What happens to cobalt prices if supply ‘disappears’?

Mining

Mining

Since March, numerous cobalt-producing operations have temporarily closed to control the spread of COVID-19. But any supply shocks could get a lot worse if the Democratic Republic of Congo – which produces 80 per cent of this key battery metal – is forced to close its mining operations.

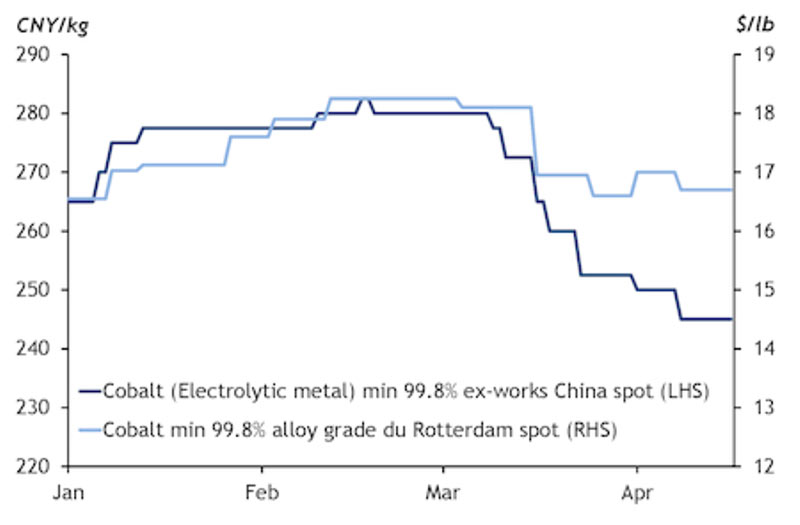

The global pandemic is generating simultaneous supply and demand shocks across a range of commodities, including cobalt. The battery metal has given back much of its recent price gains as demand rapidly deteriorates.

Meanwhile, Roskill has recorded the closure of 21 operations as a result of the outbreak so far, including Vale’s Voisey’s Bay and Glencore’s Sudbury in Canada; Ambatovy in Madagascar; Coral Bay and Taganito in the Philippines; and CTT in Morocco.

“At the time of writing, the loss of supply from these closures amounted to over 1 per cent of the total mine supply in 2019,” Roskill analyst Ying Lu says.

But it could get worse. The Democratic Republic of Congo — where the COVID-19 outbreak is still in the early stages — is home to many major cobalt operations and accounts for the lion’s share of global supply.

The country is desperate for these operations to stay open, but may have no choice in the matter.

On April 16, the DRC mining minister warned mine shutdowns due to the COVID-19 pandemic would trigger a “catastrophic” economic and social crisis in the country, which has already reported a 15 per cent drop in cobalt exports in the first quarter.

“The DRC would not be able to withstand an abrupt halt in the mining production of the flagship projects operating there if they invoked force majeure,” Mines Minister Willy Kitobo Samsoni wrote.

“As a result [of mine shutdowns], we risk moving from a health crisis to an economic crisis, which would in turn lead to a social crisis.”

Either way, logistics issues are already emerging. The mostly landlocked DRC ships most of its cobalt to China — which appears to be the first to emerge from the COVID-19 shutdowns — for further refining via the port of Durban in South Africa.

With South Africa closing its borders to prevent the spread of COVID-19 in late March, most shipments are now having to be diverted to ports in Mozambique or Tanzania.

“Roskill understands this change in logistics has slowed the number of cobalt units able to be shipped, as thousands of trucks carrying cobalt hydroxide/concentrate are currently queuing at the DRC border for customs clearance,” Roskill’s Lu says.

“Meanwhile, logistical restrictions and a decrease in the number of available trucks has also imposed challenges on the shipping of supplies essential for production (such as equipment and reagents) and their ability to reach mining operations.

“This could be particularly challenging for new projects, where some delays to construction and/or ramp up are likely if logistical restrictions persist or become stricter owing to the spread of the pandemic.”

As the result of uncertainties surrounding both supply and demand, Roskill understands that cobalt refiners are “cautiously buying feedstock with a preference towards purchasing at fixed prices and tolling to minimise future risks”.

“Hydroxide stocks in China and other Asian ports will be sufficient to support capacity in the next month or so, but Roskill expects intermediate supply to become tight in Q3,” Lu says.

Analysts at Argus believe potential production outages from the DRC has traders reluctant to dissolve their positions “mindful that the market may be thrust into an acute supply shortage”.

READ: Have the next crop of battery metals producers been oversold?

Against a normal demand backdrop this wave of supply disruptions would quickly boost cobalt prices, Argus says. But in these unprecedented times it could go either way.

“In the electric vehicles (EV) sector — which had anticipated that this would be a pivotal year for progress — key market indicators are not generating optimism,” Argus’ Thomas Kavanagh says.

“European passenger vehicle registrations were down by 55.1 per cent year on year in March, at 567,308 units. April’s registrations are expected to be even lower.”

The COVID-19 outbreak has dented demand so severely that no immediate cobalt price response has yet been seen in Europe or the US, he says.

“And many market participants are reluctant to speculate on the medium-term price outlook, preferring instead to wait and see how western economies stabilise once lockdown measures are lifted.”

NOW READ: The outlook is unchanged — Goldman Sachs predicts ‘long-term secular growth’ for electric vehicles