Zenith to focus on copper as the red metal enters anticipated ‘10-year supercycle’

Mining

Mining

Zenith Minerals (ASX:ZNC) is accelerating exploration at its copper projects in Queensland, Develin Creek and Flanagans.

Now is a great time to be a copper explorer or miner, with prices recently hitting nine-year highs.

This could just be the beginning of an extended bull run for the commodity – traditionally a bellwether for the health of the global economy, but increasingly a critical input into the production of electric vehicles.

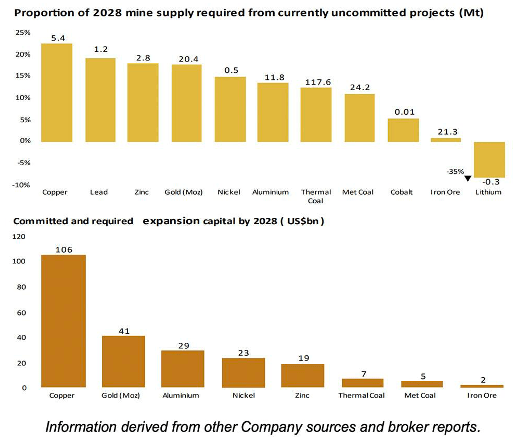

A monstrous ~$US106 billion ($137 billion) must be spent on new copper production by 2028 to ensure an annual supply deficit of 5.4 million tonnes is met, according to Zenith Minerals.

“This is by far the most underfunded green energy input commodity in the supply chain in an era where everything environmentally clean, and most likely electrical, is desired,” Zenith chairman Peter Bird says.

“As illustrated in the graphs below the supply-demand balance for copper is very favourable if one is on the supply side of the equation.”

In February, JP Morgan said the red metal could be entering a 10-year super cycle. Zenith believes it has the right projects to take advantage.

The Devlin Creek VMS project in Queensland already has a 2.57 million tonne resource grading 1.76 per cent copper and 2.01 per cent zinc, with significant gold and silver credits.

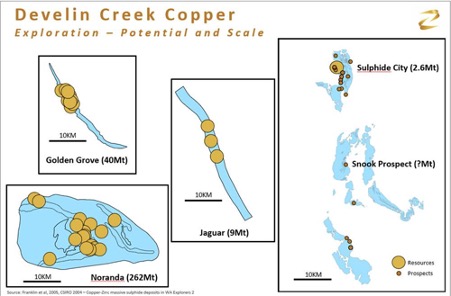

VMS deposits are generally very high in value but can be relatively small, often occurring in ‘clusters’, which means a VMS camp can be mined for a very long time.

Commercial-sized VMS copper systems can be very discrete in their size, Zenith says.

“Whilst it is very early stage at Develin Creek, one can see that major known copper–base metal VMS systems can exist in a favourable stratigraphy over a strike length of not much more than 10km.

“The lease holding that hosts our current Sulphide City resource extends over 50km and thus gives a very good working area to evaluate.”

Zenith’s ultimate goal for Develin Creek is a 1mtpa operation for at least 10 years – which means finding a lot more metal.

Last year the explorer made a new high grade discovery called ‘Snook’.

This maiden drill program at Snook tested a small area of what is now interpreted as a likely footwall feeder fault zone, but nonetheless delivering very encouraging first pass drill results.

They included 3m of shallow massive and semi-massive sulphides grading 1.6 per cent copper, 1.1 per cent zinc, 43 g/t silver, and 0.2 g/t gold.

Recent detailed geological mapping confirms that the most prospective portion of the Snook Prospect remains ‘open’, with follow-up drilling now anticipated to kick off in April.

Zenith is also planning to drill the established ‘Sulphide City’ resource at Develin Creek, where historic drilling may have understated actual grades.

If successful, this program may result in a higher-grade resource.

Drilling will also target other ‘near resource’ anomalies.

The early stage Flanagans copper-gold project contains several high-grade copper and gold prospect areas.

Prospect areas ‘Inverted Pig’ and ‘Quartz Ridge’ will be the focus of confirmatory surface geochemical mapping and sampling in mid-2021.

Historic 1980s surface sampling at Inverted Pig returned best results of 1.04 g/t Au and 1.44 per cent copper.

It was also considered significant that surface sampling returned hits up to 0.85 per cent copper in an area which is surrounded by a basalt ‘cap’ which could obscure any potential mineralisation.

Previous rock chip sampling also returned gold results to 12g/t gold at Quartz Ridge.

Soil sampling (500 samples), geological mapping and rock chip sampling of the copper and gold targets is planned for April 2021.

This article was developed in collaboration with Zenith Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.