Bauxite sales deals prove Metallica’s China focus is on point

Mining

Mining

Bauxite is still booming in China, with two new sales deals with Metro Mining proof of hot demand.

Metro (ASX:MMI) has entered sales contracts for a total of 780,000 tonnes of bauxite, with 580,000 tonnes of that to be delivered this year and the remainder to delivered any time before the end of 2019.

Metro said sales have been made into Henan Province in inland China — an area which has had to start importing bauxite for the first time as supply has been slowed by recent mine closures.

“It demonstrates the strong demand for our bauxite in the Chinese market and supports our growth and marketing strategy,” said Metro Mining managing director Simon Finnis.

Bauxite is the main source of aluminium, a market which has been consistently on the rise since late 2015.

Chinese demand

China has been looking to shore up its supply, as its own supplies fall thanks to a crackdown on illegal and environmentally damaging operations.

The country sources half its bauxite from domestic sources and imports the rest.

But problems such as strikes in Guinea and Malaysia’s crackdown on corruption in the sector are squeezing the locations where China can find regular supplies.

According to CM Group, Chinese demand for bauxite will increase by 65-70 million tonnes a year over the next five to seven years, thanks to new alumina refining capacity being built and about 60 per cent of that new demand to be met by imported bauxite.

Doors open for emerging Aussies

This is opening doors for emerging miners in more stable countries, such as Metallica Minerals (ASX:MLM).

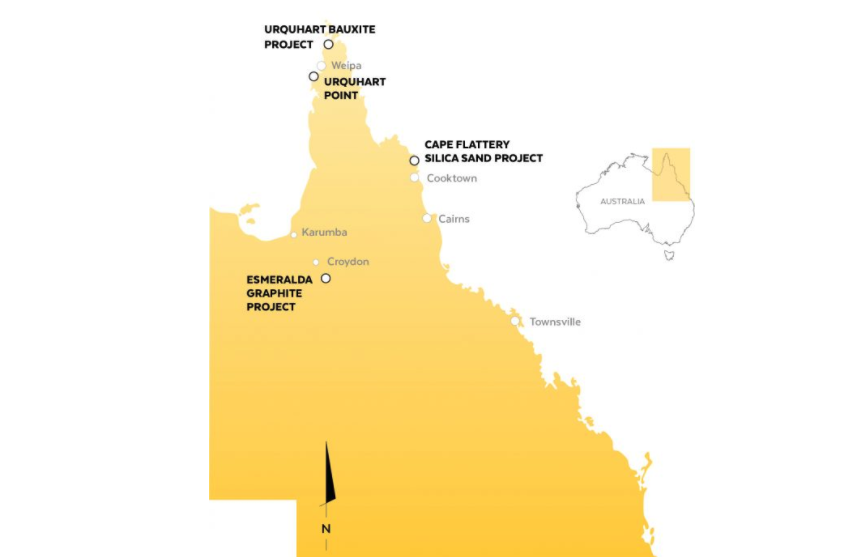

In a 50-50 joint venture with a private Chinese company, Metallica is developing the Urquhart bauxite deposit, which was discovered in late 2014 on the Cape York Peninsula in far north Queensland.

Bauxite mines often take years to bring into production, but Metallica is on the cusp of becoming a producer after little more than three years of hard work.

It’s now only waiting on government approval to construct a haul road from the project site to the nearby port of Hey Point.

Over the initial 5.5 years, Urquhart is expected to produce 6.5 million tonnes of saleable bauxite, creating a payback period of just five months.

Once the company has the haul road approval in hand it will take just four to six weeks to bring Urquhart – which is estimated to cost Metallica just over $1 million to build – into production.

The project is fully funded, and Metallica has $6.1 million in cash to play with.

The company is following a customer-first approach. It is not signing any offtake deals until it can say with certainty when it will be able to start shipping the ore.

This special report is brought to you by Metallica Minerals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.