The Explorers: Venus Metals’ Matt Hogan on hot tips from Mark Creasy and ‘blue sky’ potential at Youanmi

Mining

Mining

The Explorers is Stockhead’s in-depth look at the people behind some of Australia’s most innovative and courageous junior mining companies. This week, resources reporter Reuben Adams chats with managing director of Venus Metals (ASX:VMC), Matt Hogan.

Profitable deals that actually return cash to shareholders are pretty rare in the exploration game. Hogan has been doing it since 2009, when he sold his first iron ore company to BHP (ASX:BHP) for $204m.

The business-savvy Hogan puts it down to acquiring assets with “decent nearology”; very prospective projects adjacent to existing mines or big mineral discoveries.

The same tactic has secured Venus Metals a dominant landholding on the increasingly popular Youanmi greenstone belt — an under-explored treasure trove of gold, vanadium, lithium, and base metals.

I started in broking in the late 1980s. I worked with several different stockbroking firms as a floor trader when the Stock Exchange was an ‘open-outcry’ system.

We established family broking firm Hogan and Partners in 1994. My late father, Terry Hogan, was at one stage chairman of the Perth Stock Exchange and Paterson’s Securities. We raised a lot of money for mining companies over the years, so we have a strong understanding of business and mining deals.

In 2004/2005, I was instrumental in floating a couple of iron ore explorers on the ASX – Iron Ore Holdings and United Minerals Corporation (UMC).

UMC paid $1m for some Pilbara leases, a deal I initiated. We quickly discovered a massive hematite iron ore deposit which was surrounded by Rio and BHP in the heart of the Area C production hub.

UMC was bought out by BHP for $204m in 2010. In 2014, Iron Ore Holdings was acquired by BC Iron for $250m.

The money from the UMC transaction was returned to shareholders’ pockets. Many ex-shareholders from both those companies are now in Venus Metals, which was floated in 2007. I became Venus managing director in 2009/2010 after we sold UMC.

Venus had acquired an iron ore asset in the Mid-West region of WA called Yalgoo, which was next to Gindalbie’s (ASX:GBG) Karara project.

We paid $1m for it in 2009 and, in 2010, managed to secure a $12m, 50-50 JV with a Chinese company.

They gave us $4m cash – a great deal in itself — and spent $8m on exploration, which proved up a big 700 million tonne magnetite deposit.

But instead of going down the same path as Gindalbie at Karara [a $3 billion lossmaking iron ore project] where shareholders have made nothing, we went into a holding pattern on the asset in 2013 due to a decline in iron ore prices.

Recently, we’ve been able to sell our other half to a large Iranian company for $2.5m plus trailing royalties.

We are good at finding assets that have decent “nearology”.

I look for tenements that are close to mines or big mining projects. We don’t want to be out in the boondocks because exploration is expensive. Nearology is the key.

This means Venus has built a diverse portfolio, which has been hard to articulate to people over the years. People ask us: “what are you?”

What do you mean, what are we? We’re explorers.

We have a multi commodity focus – for lithium, vanadium and gold. But it’s a hard sell because people don’t understand that. They want a vanadium story, or a lithium story, or gold story.

I managed to acquire a whole lithium portfolio for pegging costs after hearing Lithium Australia’s (ASX:LIT) Adrian Griffin’s presentation at a Melbourne conference in 2015.

We pegged the old nearology adjacent to Pilbara Minerals and Altura in the Pilbara, and Greenbushes in the South West. After that it was ‘bang bang bang’ — there was a massive pegging rush. Within two months you couldn’t get a look in anywhere.

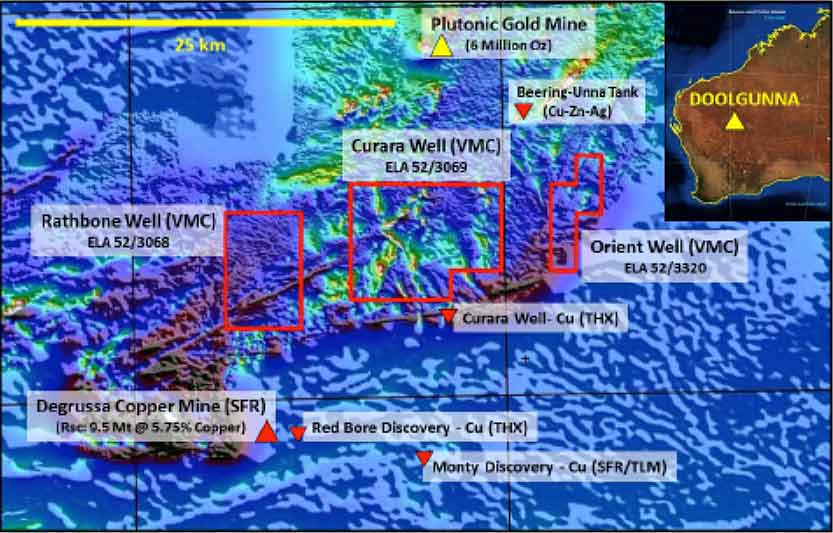

Another lucky strike I had was up near Sandfire’s DeGrussa mine. A few years ago, I mentioned that I liked that area. Two weeks later I got a call on Melbourne Cup Day, right when the horses were about to jump.

Someone told me a hole had just opened up near DeGrussa – right next to the mine. I said ‘peg it — get it now!’.

Now we have some completely undrilled areas just north of the DeGrussa mine which we are going to follow up with some geochem and some ground EM to firm up some targets.

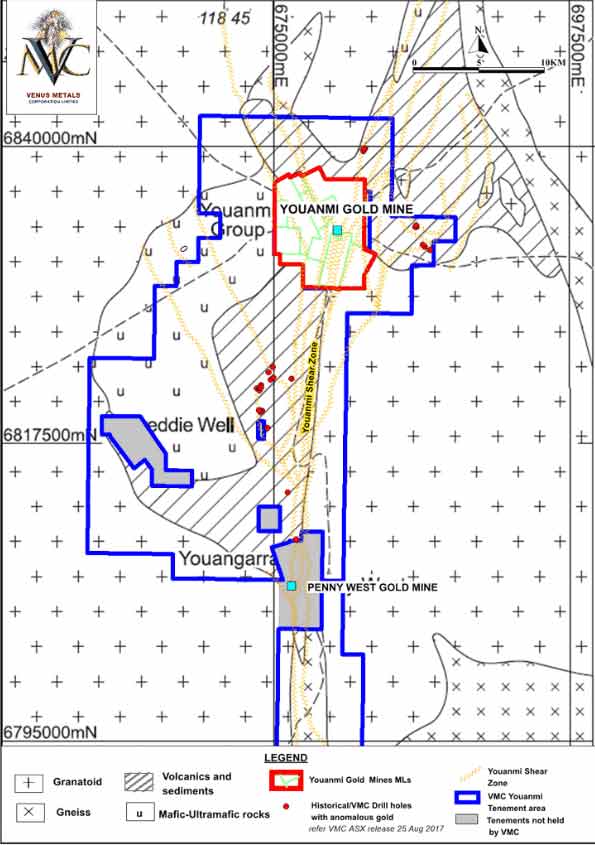

A few years ago, I was chatting to Mark Creasy and he asked me if I’d ever looked at Youanmi. I hadn’t, but it got me interested. It became clear that the Younami greenstone belt was a treasure trove of gold, vanadium, lithium, cobalt and base metals.

It’s very under explored and no one has ever assembled the whole tenement package together — ever. That’s what we’ve been doing for the last five years.

The first acquisition came from one of Mark Creasy’s mates for $50,000; this area now hosts a big, advanced vanadium asset. Then we picked up the area between [Spectrum Metals’ (ASX:SPX)] Penny West project and the historic Younami gold mine for about $200,000.

But the final piece of the jigsaw puzzle was the Youanmi gold mine itself, which has open pit and underground resources of 1.2 million ounces of gold. When the mine closed in the 90s, gold was selling for just $AUD400/oz.

The previous owner had originally bought the mine from receivers for $3m but it was then plainted a short time after.

Last year, I managed to get in between the two sides as a result of two unique option deals. Venus paid the guy $650,000 to withdraw the plaints, and the owner $5m for the project ($3m in scrip and $2m in cash).

We bought the whole package for $5.65m, but the deal has effectively cost Venus $0.

We recently finalised four significant joint venture deals with Rox Resources (ASX:RXL), which gives them a 50 per cent interest in the mine.

Additionally, Rox is required to spend $2m inside the mining leases and $1m on regional exploration. Rox can acquire a further 20 per cent from Venus in regards to the mining leases only by payment of a further $3m ($1.5m cash and $1.5m scrip) at Venus’ election.

Venus is also entitled to a 0.7 per cent NSI production royalty of anything produced from within the mining leases.

We are actually in for the whole Younami package for next to nothing; and now Rox is spending all the money on exploration for the next two years.

We also recently purchased the Curran’s Find block which has already delivered shallow bonanza gold grades in our first drilling campaign up to 70g/t gold.

It’s a stones-throw from the recently announced Spectrum Metals’ high-grade discovery at Penny West North.

READ:Spectrum Metals’ Paul Adams on dodging bullets and that 1 month, 525pc share price increase

Our main focus is proving up oxide gold resources at Youanmi. The joint venture is deploying 14,500m of drilling on the mining leases this month.

Before we did the Rox deal, Venus completed an electromagnetic (EM) survey over Youanmi which lit up 25 [undrilled] anomalies. Incredibly, this had never been done before.

The existing Youanmi underground mine contains refractory ore [finely disseminated gold which is hard to process] so we aren’t going to touch that at this stage. Underground mine development can happen down the track.

The plant probably needs a big refurbishment, but we need to go through the normal studies to assess where it’s all at.

Eventually, we would like to mine the Youanmi gold project. It’s early days, and there’s lot of exploration to come, but based on the early results – hitting 70g/t at Currans Find — it looks very positive.

Youanmi is a treasure trove, and it’s been severely underworked. Spectrum’s success promotes the whole region. They are doing a great job; there are fantastic results coming out of Penny West.

It’s early days for Venus but there is real opportunity here. Gold, vanadium, lithium and zinc – it’s got everything. Lithium Australia has recently acquired some tenements at Youanmi as well.

It has been tough. I think the recent demise of gold miners like Gascoyne, and the problems that Dacian are having hasn’t made it any easier. So, the sentiment isn’t great, but you have to think things will improve with more discoveries and the gold price going the way it is.

As a rule, we don’t like over extending ourselves. We wanted to be standing for the next gold bull run, which we are. This is just the start.