Trump’s new tariffs could see copper consumption take a hit

Mining

Mining

Last week, the US threw a curveball, increasing tariffs on $US200 billion of Chinese goods from 10 per cent to 25 per cent.

Subsequent trade talks were unsuccessful, but there’s “no need to rush”, Trump says — it’s all good.

Talks with China continue in a very congenial manner – there is absolutely no need to rush – as Tariffs are NOW being paid to the United States by China of 25% on 250 Billion Dollars worth of goods & products. These massive payments go directly to the Treasury of the U.S….

— Donald J. Trump (@realDonaldTrump) May 10, 2019

Or maybe there is. Wood Mackenzie says the tariffs introduced in 2018 had a clear and negative impact on the US economy – and the new ones will be worse.

“A detailed study by Princeton University and the US Federal reserve showed that 2018 tariffs did not result in exporters lowering prices to offset,” says Wood Mackenzie Principal Economist Jonathan Butcher.

“Instead, the bill has been paid by US consumers and companies. Also, the losses to consumers were greater than the new tariff revenues for the government.”

In other words, the US economy lost out overall.

Butcher says a trade war escalation could push global GDP growth down from 2.9 per cent in 2018, to 2.3 to 2.4 per cent this year.

Firstly, copper is considered a bit of an economic bellwether.

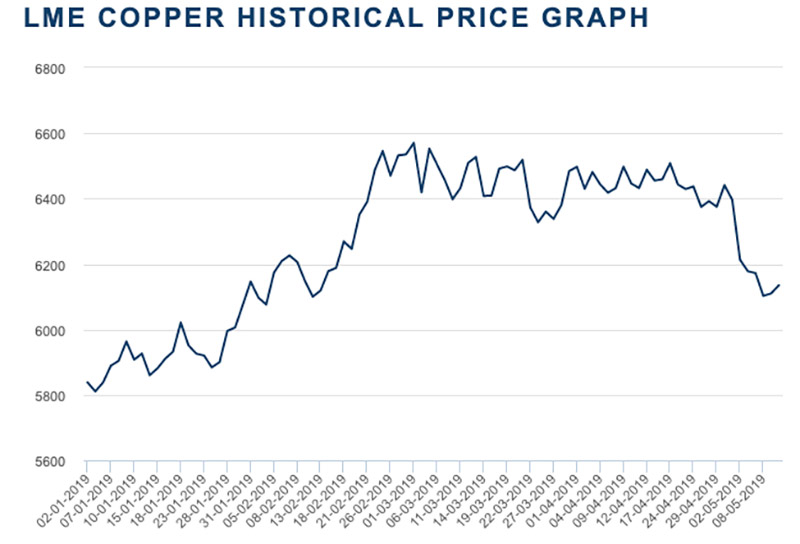

For instance, price increases earlier this year were driven by optimism that trade deal between the US and China could be reached, while recent price falls were a response to soft economic data from some of the world largest economies.

Previous experience shows the escalation of trade tensions has a negative impact on the copper price, Wood Mackenzie’s Yanting Zhou says.

Secondly, China is the world’s top consumer of copper, widely used in construction and manufacturing.

This $200 billion worth of Chinese goods contains most of the copper intensive products that China exports to the US.

READ: For copper, sentiment Trump’s fundamentals

This includes stuff like home appliances and electrical equipment.

“Under the 10 per cent tariff, most of the copper intensive goods from China still have a cost advantage over products from other countries,” she says.

“Therefore, the impact on Chinese copper demand is very limited under our current forecast.”

“However, the 25 per cent tariff will make a material difference and we estimate Chinese total copper consumption will drop by 0.5 per cent if the tariff is effective on a whole year basis.”