The humble suburb which tells the tale of Perth’s boom and bust economy

Mining

Mining

It’s long been a running joke in Perth investment circles that you could draw a ring around the suburb of West Perth and find most of the ASX’s junior mining companies — and that’s not far off from the truth.

Walk into a random office in West Perth and you have a 50-50 shot of walking into a business tied to the resources industry.

But that could soon change.

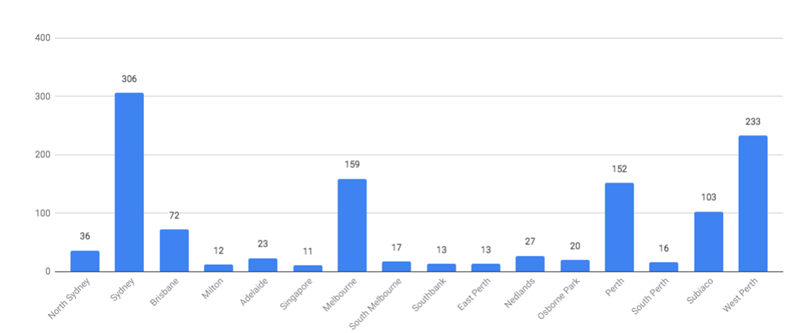

Sister publication Star Investing recently ran the numbers on exactly where all the ASX’s companies are located, and after Sydney, West Perth was the next most-populous suburb, with 233 companies calling ‘the 6005’ home.

It’s a fair chance a lot of those are resources companies. The latest research indicates that 46.8 per cent of all offices in the suburb are involved in some way with the resources industry, whether they be a supplier or producer.

Speaking with Stockhead, commercial real estate specialists Y Research said the reasons why a lot of small resources companies have traditionally flocked to West Perth aren’t a huge mystery.

“The average rent in West Perth for high quality properties is $364.5 per square metre, with the average for lower grade properties $251.70,” Y Research principal Damian Stone said.

“These average market rents are 31.3 per cent and 21.5 per cent lower than comparable properties in the Perth CBD.”

Given West Perth is just a stone’s throw from the CBD, the rationale for smaller companies to seek rent there makes sense — but the typical size of offices also screams ‘one-project mining company’.

“A key feature of West Perth are former residential properties now used for office space. They account for 32.4 per cent of office properties in West Perth. The average size of these properties is 150 square metres, making them suitable only to smaller users.”

The twin convenience of cheaper rent per square metre and fewer square metres per office mean West Perth was a no-brainer for a lot of smaller companies.

Things really ramped up just prior to the GFC.

“Prior to the GFC, no office market in the world benefited more from the resources boom than West Perth,” Stone said.

“By mid-2007, West Perth became the first major market in Australia to record a 0 per cent vacancy rate with no office space available across the suburb.

“A range of resources related companies, from major multinationals to small companies, focused on exploration and their project partners occupied all available space.”

But if West Perth’s office spaces told a story of a bull market pre-GFC, post-GFC the current scene tells an altogether different story.

Stone said while the suburb rode the rise of mining investment before the GFC, it’s also in the midst of its own ‘boom and bust cycle’. This hasn’t been helped by investment in commercial real estate elsewhere.

“Office stock in West Perth is ageing, there has been limited office development in West Perth over the last two decades,” he said.

He estimates that a whopping 77.2 per cent of office stock in the suburb was developed prior to the year 2000 — and with resources companies developing presences in the CBD to take advantage of lower occupancy rates, West Perth has been on the slide.

“In the last five years, West Perth has seen significant space vacated by relocating tenants including BP, Bentleys, Data#3, Fugro, Grant Thornton, Gilbert and Tobin, Leighton Group, Lend Lease, Modec, Moray and Agnew, Shadforth Financial Group, Snowden and Wrays,” Stone said.

“Major West Perth tenants Technip and CBH Group have announced moves to the Perth CBD by the end of 2019.”

He said the GFC had created enough slack in the Perth CBD market that it started to look attractive again once the worst was over.

“The transition from the investment phase of the resources boom to the operational phase has been difficult for the West Australian economy,” Stone said, putting it lightly.

“As commodity prices have fallen, investment in new projects has dried up. Resources firms and their suppliers have made significant staffing cuts which have flowed through to lower office space requirements.

“At the same time, high vacancies in the Perth CBD and new developments in the suburbs has seen a number of major occupiers vacate their West Perth office premises.”

It’s why West Perth, which has traditionally been an incubator for junior resources companies, is going through its own decline.

That 0 per cent vacancy rate has now blown out 23.7 per cent.

“[This] is the highest level of vacancy ever recorded in West Perth,” Stone says.

So while West Perth still has the highest number of resource company headquarters in Perth, this is changing.

Markets such as Subiaco and the Perth CBD itself are catching up, but expect West Perth hold-outs to stay for some time to come.

NOW READ: CEO pay rises, M&A growth and job shortages – all the signs a smarter Perth is rising