A landmark acquisition deal which instantly transformed former junior explorer Firefinch (ASX:FFX) into a cash-generating gold producer is just the beginning. “My firm view is that in 18 months to two years’ time we will be sitting at multiples of our current share price,” says managing director Michael Anderson.

The acquisition of 80 per cent of the 2.4moz Morila gold mine in southwest Mali for $US29.7m – at a cost of less than $US15/oz — has already paid off for Firefinch shareholders, which have enjoyed a 120% gain since the start of the year.

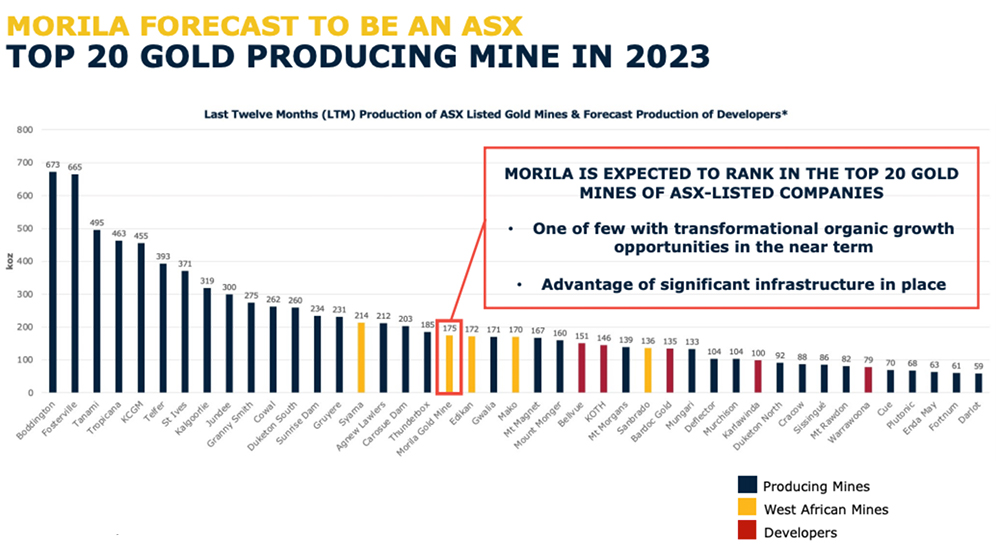

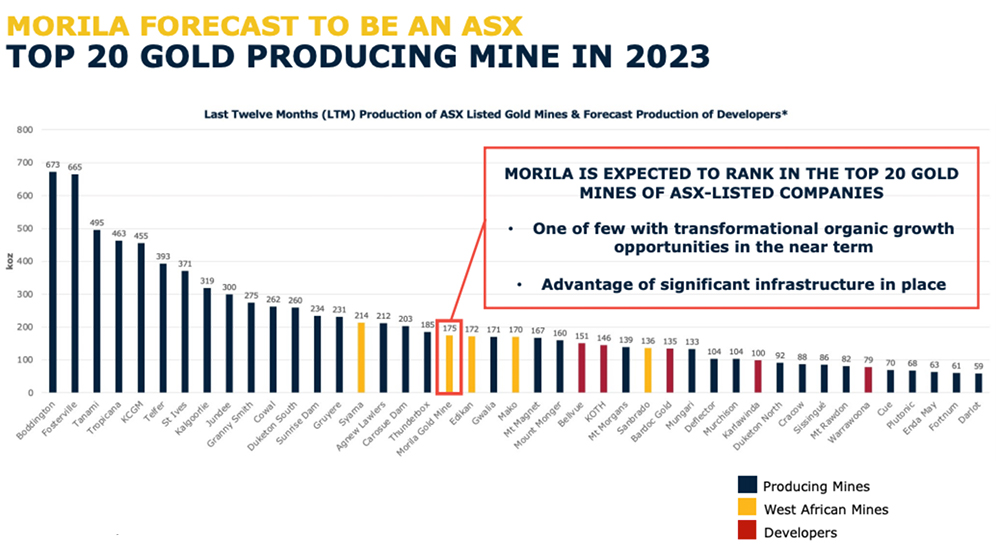

A new Life of Mine plan confirms between 150,000oz to 200,000oz production per year over the next 10 years. That puts Morila in the top 20 gold mines on the ASX:

“We have a projected production profile of 50-60,000oz this year, 120,000oz next year, 170,000oz in 2023, and 200,000oz in 2024,” says Anderson.

The staged ramp-up involves mining smaller ‘satellite’ deposits first – now underway — then a cutback of the 1.2km by ~900m Morila Super Pit.

The underground potential at the Super Pit and the regional upside have not been accounted for in the ‘base case’.

Firefinch has barely started drilling the 2.43moz project, and — at a current market cap of $300m –the upside is obvious.

“We have done over 30,000m of drilling at our satellite deposits, close to doubling the collective resource base for those from 113,000oz to 213,000oz in the space of just six months,” Anderson says.

“That is a good marker of what we think is possible here when you put the drills to work.

Last week, the company made a high grade discovery at the ‘K3 South’ prospect, hitting an astonishing 21m at 13.45g/t gold with its very first hole.

“Everything is in front of us. We try to make the point that this [production plan] is just the beginning, based on what we know today,” Anderson says.

“It is going to be constantly reinformed and optimised as we go along.”

Investors reacted favourably to the recent news with the stock jumping 15 per cent last Friday.

A short history of Morila

The super high grade ~14g/t Morila open pit was operated very successfully between 2000-2009 by joint owners Barrick Gold and AngloGold Ashanti, producing up to 1 million ounces a year.

Mining stopped in 2009, but operations continued by treating stockpiles, a little bit of satellite mining and then – more recently – tailings retreatment.

“Importantly, the geological teams moved offsite in 2009,” Anderson says.

“There genuinely has not been another exploration hole drilled in Morila since that time.”

During the due diligence process Firefinch found an absolute wealth of exploration data.

“We took it away, assimilated it into our modelling and came up with our resource upgrades,” Anderson says.

“We now have a 2.2moz resource in the Morila pit, plus our satellites — a hell of a starting point, and that’s before we drill the Super Pit, which just cries out to be done.”

You can see on this great animation the high grade material continuing to plunge into the base of the pit.

“A couple of metres below the base of the pit you have an intersection 56m at 5g/t gold. Beneath that there is no drilling,” Anderson says.

“Those sorts of intersections could support an underground operation.”

Finding the next Morila

That’s just at Morila itself. Firefinch now also has ownership of some 685sqkm of tenure between the Morila license and its previous holdings, all on what looks to be a very well-endowed, but lightly explored, mineralised belt

There’s no shortage of big regional targets, Anderson says.

“I was looking at regional soil data. Morila does stand out but it’s not the biggest soil anomaly in our package,” he says.

“There’s plenty of opportunity and plenty of targets for us to be going after. We certainly won’t die wondering.”

A lithium bonus

In February, Firefinch announced plans to demerge its advanced Goulamina lithium project, also in Mali, into a separate ASX listed company “to realise its full value”.

Results of a Definitive Feasibility Study (DFS) in October 2020 placed Goulamina among the world’s highest quality and largest undeveloped lithium deposits, Firefinch says.

The feasibility study revealed a pretty good set of numbers with a pre-tax net present value of $1.7bn and a reasonably low all-in cost of about $313 a tonne.

Since completion of the Goulamina DFS, there have been unsolicited expressions of interest in Goulamina relating to partnership and offtake opportunities.

“We genuinely believe there is no value for the lithium reflected at all in our stock price at the minute,” Anderson says.

The value propositions

“We sit at a market capitalisation of $300m but the reality is that the peers we aspire to sit alongside – producing 150,000oz per annum plus – are capped at two to three times that,” Anderson says.

“That is the value proposition for shareholders.

“This is not a far-fetched story at all — we will be back at those production levels, and that’s just on the gold.

“Add in the lithium asset as well and it is easy to see where the catalysts and reratings will come from.”

Firefinch (ASX:FFX) share price chart

This article was developed in collaboration with Firefinch, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

You might be interested in