Electric car makers look for new cobalt sources as severe shortage emerges

Mining

Mining

The case for cobalt is stronger than ever despite attempts by Tesla and Panasonic to dampen the sentiment.

It is pretty evident there is still strong demand emerging from other electric vehicle and battery makers, but what is adding to the potential for cobalt prices to rise even further is the severe supply shortfall that has already started to emerge.

Market research provider Research and Markets says the global cobalt market is facing an imbalance in the demand-supply ratio.

The market has shifted from an oversupply in 2016 to a supply deficit in 2017, according to the recently released “Global Cobalt Market 2018-2022” report.

This pushed the cobalt price up to a record high of $US91,500 per tonne in May this year from a low of $US21,750 per tonne in February 2016. That is a 320 per cent increase in the past two years.

While American car giant Tesla and Japanese battery maker Panasonic have both said they are phasing out the use of cobalt in their products, Research and Markets predicts the global market will still grow at an annual rate of 9.26 per cent between 2018 and 2022.

Volkswagen says it expects to produce 3 million electric cars by 2025, nearly tripling its initial target, driven largely by demand in China and India.

BMW, meanwhile, has also announced it will ramp up electric car production by 2020.

A new research report from Amadee + Company predicts sales of 100 million electric vehicles globally by 2025 and the phasing out of internal combustion engine cars by 2050.

There is also the key issue of where new supply will come from.

More than half the world’s cobalt currently comes from the Democratic Republic of Congo.

But end users are now boycotting supply from the African country over ethical concerns, including the use of child labour to mine the battery metal.

The London Metal Exchange has launched an investigation into whether cobalt mined by children is being traded in London.

The DRC is also facing a fresh outbreak of the deadly Ebola virus, adding a further layer of risk for companies looking to invest there.

Canada a safe bet

This places companies like Canada-focused Meteoric Resources (ASX:MEI) in good stead to step up and help meet that supply.

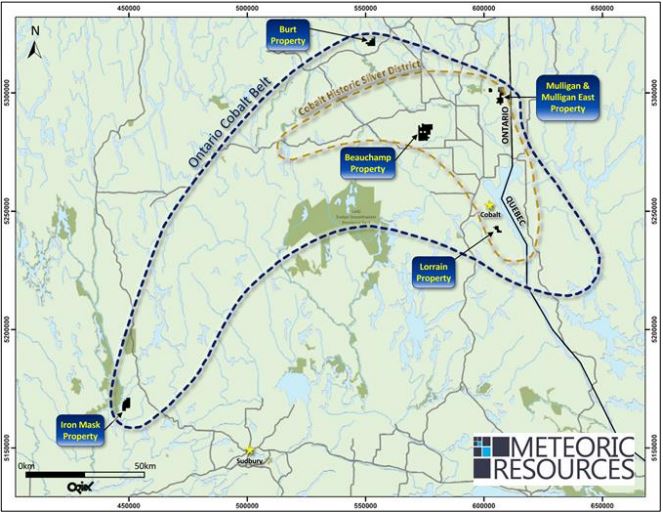

Meteoric has been rapidly expanding its portfolio of cobalt projects in the historic “Cobalt Camp” mining centre in Ontario.

The company has also picked up land to the west, which it says is still prime real estate for mineral exploration in Canada.

All of Meteoric’s projects are historical producers.

After a flurry of acquisitions in the past month the company is getting down to business, starting with drilling at the Mulligan project in July but with the aim to define drill targets for each of its projects.

“Meteoric has now secured an impressive land holding and it’s time to focus our attention to the exploration and development of these exciting assets and implementing our strategy of becoming a serious Canadian cobalt producer,” managing director Andrew Tunks said.

Meteoric’s cobalt project manager, Tony Cormack, has been on-site since mid-April, along with Orix Geoscience’s Sudbury-based geologist, Sam Grasis, assessing all of the company’s cobalt assets.

“Having spent the past six weeks on the ground in Ontario, I have had the opportunity to visit and assess all of the company’s cobalt projects and I am impressed with their prospectivity for high-grade cobalt mineralisation,” Mr Cormack said.

Having established access to the projects and confirmed the geology and structure, Meteoric has now finalised fully funded geophysics programs for all seven of the cobalt projects.

A ground-based geophysics program has already been completed at the Mulligan project, where grab samples show grades of up to 9.71 per cent cobalt, 16.5 grams per tonne (g/t) silver and 14.3 g/t gold.

Samples collected by the Ontario Department of Mines in 1952 yielded 12.6 per cent cobalt, 1.03 per cent nickel, 29.76 g/t gold and 39.69 g/t silver.

Meanwhile, samples collected by Conwest Exploration delivered grades of as high as 19 per cent cobalt and 56.69 g/t gold.

Meteoric is set to begin drilling at the Mulligan project in July.

This special report is brought to you by Meteoric Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.