Who made the gains? Here are the top 50 resources winners for November

Mining

Mining

‘Slow’vember certainly lived to its name, with only FIVE stocks making gains of 100% or more (the biggest movers being Tim Goyder-backed Devex Resources at 126% and new copper miner AIC Mines (ASX:A1M) at 118%).

Compare that with October and September which had 14 and 19 stocks above 100%, respectively.

The biggest mover both months was Chinese rare earths stock Viagold, which is still suspended because it can’t explain some suspect trading action.

No Viagolds in November, just (mostly) quality stocks with good news to share.

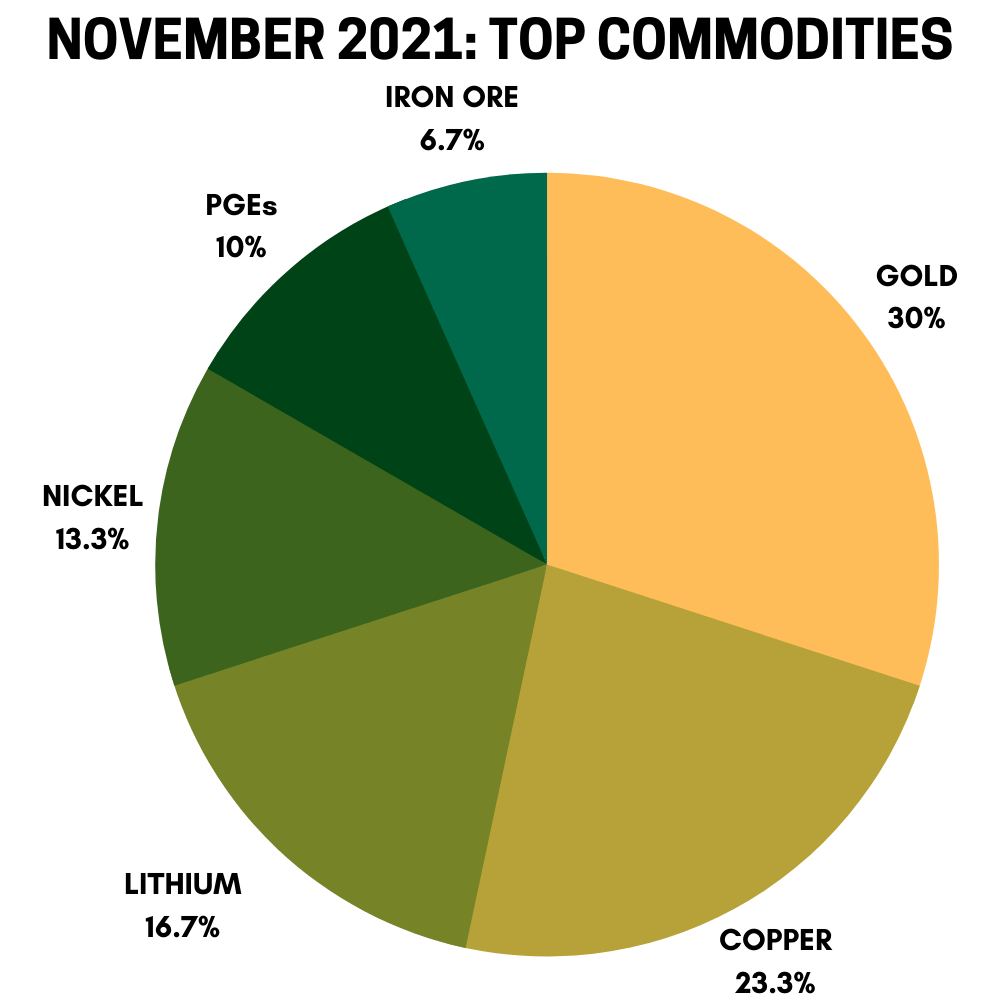

The standout commodities in November were gold, copper and lithium.

Copper, lithium, nickel and platinum group elements (PGEs) increased their share of the top 50 month-on-month.

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | 1 MONTH RETURN % | SHARE PRICE END NOV | MARKET CAP | COMMODITIES |

|---|---|---|---|---|---|

| DEV | Devex Resources | 126 | 0.7 | $ 207,342,169.32 | NICKEL, COPPER, PGEs, URANIUM |

| A1M | AIC Mines | 118 | 0.49 | $ 152,813,933.91 | COPPER, GOLD |

| HAW | Hawthorn Resources | 102 | 0.105 | $ 31,683,983.24 | IRON ORE, GOLD |

| ASQ | Australian Silica | 100 | 0.23 | $ 50,918,805.28 | SANDS, NICKEL, COPPER, PGEs |

| MRR | Minrex Resources | 100 | 0.04 | $ 15,778,450.49 | LITHIUM, GOLD, COPPER |

| AVZ | AVZ Minerals | 94 | 0.69 | $ 1,995,267,061.60 | LITHIUM, TIN |

| KWR | Kingwest Resources | 76 | 0.22 | $ 55,570,420.75 | GOLD |

| PGO | Pacgold | 76 | 0.545 | $ 16,252,980.00 | GOLD |

| KMT | Kopore Metals | 74 | 0.04 | $ 24,524,778.20 | COPPER, GOLD |

| TRL | Tanga Resources | 74 | 0.073 | $ 32,362,250.76 | GOLD |

| LCY | Legacy Iron Ore | 69 | 0.022 | $ 153,713,724.41 | IRON ORE, GOLD |

| CPN | Caspin Resources | 67 | 1.41 | $ 83,435,748.45 | NICKEL, COPPER, PGE |

| PSC | Prospect Resources | 64 | 0.69 | $ 287,110,768.45 | LITHIUM |

| TRT | Todd River Resources | 59 | 0.11 | $ 59,261,788.22 | NICKEL, COPPER, PGEs |

| MQR | Marquee Resources | 52 | 0.12 | $ 21,366,813.26 | LITHIUM, GOLD, COPPER |

| ATC | Altech Chem | 51 | 0.14 | $ 180,441,939.58 | HIGH PURITY ALUMINA |

| CDT | Castle Minerals | 50 | 0.027 | $ 22,862,960.93 | LITHIUM, GRAPHITE, GOLD, COPPER, LEAD, ZINC |

| PNR | Pantoro | 50 | 0.33 | $ 465,134,570.34 | GOLD, PGEs |

| CHN | Chalice Mining | 49 | 9.97 | $ 3,347,550,801.00 | NICKEL, COPPER, PGEs |

| LMG | Latrobe Magnesium | 49 | 0.094 | $ 142,201,928.78 | MAGNESIUM |

| EMT | Emetals | 47 | 0.022 | $ 7,885,000.00 | RARE EARTHS, GOLD, NICKEL, COPPER |

| LPD | Lepidico | 45 | 0.045 | $ 261,258,367.69 | LITHIUM |

| HIO | Hawsons Iron | 43 | 0.11 | $ 68,645,083.20 | IRON ORE |

| EFE | Eastern Iron | 41 | 0.076 | $ 65,821,914.05 | LITHIUM, IRON ORE |

| EGR | Ecograf Limited | 39 | 0.85 | $ 373,776,770.97 | GRAPHITE |

| STM | Sunstone Metals | 39 | 0.093 | $ 214,744,413.98 | COPPER, GOLD |

| JDR | Jadar Resources | 38 | 0.054 | $ 39,298,937.66 | LITHIUM, COPPER, TIN |

| RLC | Reedy Lagoon | 38 | 0.04 | $ 21,601,046.64 | LITHIUM, GOLD IRON ORE |

| E2M | E2 Metals | 36 | 0.32 | $ 46,646,076.03 | GOLD, SILVER |

| NIC | Nickel Mines | 36 | 1.42 | $ 3,495,890,380.89 | NICKEL |

| GW1 | Greenwing Resources | 34 | 0.45 | $ 50,206,439.25 | GRAPHITE, LITHIUM |

| M3M | M3Mininglimited | 34 | 0.295 | $ 8,463,188.40 | COPPER, GOLD |

| LOM | Lucapa Diamond | 33 | 0.084 | $ 97,998,706.81 | DIAMONDS |

| GLN | Galan Lithium | 33 | 1.68 | $ 434,180,203.50 | LITHIUM |

| MEP | Minotaur Exploration | 33 | 0.18 | $ 87,734,350.90 | KAOLIN, COPPER |

| MI6 | Minerals260 | 33 | 0.62 | $ 140,800,000.00 | GOLD, NICKEL, COPPER, PGEs |

| SMI | Santana Minerals | 32 | 0.33 | $ 39,791,186.40 | GOLD |

| KRM | Kingsrose Mining | 29 | 0.08 | $ 58,400,588.16 | GOLD, SILVER, NICKEL, COPPER, PGEs |

| FNT | Frontier Resources | 29 | 0.0245 | $ 16,675,045.72 | RARE EARTHS, LITHIUM, GOLD |

| NXM | Nexus Minerals | 29 | 0.515 | $ 145,417,789.60 | GOLD, COPPER |

| SPQ | Superior Resources | 29 | 0.018 | $ 24,609,234.26 | GOLD, NICKEL, COPPER, PGEs, |

| WCN | White Cliff Min | 29 | 0.018 | $ 8,275,142.38 | RARE EARTHS, LITHIUM, GOLD |

| GL1 | Globallith | 28 | 0.62 | $ 64,704,551.87 | LITHIUM |

| DME | Dome Gold Mines | 28 | 0.23 | $ 73,849,351.28 | SANDS, COPPER, GOLD |

| STA | Strandline Res | 28 | 0.255 | $ 257,691,885.46 | SANDS |

| IR1 | Irismetals | 26 | 0.43 | $ 17,531,249.58 | NICKEL, GOLD |

| S2R | S2 Resources | 26 | 0.215 | $ 74,838,719.55 | GOLD, NICKEL, COPPER, PGEs |

| MGU | Magnum Mining & Exp | 26 | 0.087 | $ 40,765,882.95 | IRON ORE |

| ASM | Ausstratmaterials | 26 | 13.32 | $ 1,738,244,834.76 | RARE EARTHS, CRITICAL MINERALS |

| ASN | Anson Resources | 25 | 0.125 | $ 132,781,906.40 | LITHIUM |

| AVL | Aust Vanadium | 25 | 0.03 | $ 91,879,454.97 | VANADIUM, GOLD, NICKEL, COPPER, PGEs |

The explosive impact of Chalice Mining’s (ASX:CHN) Gonneville discovery on surrounding explorers and other nickel-copper-PGE stocks is well documented.

Last month, CHN hit an all-time high after announcing a truly specular maiden resource of 10Moz Pd-Pt-Au, 530,000t nickel, 330,000t copper and 53,000t cobalt — the equivalent of 1.9Mt of nickel or 17Moz of palladium.

That’s the largest platinum group elements discovery ever in Australia, and the largest nickel sulphide discovery globally in 20 years.

Noted PGE expert Keith Goode told us Gonneville’s the best PGE discovery he’s ever seen.

It kicked off another run for surrounding high quality explorers like Devex Resources (ASX:DEV), Caspin Resources (ASX:CPN), Todd River Resources (ASX:TRT), and Minerals 260 (ASX:MI6).

DEV’s chairman is Tim Goyder, the same man who has stewarded Chalice and lithium explorer Liontown into positions as two of the ASX’s best performing stocks over the past year.

The visual indications from the first two stratigraphic holes at ‘Sovereign’ — a 50-50 JV with fellow November winner Australian Silica (ASX:ASQ) — immediately to the north of Chalice’s Gonneville discovery are very promising.

“We are methodically ticking the boxes towards what we all hope will be a game-changing discovery at Sovereign,” DEV managing director Brendan Bradley says.

“The outcomes of these two widely-spaced stratigraphic holes have exceeded our expectations and given us confidence that we are very much on the right track with our exploration approach.

CPN was demerged from Cassini Resources, which was acquired by copper major OZ Minerals (ASX:OZL) in October last year for its ‘West Musgrave’ copper-nickel project.

What’s interesting about CPN is that it was one of the only explorers looking for nickel-copper-PGEs near Perth, WA, before Chalice moved next door and hit the motherlode in its very first hole.

That’s right — CPN is arguably the Julimar region OG.

Its main game is ‘Yarawinda Brook’, where drilling at the ‘XC-22’ anomaly last month intersected significant nickel and copper sulphides. Assays are pending.

TRT has one of the finest exploration teams in the business.

Managing director Will Dix was part of the team that discovered the ‘Waterloo’ nickel mine and the 2Moz ‘Thunderbox’ gold project, which is probably where he met non exec director Mark Bennett, best known for his leadership of small cap success story Sirius Resources.

Also on the board is Stu Crow, non-exec chairman at white hot lithium stock Lake Resources (ASX:LKE).

TRT has 5-6 projects, the most interesting right now being its ground near Julimar called ‘Berkshire Valley’ where 8,000m of drilling has now kicked off.

Liontown (ASX:LTR) spinout Minerals 260 has been a popular addition to the bourse.

Liontown had held the Moora gold-nickel-copper-PGE project near Julimar since 2018, with the asset now in the hands of MI6 and former Liontown CEO David Richards.

MI6 also holds an option to earn a 51% interest in the Koojan gold-nickel-copper-PGE project, the Dingo Rocks project and tenement applications at Yalwest.

A maiden gold drilling program at Moora kicked off early November.

It had been another fantastic month for those veteran lithium stocks who did the hard yards when times were really bad.

Like, last year.

These near-term producers — like AVZ Minerals (ASX:AVZ), Prospect Resources (ASX:PSC), Lepidico (ASX:LPD), Galan Lithium (ASX:GLN) and Anson Resources (ASX:ASN) — have next dibs on this emerging and potentially very lucrative boom.

But the November top 50 also contains a bunch of latecomers who are successfully riding this wave of supportive market sentiment.

Buying a couple of North American lithium and copper-gold projects propelled Marquee Resources’ (ASX:MQR) share price to three-year highs.

The ‘Kibby Basin’ lithium project in Nevada is ~50km from Ioneer’s (ASX:INR) advanced Rhyolite Ridge lithium boron project, and 60km from MQR’s existing ‘Clayton Valley’ lithium project.

A drill campaign will begin in Q1 of 2022, MQR says.

Minrex Resources (ASX:MRR) is up ~100% since picking up a bunch of lithium projects in the Pilbara early last month.

This is all part of a strategy to become “an emergent lithium explorer with high-quality assets” within 70km of world-class lithium and tantalum producers Pilbara Minerals (ASX:PLS) and Mineral Resources (ASX:MRL), it says.

A further 97sqkm in exploration licence applications are currently subject to a ‘ballot’ (aka picking a name out of hat), including three tenements surrounding and adjoining Global Lithium’s (ASX:GLI) 10.1 million tonnes at the 1.1% Li ‘Archer’ project near Marble Bar.