You might be interested in

Mining

AUZ eyes mining lease extensions at Sconi project, which could produce enough nickel-cobalt to power millions of EVs

Mining

Rumours of cobalt’s death are greatly exaggerated – here’s why

Mining

Mining

A fall in China’s cobalt imports in July due to ongoing issues at Durban port in South Africa — a key export channel for Democratic Republic of Congo (DRC) supply – is set to continue in the near term, market participants told Argus.

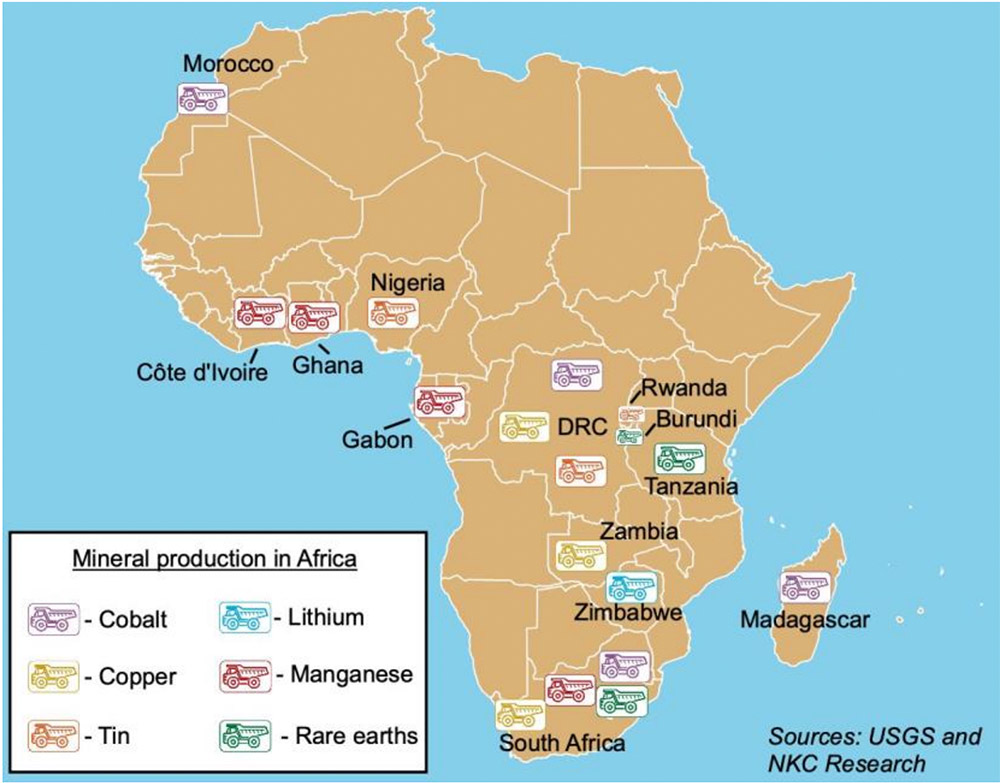

The landlocked DRC is a global giant when it comes to production of the key battery metal.

According to the United States Geological Survey (USGS), the DRC produced 95,000 tonnes of cobalt in 2020, accounting for 68% of global output.

It’s where China – the world’s biggest consumer by far — gets ~90% of its supply.

But these cobalt shipments have been interrupted in 2021.

In the first quarter, shipments from Durban were delayed due to the COVID-19 pandemic.

This was followed by the arrival of a deluge of cargoes in China in April, but civil unrest in South Africa from early July — which lasted for nearly half a month – “led to disorder and lower efficiency at Durban port, resulting in port congestion and shipment delays”, Argus says.

In July, China imported 1,744t of cobalt concentrates — corresponding to 122t of metal equivalent — down 72% from a year ago and by 29% from the previous month.

Market participants do not expect China’s cobalt feedstock imports to rebound in August, Argus says.

“If lots of cobalt feedstock deliveries to China are postponed in August, I expect supplies to tighten as China is dependent on shipments from DRC, with above 90% of its imports coming from this country,” said a key cobalt refiner in China.

“Durban port is congested, resulting in shipment delays, so we are unable to supply any material in the free market now,” said a major cobalt feedstock supplier that owns a copper-cobalt mine in the DRC.

This supplier added it was normal now for shipments to be delayed by up to a month.

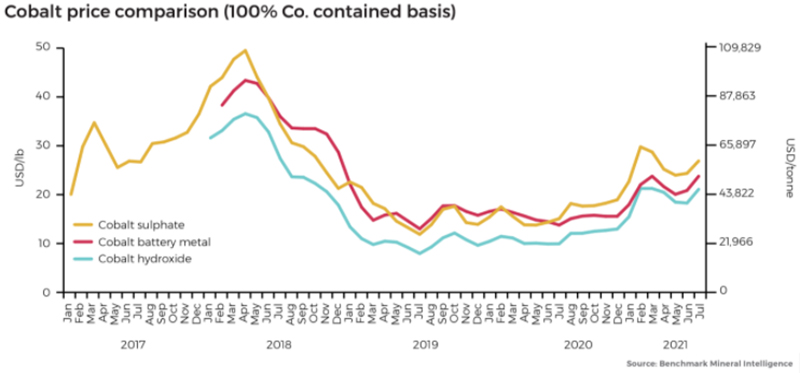

Benchmark Mineral Intelligence said cobalt hydroxide and cobalt sulphate prices recorded gains of 15.6% and 10.6% respectively for July, largely in response to these concerns surrounding the outbreak of riots in South Africa.

While Benchmark expects them to be short-lived, “with the potential for further unrest in South Africa remaining high, Benchmark continues to monitor the situation and its impact on the cobalt supply chain”.

Cobalt supply is expected to be dominated by unstable and unreliable jurisdictions like the DRC for the foreseeable future.

That underscores the importance of cobalt projects in ‘de risked’ tier 1 jurisdictions – like those owned by Jervois Mining (ASX:JRV), Australian Mines (ASX:AUZ), Sunrise Energy Metals (ASX:SRL) Queensland Pacific Metals (ASX:QPM) and Cobalt Blue (ASX:COB).

Cobalt Blue chief exec Joe Kaderavek says three big news stories for cobalt – and by extension the EV sector – over the past year have been COVID, Durban Port, and the Suez Canal blockage.

It has been these sorts of issues that have prompted battery makers to ask the question – how do I shorten and de-risk my supply chain?

“[Shortening the supply chain] means that a kilogram of cobalt doesn’t go around the world three times,” Kaderavek told Stockhead.

“It can effectively go from the mine to an intermediate processing facility — which may/may not be on site — then into a refining process which can be ultimately located [alongside] an upstream battery facility.

“It’s about battery makers getting greater visibility of the supply chain and [product quality].”

For near term producers like Cobalt Blue the most important thing for future success is to know, and keep pace with, this rapidly evolving market.

“We have about 30 partners – the cream of the global battery industry. Not just EV players, but consumer electronics, and a few metallurgical cobalt customers as well,” he says.

“Firstly, the key here is to open the door with the quality of the product.

“Secondly, to nail a commercial agreement on the back of our much larger demonstration plant, which is due for operation in the next six months.

“There is a big difference between a small sample and a sample big enough to allow you to prequalify as a supplier to that particular battery maker.

“That’s where we will be in six months.”

The world currently consumes around 130,000 tonnes of cobalt each year.

By 2050, Glencore estimates about 507,000 tonnes per annum will be consumed – a ~300% increase on existing levels.

Most of that will go into lithium-ion batteries for the EV sector.

Moving into the second half of the year, the outlook for both battery and industrial demand is set to increase, on improving macroeconomic conditions and surging EV sales globally.

Nevertheless, there remain prominent headwinds which are projected to negatively impact cobalt demand throughout H2 2021, Benchmark says.

“Most notably the global shortage of semiconductors, which, according to market participants, is already having a tangible impact on LCO demand from the consumer electronics industry,” it says.

“Although OEM’s do project vehicle production to be affected, the automotive sector accounts for less than 10% of the semiconductor market, with the majority of chips being used within consumer electronics.”

Kaderavek has said 2022 onwards is going to be very exciting for the cobalt price and, by extension, listed miners and explorers.

“The rate of change on the battery industry in the last six months was greater than the previous six years,” he says.

“It’s really starting to hit its straps.”