Analyst sets 32c target for ‘erroneously labelled’ Real Energy

Energy

Energy

Real Energy, and its share price, has been unfairly tarred with the same brush as Queensland shale gas explorers, an analyst from Breakaway Research says.

Senior analyst Stuart Baker thinks the share price, which on Wednesday closed at 7.8c, should be closer to 32c. Mr Baker has worked as an oil and gas analyst with Morgan Stanley, Macquarie and Bankers Trust.

“The share price discounts any success, we think due to the failure of ‘shale gas’ campaigns conducted by others in the Cooper Basin… The basin-centred gas play is erroneously labeled as a shale play. It isn’t,” Mr Baker said in the Breakaway Research report.

“We generate a valuation range of 32-40c and set our price target at 32c,” he said.

The Cooper Basin, which stretches over 130,000 sq km from south-west Queensland into South Australia, is one of Australia’s most important gas regions.

“We think the equity market understanding of this type of geology is very poor,” Mr Baker said.

“During 2011-14, several local companies in joint venture with majors spent several hundred million dollars pursuing shale gas.

“The effort turned out to be unsuccessful and we think RLE is tainted by the history.”

Understanding the Cooper Basin

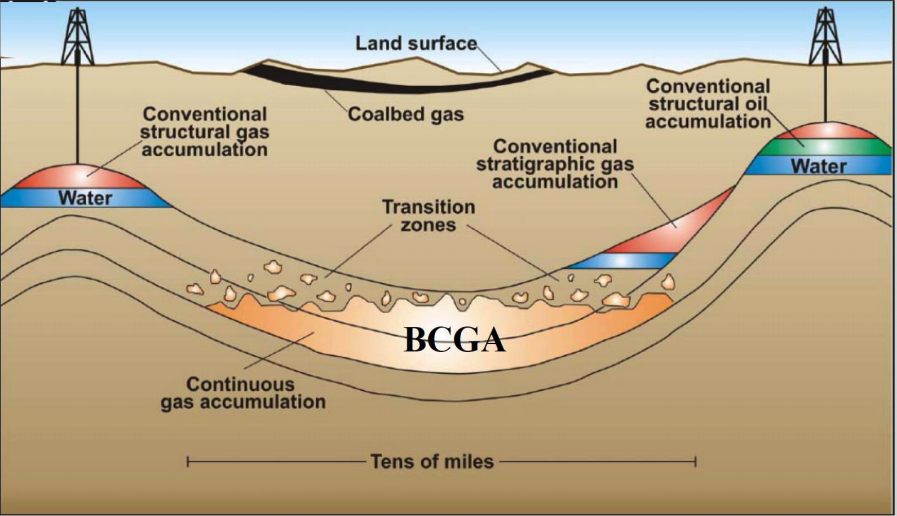

The Cooper-Eromanga Basin where Real Energy has two large licences is all basin-centred gas, or BCG, which Mr Baker says has received less investment than the nearby failed shale explorations.

It’s also a very different geological structure to gas found in shale rock.

BCG is trapped in sandstones which are not highly permeable — meaning gas doesn’t flow through the rock easily — but it’s water instead of rock that holds it in place.

“Once the water is pumped out [the gas] lacks a production drive, so gas flows at low pressure and low rates. Commonly, fraccing or some other form of stimulation is required to aid commercial flow rates,” Mr Baker said.

Fraccing, or hydraulic fracturing, is a method where water mixed with lubricants is flushed down a well to force open cracks and fissures holding oil or gas.

Real Energy’s two wells Queenscliff and Tamarama, drilled since 2014, didn’t initially need to be fracced, but re-testing at Tamarama resulted in flow rates up to 2 million cubic feet per day (mmcf/d) — the minimum Mr Baker says is necessary for commercial quantities.

But at the Tamarama well there was more water than expected, which affected the flow rate.

Real Energy is de-watering the well and expects gas flows to rise.

Cheaper, better

Mr Baker says a collective $700 million was sunk into 30 shale wells in the area between 2011 and 2014, an average of $23 million a well — with none achieving Real Energy’s flow rate.

Real Energy has raised $20 million to date, spending $15 million on completing and re-completing and re-testing two wells.

With East Coast gas prices between $8-10 per gigajoule and not much cheaply obtainable gas available in that region, Mr Baker thinks it’s “only a matter of time” before bigger players begin to eye the gas in Real Energy’s resource.

“Compared to 10 years ago when there were more than 25 companies with gas projects, the consolidation phase that followed has reduced the opportunity set to five now,” Mr Baker said.

Race to find commercial gas

Real Energy has a 3C contingent resource of 672 billion cubic feet of gas — or the highest level of estimated, but as yet unproved, volumes of oil or gas.

Contingent Resources are rated as 1C, 2C and 3C according to low, best and high estimates. A 1C resource is a low estimate and a 3C is high.

“The question to resolve is how much gas, if any, can be produced commercially. For this, Real Energy needs to establish flow rates high enough, and keep well costs low enough in order to book reserves,” Mr Baker said.

He says the key to this will be identifying permeability sweet spots, the best use of drilling and fraccing to maximise flow rates, dealing with associated water production, and keeping well costs low.

“Real Energy is a cheap option on the potential commerciality of a large, wholly-owned contingent resource, in an excellent location and with fledgling commercial agreements to enter a development phase.

The scale of the prospective resource is enormous, and we think would be very attractive to larger, gas-short LNG exporters if commerciality can be proved, and reserves booked.”

This special report is brought to you by Real Energy.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.