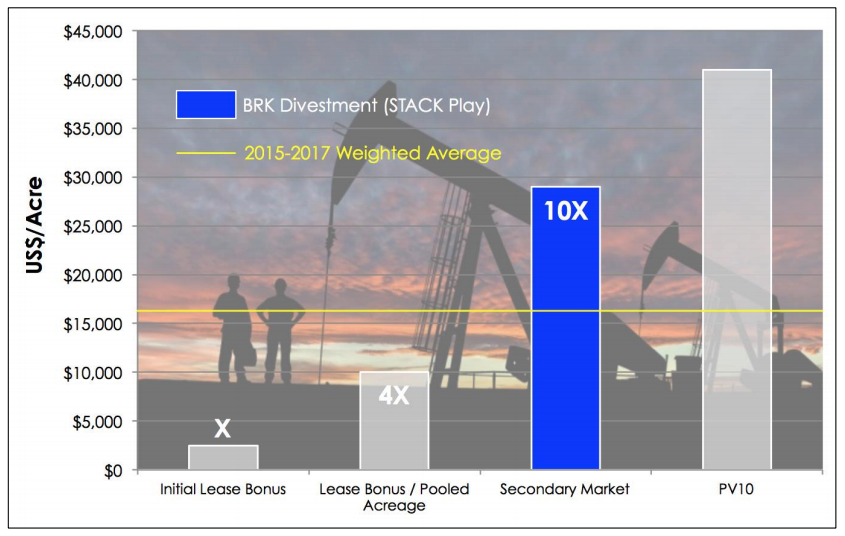

Special report: Brookside Energy has sold off a US oil and gas lease for more than 10 times what it paid — and almost twice the average prices seen over the last two years.

The oil property developer sold 11 acres (or 44,500 sq m) in the first of 17 “STACK” projects in Oklahoma for an average of $US28,600 ($38,000) per acre.

The so-called STACK and SCOOP plays in Oklahoma’s Anadarko Basin have been been described as two of the “hottest new areas” for oil development in the US.

Brookside (ASX:BRK) bought this particular leasehold in the last half of calendar 2016 for an average $US2500 an acre.

Merger and acquisition activity over the last two years has meant leases have gone for an average of $US16,000 an acre — indicating how fast prices have been moving upwards.

The oil-property company (ASX:BRK) buys cheap undeveloped oil leases Oklahoma, gussies them up by proving the underlying oil reserves, then looks to sell the acreage for a tidy profit.

As oil prices rise — West Texas Intermediate hit a four-year high this week of $US71.89 — the business model is working well.

Bloomberg’s head of short term oil research Bert Gilbert told Stockhead the early shale oil rush where companies were seeking to produce as much as possible was over.

The story now was about being conservative and generating cash from existing reserves.

Brookside is supplying those reserves.

Managing director David Prentice told Stockhead he wanted to close the gap between the value extracted by selling into the secondary market — the companies that buy their leases — and the “PV10” (present value with a 10 per cent discount) of the land.

Brookside estimates the PV10 to be about $US41,000 an acre, which will increase as the oil price rises.

Brookside is producing about 300 barrels of oil equivalent (BOE) a day from its Anadarko Basin properties in Oklahoma. The 130,000 sq km Anadarko Basin is among the most productive oil and gas regions in the United States.

The acreage they’re selling is operated by a tier one independent exploration and production company who is about to start drilling eight proved undeveloped wells there.

“The executed sale price reflects the significant interest in the secondary market for acreage in the Anadarko Basin Plays and the high quality proved undeveloped locations that are being generated in these plays,” the company says.

They plan to reinvest the proceeds into acquisitions in the SCOOP Play and drilling and completion activity in the STACK Play.

Brookside and its partner and manager of US operations, Black Mesa, are on a leasing campaign targeting about 8,000 acres in the newly named SWISH play that includes at least 10 drilling units.

This special report is brought to you by Brookside Energy.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.