The Texans are coming: Key lands US private equity deal for Queensland gas

Energy

Energy

Key Petroleum has got into bed with a Texan capitalist to fund the development of its Queensland gas field.

Six Pines Capital, a three-year-old boutique oilfield advisory firm from Woodlands, Texas, will spend a minimum of $5 million to develop ‘Area 3’.

Area 3 covers five licence blocks that surround Santos’ (ASX:STO) Marengo gas field.

Six Pines will receive 75 per cent of Area 3 in exchange for the minimum buy-in, which will partially cover the drilling, completion and testing of two wells.

The deal is conditional on Six Pines raising that $5 million in four months, which Key managing director Kane Marshall says they’re confident they can do.

The area is largely unexplored but sits near the Carpentaria Gas Pipeline that connects Santos’ Ballera gas field in the south to Mt Isa in the north, where it is expected the Northern Gas Pipeline will complete this year connecting Mt Isa to Tenant Creek.

“With the private equity interest in other producing Cooper Basin operators such as Senex and Santos, it is not surprising that North American private equity is now starting to look at lower risk gas exploration adjacent to infrastructure to supply the East Coast gas market,” Mr Marshall said.

He told Stockhead that Six Pines approached him a few months ago and he’s seeing increasing interest in the Cooper-Eromanga basin from US investors.

We’re seeing some private companies in America, where people who have made a lot of money out of shale or even conventional gas, are looking for the next phase of growth are looking for opportunities.”

Mr Marshall says Six Pines have worked in Australia before and understand issues such as gas shortages.

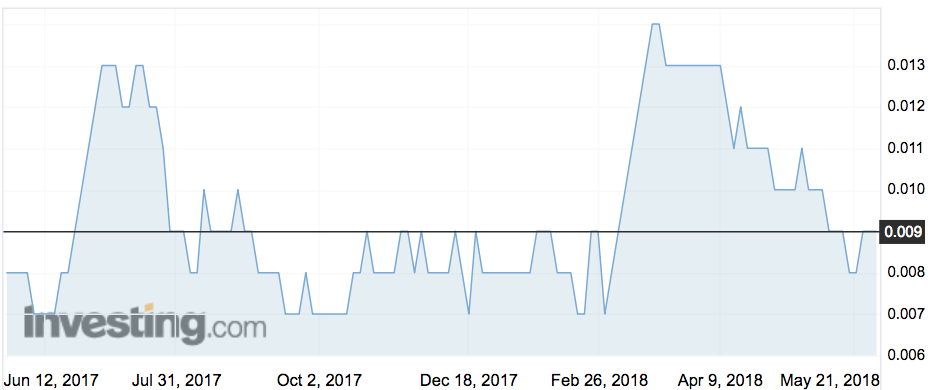

Key shares remained flat at 0.9c on Wednesday morning.

Key per

Key per