You might be interested in

Mining

Monsters of Rock: MinRes has 'seen the bottom' in lithium prices, Lynas tightens the screws on rare earths supply

News

Closing Bell: A big relief rally for the ASX today; copper continues its bull market rally

News

Investors – where to put your money when everything looks so bloody good?

Iron ore touched $200/t once again to close out a volatile month in positive territory.

Gold bounced back to record its biggest month-on-month gain since July last year.

Poor cousin silver and the platinum group elements – platinum, palladium, rhodium – weren’t far behind.

Red hot base metals nickel (+1.6%), copper (+2.5%), lead (+0.65%), zinc (+2.83%) and tin (+3%) got hotter.

Meanwhile, battery metals like lithium, cobalt and graphite continued their resurgence.

It’s hard to argue against experts who say we are in the midst of a ‘commodities super cycle’. So, what were the top 50 resources winners for May searching for?

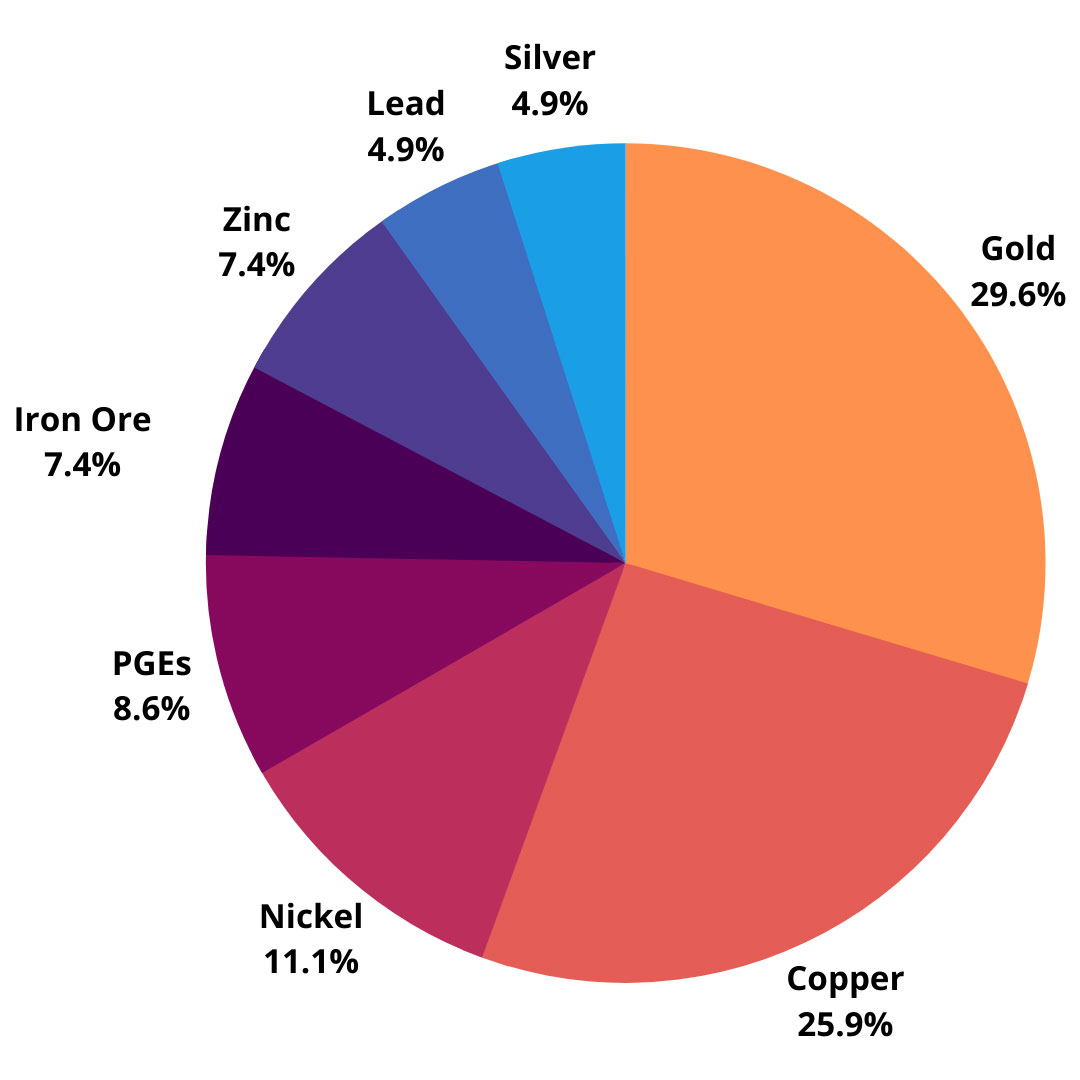

Mostly gold and copper, but with a healthy amount of everything else, sans battery metals (don’t worry, there’s always next month).

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | PRICE | MONTHLY RETURN % | MARKET CAP |

|---|---|---|---|---|

| MDX | Mindax | 0.072 | 2300 | $ 115,515,825.60 |

| CPN | Caspin Resources | 2.72 | 306 | $ 148,978,366.56 |

| CAP | Carpentaria Resources | 0.14 | 186 | $ 73,739,799.98 |

| BPM | BPM Minerals | 0.515 | 134 | $ 14,321,250.00 |

| 4CE | Force Commodities | 0.035 | 133 | $ 37,699,331.75 |

| GBR | Great Boulder Resources | 0.12 | 131 | $ 45,807,831.03 |

| HLX | Helix Resources | 0.036 | 125 | $ 51,435,357.60 |

| CLZ | Classic Minerals | 0.002 | 100 | $ 40,221,264.37 |

| ASQ | Australian Silica | 0.18 | 98 | $ 38,859,088.24 |

| VAR | Variscan Mines | 0.061 | 91 | $ 13,204,885.49 |

| ODY | Odyssey Gold | 0.14 | 84 | $ 61,091,611.43 |

| TKL | Traka Resources | 0.031 | 82 | $ 15,700,417.11 |

| TAR | Taruga Minerals | 0.1 | 82 | $ 53,075,033.13 |

| RDS | Redstone Resources | 0.02 | 82 | $ 12,222,984.07 |

| BUX | Buxton Resources | 0.125 | 76 | $ 15,646,374.68 |

| CVV | Caravel Minerals | 0.515 | 69 | $ 194,679,471.28 |

| LOT | Lotus Resources | 0.2 | 67 | $ 195,291,549.32 |

| ATR | Astron Corp | 0.57 | 61 | $ 70,424,319.85 |

| LCD | Latitude Consolidated | 0.073 | 59 | $ 62,172,278.57 |

| TLM | Talisman Mining | 0.22 | 57 | $ 41,058,244.70 |

| SLZ | Sultan Resources | 0.28 | 56 | $ 18,426,613.09 |

| MSR | Manas Resources | 0.01 | 54 | $ 24,842,462.38 |

| POD | Podium Minerals | 0.545 | 54 | $ 180,834,574.89 |

| MTC | MetalsTech | 0.19 | 52 | $ 26,148,998.46 |

| CR1 | Constellation Resources | 0.47 | 52 | $ 13,613,173.58 |

| PBX | Pacific Bauxite | 0.003 | 50 | $ 1,189,842.10 |

| SVL | Silver Mines | 0.33 | 47 | $ 351,308,176.33 |

| VRC | Volt Resources | 0.033 | 43 | $ 80,931,155.43 |

| ACS | Accent Resources | 0.05 | 43 | $ 23,301,364.15 |

| IVR | Investigator Resources | 0.12 | 43 | $ 139,014,393.74 |

| LTR | Liontown Resources | 0.555 | 42 | $ 909,554,990.50 |

| HGO | Hillgrove Resources | 0.069 | 41 | $ 62,776,948.53 |

| PF1 | Pathfinder Resources | 0.335 | 40 | $ 16,160,361.75 |

| AIS | Aeris Resources | 0.16 | 39 | $ 326,304,320.94 |

| PEX | Peel Mining | 0.33 | 38 | $ 135,881,771.03 |

| VXR | Venturex Resources | 0.785 | 37 | $ 357,095,628.96 |

| STM | Sunstone Metals | 0.019 | 36 | $ 41,989,765.27 |

| CAZ | Cazaly Resources | 0.062 | 35 | $ 22,912,922.55 |

| MZZ | Matador Mining | 0.49 | 34 | $ 84,229,588.32 |

| DM1 | Desert Metals | 0.715 | 34 | $ 24,500,000.00 |

| ALY | Alchemy Resources | 0.02 | 33 | $ 12,772,625.61 |

| ERW | Errawarra Resources | 0.25 | 32 | $ 7,641,135.90 |

| RSG | Resolute Mining | 0.61 | 31 | $ 645,777,233.01 |

| BKT | Black Rock Mining | 0.19 | 31 | $ 125,348,075.65 |

| ALK | Alkane Resources | 0.93 | 30 | $ 523,942,144.00 |

| E25 | Element 25 | 2.48 | 30 | $ 358,584,789.29 |

| TIE | Tietto Minerals | 0.37 | 30 | $ 164,226,764.16 |

| ACP | Audalia Resources | 0.035 | 30 | $ 34,606,809.55 |

| VMS | Venture Minerals | 0.11 | 29 | $ 145,659,721.13 |

| PEK | Peak Resources | 0.115 | 29 | $ 169,186,300.29 |

In April, Rumble Resources (ASX:RTR) gained 500% after hitting the zinc-lead motherlode at ‘Chinook’, part of the Earaheedy project in WA.

It didn’t take long for the ‘nearologists’ – stocks that pick up ground near a major discovery – to benefit.

Recent IPO BPM (ASX:BPM) gained 134% after picking up three projects next to Rumble.

The projects – Hawkins, Ivan Well and Rhodes – cover the same rock layer ‘target zone’ as Chinook, BPM says.

Importantly, the ground was pegged prior to the recent Rumble discovery, “delivering a first mover advantage with all surrounding ground now fully pegged”.

Great Boulder Resources (ASX:GBR) raised $5.5m to explore the Whiteheads (gold, nickel) and Side Well (gold) projects, as well as the ‘Wellington’ acquisition near Rumble in the Earaheedy Basin.

Special mention goes to hard-working tiddler Variscan Mines (ASX:VAR) which — on the same day market darling Rumble launched a new drilling campaign – re-rated on a big discovery at its Novales lead-zinc project in Spain.

Nearologists also continue to dine out on Chalice Mining’s (ASX:CHN) Julimar discovery.

Before Chalice came crashing in, tearing up the rulebook, companies had only really explored and mined the area for bauxite and mineral sands.

It was not a known nickel-copper-PGE province at all. This is true frontier exploration, despite being less than an hour from Perth.

In May, standout explorers included Caspin Resources (ASX:CPN) (+306%), Liontown Resources (ASX:LTR) (+42%) and Venture Minerals (ASX:VMS) (+29%) – although Liontown (lithium) and Venture (iron ore, tin) have other very attractive irons in the fire to explain their gains.

Special mention goes to Errawarra Resources (ASX:ERW) which is hunting ‘Julimar style’ deposits at its Errabiddy project in WA’s Mid-West.