The UK needs twice the current global cobalt production to hit its 2050 EV target… and the rest

Mining

Mining

The United Kingdom will need a staggering amount of cobalt, lithium, copper and rare earths to meet its 100 per cent EV target in 2050, according to a new report.

This is what it’s going to take to replace all UK-based vehicles today with electric vehicles:

(200% global production, 2018)

(75% global production, 2018)

(100% global production, 2018)

(50% global production, 2018)

This assumes vehicles use the most “resource-frugal” next-generation NMC 811 batteries, and doesn’t include the large and heavy goods fleets, says Prof Richard Herrington in a letter to the UK’s Committee on Climate Change.

It also fails to mention other crucial battery metals, like nickel or graphite.

These are staggering numbers. Remember this is just the UK we’re talking about here.

“Over the next few decades, global supply of raw materials must drastically change to accommodate not just the UK’s transformation to a low carbon economy, but the whole world’s,” Prof Herrington says.

“Society needs to understand that there is a raw material cost of going green and that both new research and investment is urgently needed for us to evaluate new ways to source these.”

This follows a report from Sydney’s Institute for Sustainable Futures (ISF), which assessed the projected demand for 14 metals in a “100 per cent renewable electricity and transport system by 2050” scenario.

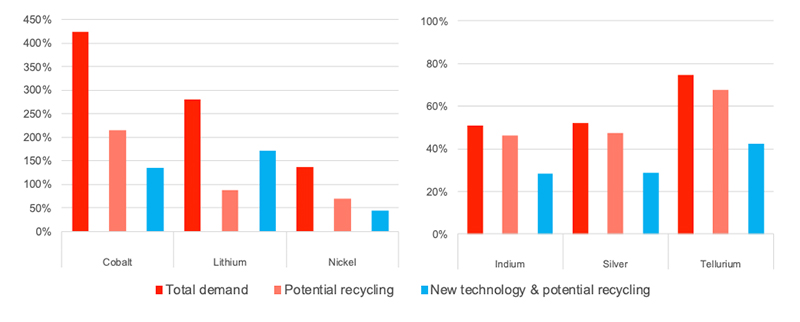

It found global demand from renewable energy and storage technologies could exceed reserves for cobalt, lithium and nickel.

You can see why the main concern for industry right now is the ability to guarantee long-term supply of key metals at a stable price.

There’s a number of battery metals project that must come online to meet projected demand, but efficient battery recycling is also going to play a crucial role.

Neometals (ASX:NMT), for example, says it has developed a profitable process that recovers 90 per cent of all raw battery materials, like cobalt, manganese, nickel and lithium from used batteries. Lithium Australia (ASX:LIT) and Lepidico (ASX:LPD) are doing something similar.

Carmakers are also getting in on the action; Tesla, for example, is developing the “unique” battery recycling system to recover lithium, cobalt, copper, aluminium and steel.

And while it’s early days, scientists at Deakin University and Spain’s Tecnalia research and innovation hub may have found a way to recycle rare earths.

Right now, a dismal 3 to 7 per cent of REMs are recycled from end products because current processes are uneconomic and/or generate huge amounts of toxic waste.