West Wits begins gold production as South Africa’s fortunes change for the better

Mining

Mining

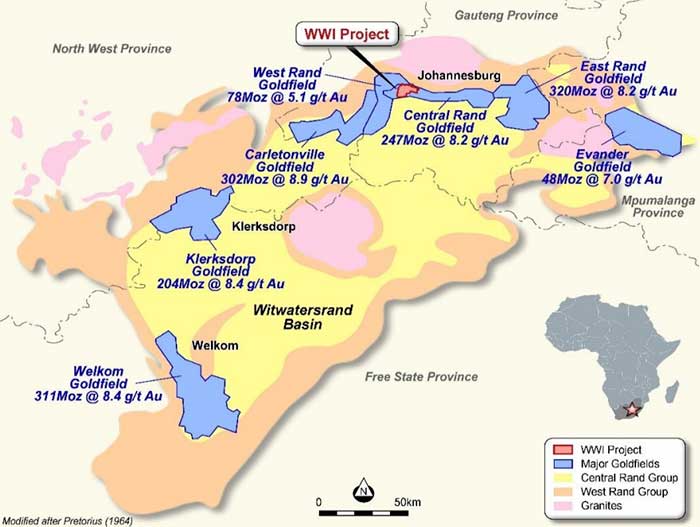

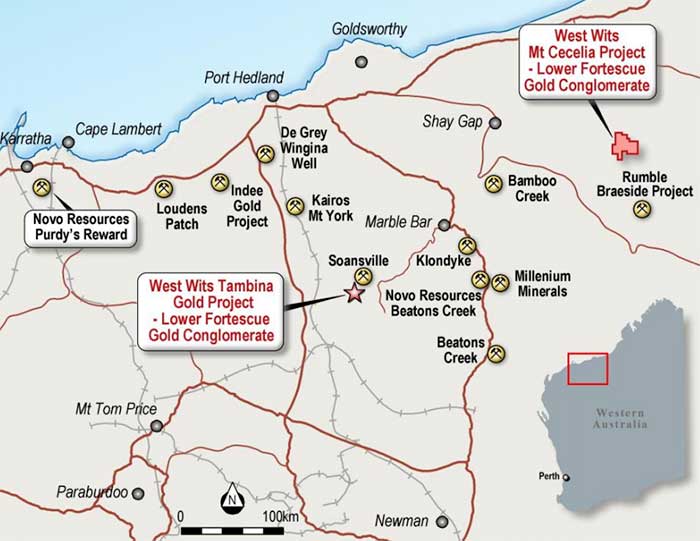

Special Report: West Wits Mining is the only ASX-listed junior to have landholdings with conglomerate-hosted gold in both South Africa’s Witwatersrand Basin and the Pilbara.

West Wits (ASX:WWI) has already started small-scale mining in South Africa. Its goal is to become a mid-tier gold producer from a massive landholding in the Central Rand, which alone has produced over 247 million ounces.

The Witwatersrand Basin, or the Wits for short, is a geological formation that houses the world’s biggest known gold reserves, producing over 40 per cent of the world’s gold.

The company has timed the start-up of its Witwatersrand Basin project well, with South Africa’s political and economic fortunes turning around.

There has been a significant strengthening in the Rand against the US dollar and the new President, Cyril Ramaphosa, is a successful mining entrepreneur.

West Wits remains focused on fast-tracking the Witwatersrand Basin project, which is now cash flow positive and self-sustaining, into full production.

Historically, the project has produced 41 million ounces at around 5 grams per tonne (g/t) of gold, but there are still significant areas of virgin ground untouched by previous mining.

West Wits averaged 925 ounces per month production between November and February, which saw the average net monthly cashflow beat the forecast $200,000 to $250,000 range, delivering the company cash proceeds of $315,000 on average per month.

West Wits has also successfully brought its production cost down from $US1000 ($1288) per ounce to between $US800 and $US900 per ounce as knowledge of the orebodies has grown.

Doubling gold production

West Wits has submitted two mining permit applications, each covering five-hectare open pit operations, to the government for approval.

The company expects this to lead to a material increase in gold production within the next four to six months.

Additionally, the grade in the Main and South Central target areas is expected to be much higher than what is currently being extracted from the Kimberley Central open pit.

This will positively impact monthly gold production.

“We anticipate the two licences will be granted around August and straight after that we will be looking to double our production and double our cash flow,” exploration director Andrew Tunks told Stockhead.

West Wits’ core goal is securing mining rights over the entire Witwatersrand Basin project in the first half of 2019 and ramping up production in the Pilbara region of Western Australia.

‘21st century gold rush’

In November last year, West Wits announced it was acquiring Tambina Gold, which has the right to acquire three gold mining licences that have a small-scale mining operation already in place.

Since gold nuggets were discovered in the West Pilbara last year by Artemis Resources (ASX:ARV) and its Canadian partner Novo Resources, there has been a rush of explorers looking to grab ground in the area.

It has been labelled the “gold rush of the 21st century”.

The geology of the Tambina project is similar to Artemis’ and Novo’s Purdy’s Reward project in the West Pilbara and West Wits’ other recently acquired Pilbara asset, the Mount Cecelia project — which are both part of the Lower Fortescue Group.

The Fortescue Group is made up of mafic volcanic rocks found in the Fortescue Basin in the Pilbara Craton which are known to host gold and other minerals.

These projects are showing similarity to the famous Witwatersrand gold deposits.

West Wits is aiming to restart small scale mining at the Tambina project later this year.

Tambina could potentially be a modest sized mining operation. Of West Wits’ two Pilbara assets, the Tambina project will be the main focus given its prospectivity and the fact it already has three granted mining leases.

The restart of mining could result in Tambina contributing modest cashflow toward year end.

This special report is brought to you by West Wits Mining.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.