Wind farmer Windlab hits record low as key investor drops out over ‘connection risks’

Mining

Mining

Windlab has lost its only investor in a Queensland wind farm project due to “grid connection risks”.

The stock fell 15 per cent to a record low of $1.11 after UK investor InfraRed Capital Partners pulled out of a 106 megawatt (MW) Lakeland Wind Farm project south of Cooktown, Queensland.

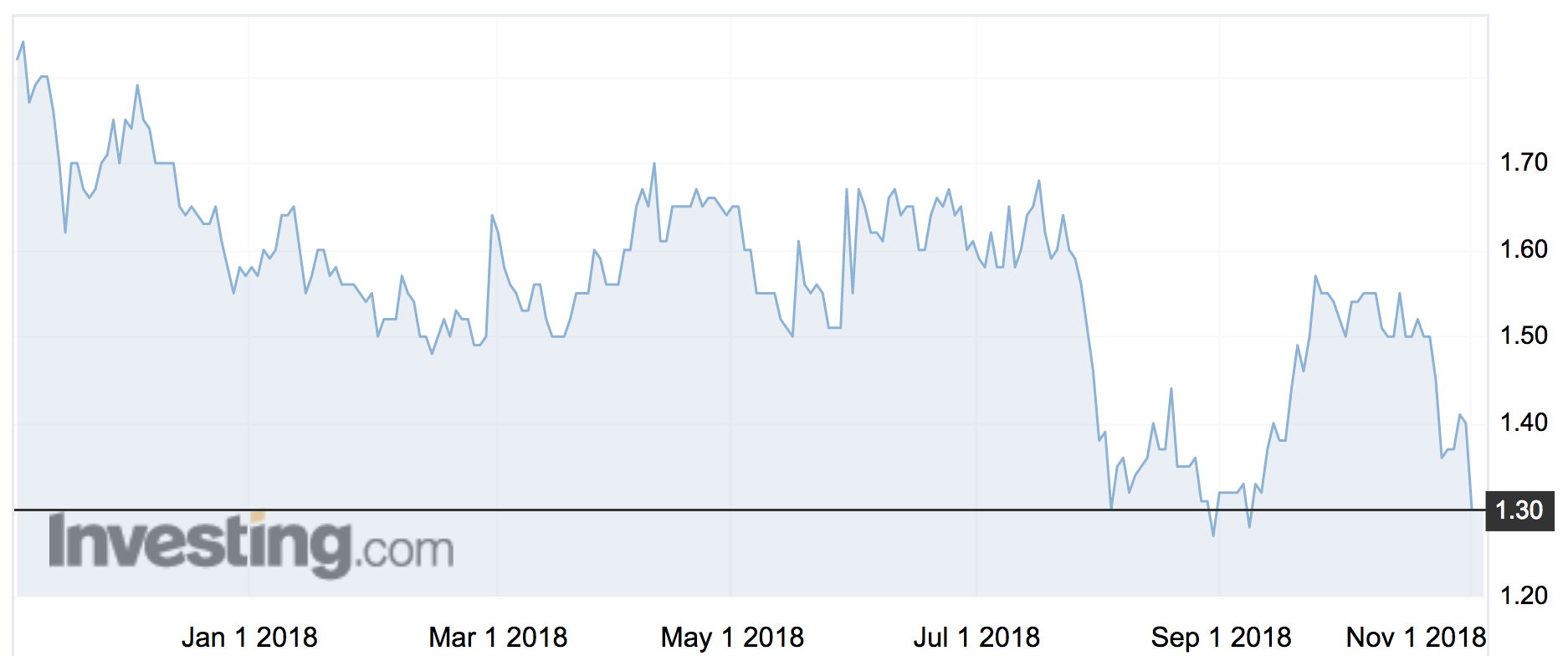

Windlab shares (ASX:WND) have traded between $1.11 and $1.85 over the past year.

“InfraRed Capital Partners of the UK has withdrawn from the project, citing its inability to price risks associated with the project’s grid connection, including risk of network losses and risk of curtailment,” Windlab said.

Grid connection risk is a rising problem as more and more renewable energy projects are built in areas where transmission lines are not “strong” enough to carry large amounts of intermittent wind and solar-generated energy.

As a result the national electricity market operator AEMO requires developers to add extra equipment to strengthen the grid if they are connecting in a “weak” area.

The regulator can also curtail the amount of energy a project operator can send into the grid.

Windlab entered into a connection agreement with Ergon Energy in April to connect the wind farm to the grid.

InfraRed came on in August offering to fund the whole Lakeland project. The company is talking to alternative investors for the far north Queensland project, but says a financial close is likely to be delayed until early next year.

Grid risk is making itself felt

Such risks have plagued project developers. AEMO and operators have often differed in their views of the strength of nearby transmission lines.

Total Eren had to add a costly synchronous condenser to its 200MW Kiamal Solar Farm in Victoria — a turbine that can be launched at short notice to stabilise the grid when voltage or frequency deviate too far from safe levels.

Green Energy Markets director Tristan Edis told Stockhead in October the issue caused delays for a “large proportion” of projects that have been committed for construction in the last 12-18 months.

That’s particularly the case when AEMO’s assesment comes after a project has been funded — making it difficult to forecast a project’s earnings.

Windlab has been contacted for comment.