Will platinum group prices soar or splutter in H2 2022? It could all hinge on a recovering car industry

Mining

Mining

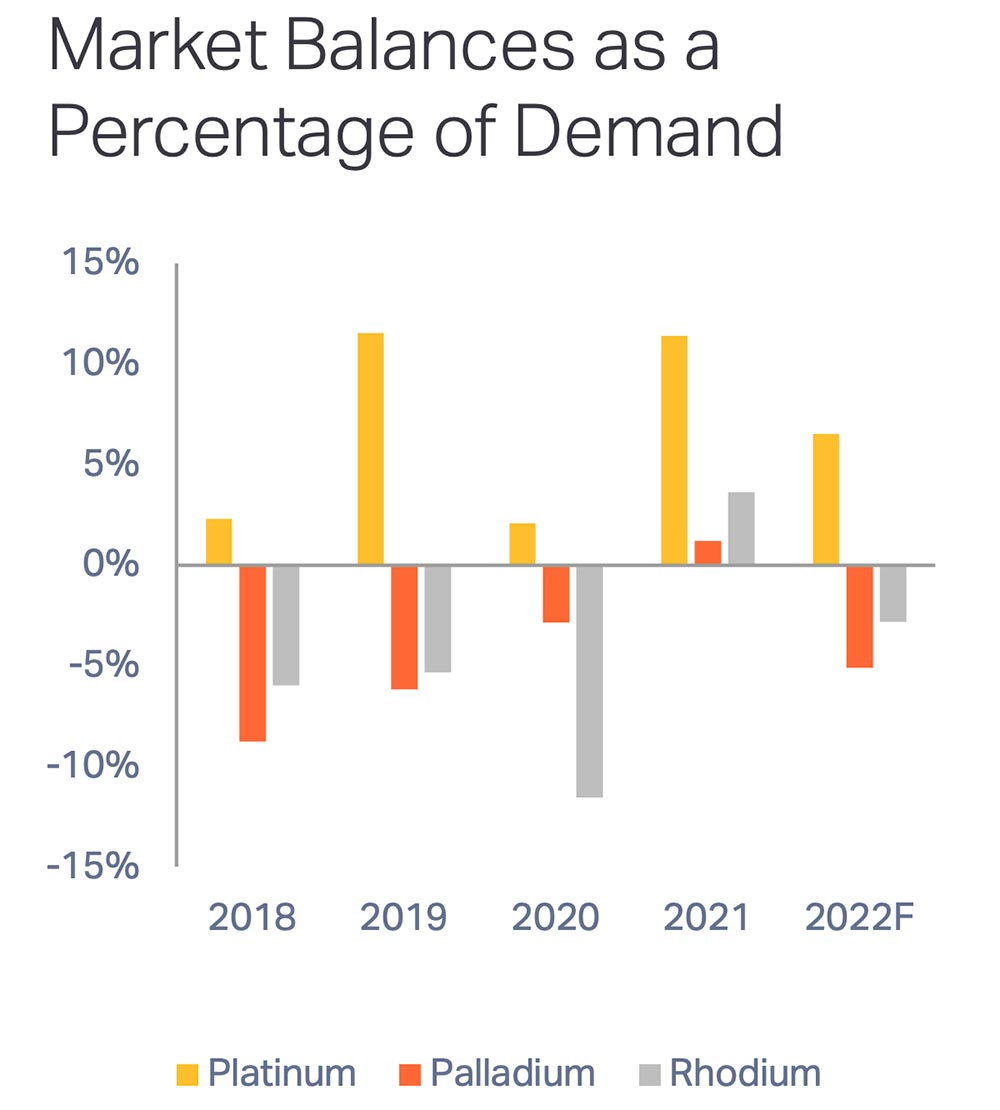

The platinum group metals (PGMs) of platinum, palladium, and rhodium all saw physical surpluses in 2021.

For palladium, this was the first surplus in 10 years.

But that will be short-lived, says Metals Focus, which expects a return to deficits in 2022 for palladium and rhodium, while platinum’s 844,000oz surplus will fall by over 40%.

Why? Firstly, mine supply will be constrained by operational challenges in South Africa and Russian sanctions, which while not directly targeting PGMs will nevertheless create “frictions to supplies from the country”.

Russia dominates the world market. It produces about 40% of the world’s mined palladium, with South Africa close behind and a big gap to third place.

Recycling, too, faces hurdles this year.

This is related to logistical issues, as well as limited automotive scrap feedstock because of the chip shortage, Metals Focus says.

This will all happen as automotive production recovers later in the year, “elevating autocatalyst demand for all metals”.

The biggest demand sector for PGMs is ‘auto catalysts’ in car exhausts which reduce polluting emissions in ICE and hybrid vehicles.

These auto catalysts, or catalytic convertors, account for 40% and 80% of annual platinum and palladium production, respectively.

Johnson Matthey’s latest PGM market report said prices for palladium and rhodium remained strong during the first four months of 2022, with palladium climbing to an all-time high of over $US3,300 in March as supply concerns intensified. Prices have since fallen back substantially.

Johnson Matthey disagrees with Metals Focus, saying demand/price growth in 2022 will be constrained by weak vehicle output.

“In recent months we’ve seen repeated cuts to vehicle production forecasts, due to semiconductor shortages and supply chain disruption,” Johnson Matthey research director Rupen Raithatha says.

“There could be further downgrades to come, especially in China, where Covid disruption led to stoppages at some car plants during April.”

Meanwhile, high prices have triggered significant thrifting by Chinese automakers, increased substitution of palladium with cheaper platinum in gasoline autocatalysts.

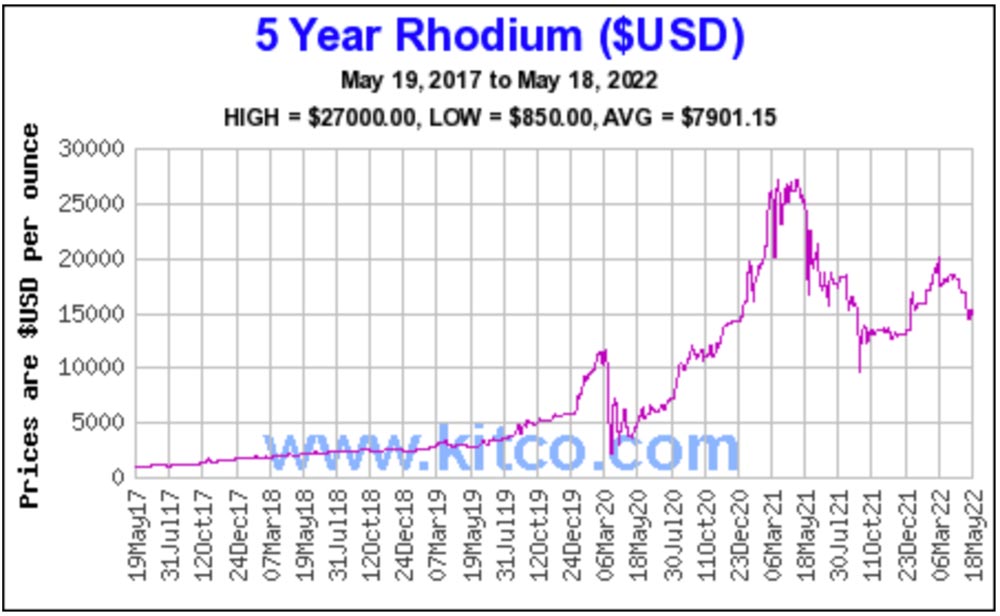

Glassmakers have also been reducing their use of rhodium, which sells for an eye-watering +$US16,000/oz.

Platinum alloys used in fibreglass production have traditionally contained 10−20% rhodium, which help glassmaking apparatus withstand extremely high temps.

Using more rhodium allows for longer production campaigns, improves productivity, and reduces the frequency of recycling and refabricating equipment, Johnson Matthey says.

“Until very recently, 10% was widely regarded as the lower limit, but exceptionally high rhodium prices have driven some fibreglass companies to reduce the rhodium content of their alloys even further,” it says.

In contrast, demand for PGMs in the chemical industry is forecast to enjoy double-digit growth in 2022, reflecting continued investment in Chinese petrochemicals capacity.

Total PGM consumption in China’s petroleum and chemical industries will rise by 12% and is set to exceed 1Moz for a fifth consecutive year.

“The 13th Five Year Plan, which ran from 2016 to 2020, saw extensive modernisation of China’s petroleum refining industry, and massive investment in ‘building block’ chemicals used in many industrial products,” Johnson Matthey’s market research manager (China) Jason Jiang said:

“This has generated significant demand for all the PGM, especially platinum,” he says.

“Since 2016, we estimate that over 7 million oz of PGM have been purchased by Chinese petroleum refiners and chemicals producers.”

Going forward, there is potential for new PGM use in energy transition applications such as lower-carbon fuels, like green hydrogen.

Green hydrogen is a large growth market for platinum, which is used in electrolysers and fuel cell vehicles.

“Using PGM process catalysts often allows for more energy efficient reactions, with fewer unwanted byproducts and reduced water consumption,” Jiang says.