$US100… $US90… $US80… Here’s where leading analysts are forecasting iron ore prices to go next

Mining

Mining

In the category for unexpected market events this year, iron ore’s surge to a five-year high rates a mention.

The price action has been driven by unexpected supply-side disruptions, starting with the Vale dam disaster in late January. Then Australia’s Pilbara region got hit by tropical cyclone Veronica on March 24, creating further bottlenecks.

The net result was a steady increase in prices for benchmark 62% fines, which topped out at $US126/tonne on July 3.

Many expect iron ore prices to remain above $US100/t for some time to come. However, analytics firm S&P Global Market Intelligence said it expects “spot prices to wane in the second-half of 2019” as the majors ramp things back up.

Including the year-to-date price action — from a base of around $US70 in January — S&P expects 2019 prices will average $US90/t.

That’s still a tick higher than its April forecast of $US87/t, due to a reassessment of the required lag time for the supply bottlenecks to clear.

From there, S&P expects iron ore prices to average $US80/t in 2020, down to $US70/t in 2021.

Speaking this week at S&P’s iron ore and steel market outlook, research analysts Maximillian Court and Chris Rogers discussed some of the latest data, which highlights the extent of this year’s supply disruptions.

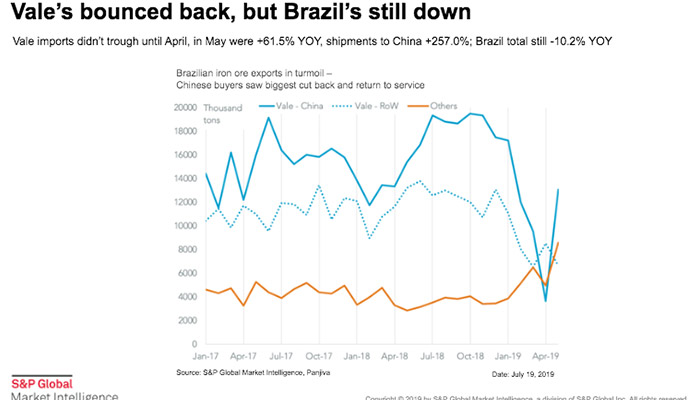

The crux of the problem — Vale’s Brumadinho dam disaster — saw Brazilian exports fall off a cliff before troughing out in April:

Despite a rebound in May, Brazil’s year-on-year exports have declined by 10 per cent.

To compensate, Rogers said Brazil exports from other majors such as Anglo-American had increased “nearly threefold, but it had not been enough to offset the loss in production”.”

Due to further disruptions in the Pilbara, Court said the deficit in seaborne iron ore exports has risen to 54 million tonnes, up from S&P’s previous estimate of 36m.

The supply disruptions “coupled with robust steel making have removed nine days of stock from the Chinese system”, Court said.

Excess stock within China now amounts to 32 days of production, down from 41 days at beginning of the year.

“These dynamics have created a market of relative seaborne scarcity, where volume is the driver that matters more, rather than products.”

And that same dynamic is why lower-grade 58% fines can now sell at just 10 per cent discount to the benchmark.

“So we’re really in a world that prefers volume over value,” Court said.

Looking further out, Court expects global supply deficits among the majors to fall to 29m tonnes in 2020, down to 9m/t in 2021 “as demand growth slows and procurers regain control of their full systems”.

Looking at the Chinese market, Court discussed the two downside catalysts for demand most commonly cited by the market; China’s ongoing focus around more eco-friendly steel production, and a trade-war related economic slowdown.

However, “speculative trading on disrupted volumes emerges as a more significant force when compared to the prospect of future declines in demand”.

And while the recent trend in global PMI data is indicative of an economic slowdown, China’s economy is still adding plenty of value.

“Annual GDP growth of 6.2 per cent is still very healthy for a $12 trillion economy,” Court said.

“The press consistently worry about declining rates of growth in China, but these need to be put in context. 6.2 per cent growth is equivalent to $750 billion of value created in 2019 alone – that’s close to the GDP of Switzerland.”

Stimulus efforts by Chinese policy makers have also increased the domestic money supply, which has “provided the world with underlying strength”.

And that ready provision of credit “has allowed for double digit growth rates in key industries — most importantly construction”.

Back in Brazil, Vale has now received approval to restart operations at its Brucutu mine. But S&P said it could take “up to three years” to restore production to 2018 levels.

Looking ahead, “we see a declining price path, and our assumptions of US$80/t in 2020 and US$70/t in 2021 factor in our view that any increase in supply would be gradual”, S&P said.

“They also embed our expectation of slowing Chinese economic growth and incremental supply returning to the seaborne market.”