Wiluna to investigate potential for nickel and other battery metals

Mining

Mining

While Wiluna Mining (ASX:WMC) remains focused on ramping up gold production, a review has highlighted the nickel, copper, cobalt and PGE potential of its operations.

The company’s tenure in the richly endowed Agnew-Wiluna greenstone belt comprises 40km of strike of the Perseverance ultramafic sequence that is prospective for tier-1 nickel-cobalt-platinum group elements (PGEs).

Notable world-class deposits in the rest of the belt include BHP’s (ASX:BHP) Honeymoon Well and Mount Keith along with Western Areas’ (ASX:WSA) Cosmos , all of which are located in the southern Agnew part of the ultramafic belt.

However, the northern ultramafics at Wiluna have not yet yielded similar economic discoveries due in part to previous operators focusing on gold as well as the multiple changes in project ownership over the past 20 years.

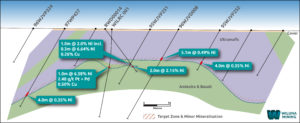

Lack of activity does not equal lack of resources though with historical drilling at the Bodkin prospect in 1995 intersecting nickel sulphides at shallow depths with results such as 2m grading 2.15% nickel and 1 gram per tonne (g/t) platinum and palladium.

This was followed up in 2005 with a 0.3m intersection grading 6.64% nickel, 0.09% cobalt and 0.26% copper within a thermally eroded footwall basalt unit that is surrounded by an extensive zone of disseminated sulphide over 200m wide and up to 10m thick with lower tenor intersections.

Additional prospects include Longbow, where the interpretation of geophysical magnetic features as being prospective komatiitic flows within a package of basalts and sulphidic sediments led to the recognition of potential for Kambalda-style discoveries.

Drilling by Independence Group in 2007 also returned some intriguing intersections though the onset of the Global Financial Crisis in 2009 led to its withdrawal.

Bodkin prospect cross section, nickel sulphide accumulation in thermally-eroded ultramafic footwall. Pic: Supplied

Wiluna is currently evaluating options to unlock value from the project, which could include a detailed geophysical review of all electromagnetic data previously acquired across the project.

This is aimed at gauging the effectiveness of past exploration with EM with the potential for re-interpreting existing datasets using advances in EM data processing and identifying areas to be surveyed or resurveyed with modern EM data acquisition systems.

An airborne EM survey may then be carried out to detect massive nickel-copper-cobalt-PGE sulphides in areas that have not been previously tested, and map the distribution of sedimentary sulphide horizons and potential points of interaction between such units and komatiite flows that could lead to sulphide formation.

Targets would then be followed up with a suitable ground-based EM survey that could improve the detection of disseminated sulphides or detect plunging sulphide deposits at greater depths than airborne EM.

With known high-grade nickel sulphides, the Bodkin target is the highest priority for exploration.

Wiluna’s work on its tenements is not the company’s only foray outside of gold.

The company is also participating in the exploration and development of laterite deposits of nickel, cobalt and associated metals of the Wiluna Nickel-Cobalt (Wilconi) project under a farm-in agreement with A-Cap Energy (ASX:ACB) that was signed in December 2018.

Operator A-Cap is currently drilling at the project and is advancing a definitive feasibility study into the development of a nickel-cobalt laterite operation to supply critical materials to the global electric vehicle market.

A-Cap has already earned a 20% interest in the project and is currently in the process of earning another 35% by spending at least $5m on project expenditure before 20 December 2022.

This can be increased to 75% by completing a definitive feasibility study, paying $1m to Wiluna and issuing Wiluna $1.5m in A-Cap shares.

Wilconi currently has a resource of 78.8 million tonnes grading 0.74% nickel and 0.07% cobalt with opportunities to expand and upgrade the resource to the higher confidence indicated category with further drilling that is currently underway.

This article was developed in collaboration with Wiluna Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.